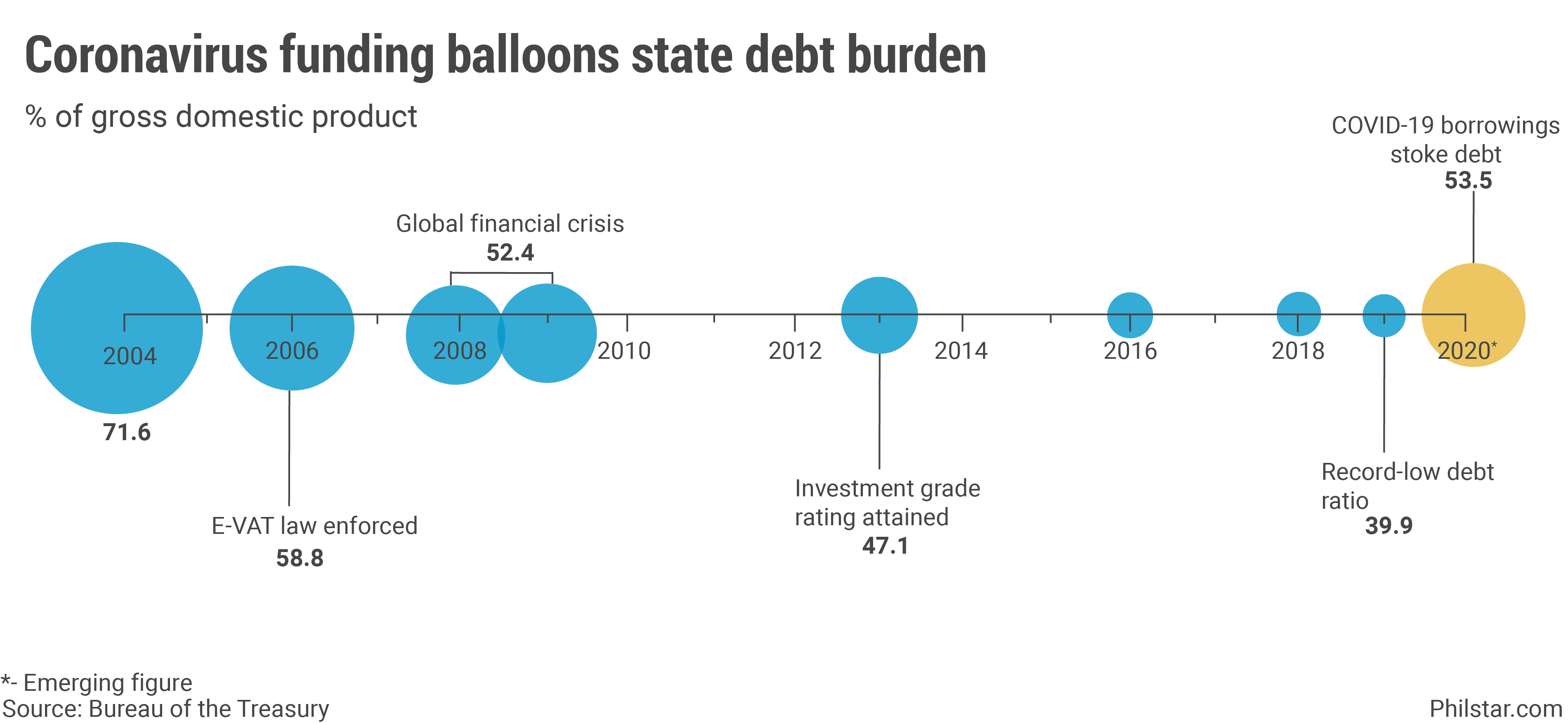

Philippines: Coronavirus borrowings stoke debt burden to 14-year high

MANILA, Philippines — The national government closed 2020 with a heavier debt burden as expected, no thanks to rising pandemic costs and falling tax receipts that forced a borrowing binge.

On Tuesday, Finance Secretary Carlos Dominguez III said emerging data showed outstanding state debt was equivalent to 53.5% of gross domestic product (GDP) last year, the highest since 2006.

Final data will not be released until next month when yearend GDP figures will have become available, but higher liabilities were already projected as early as March last year when the pandemic messed with original fiscal plans of keeping debt levels low. In 2019, the debt ratio was at a record-low of 39.9%.

Simply put, since the budget deficit rose to a record-high of P1.36 trillion last year, it was inevitable for the government to borrow funds to bridge the gap between revenues and spending.

Observers look to debt to GDP as a measure of a borrower’s creditworthiness. While hardly the sole indicator of whether obligations will be met on time, theoretically, debt levels at around 60% of GDP is considered unsustainable since it shows that a borrower accumulates debt faster than it increases resources to pay for them.

For Dominguez, last year’s debt pile which hovered at P10 trillion in absolute value, is not a cause for concern. “Even with the upscaling of our borrowing plan, we will still be able to keep our debt ratio within a sustainable threshold,” he said.

“This gives us the advantage over economies who were already saddled with heavy debt prior to the crisis,” Dominguez said in a speech during a virtual event hosted by the Management Association of the Philippines.

For 2021, the finance chief said debt will continue to increase to 57% of GDP.

Source: https://www.philstar.com/business/2021/01/13/2069966/coronavirus-borrowings-stoke-debt-burden-14-year-high

English

English