Philippines: Ayala Land, AREIT get regulators’ nod for property-share swap

MANILA, Philippines — Ayala Land Inc. has secured the approval of corporate regulators for its plan to infuse more commercial properties to AREIT Inc. in exchange for additional shares, a transaction that would further expand the real estate investment trusts (REIT) firm’s portfolio.

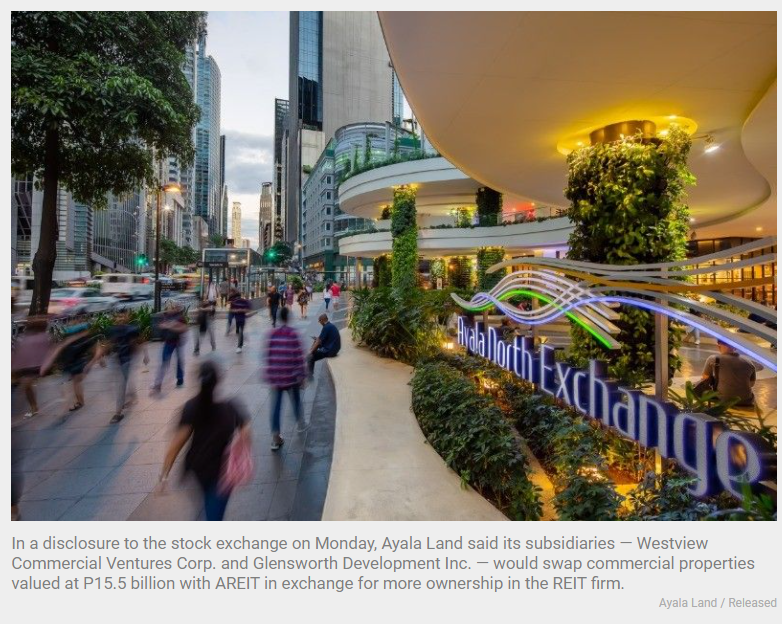

In a disclosure to the stock exchange on Monday, Ayala Land said its subsidiaries — Westview Commercial Ventures Corp. and Glensworth Development Inc. — would swap commercial properties valued at P15.5 billion with AREIT in exchange for more ownership in the REIT firm.

Investors seemed happy about the news. On Monday, shares in Ayala Land rallied 6.35% while AREIT gained 0.50%.

To accommodate its parent’s acquisition of additional shares, AREIT increased its authorized capital stock to P29.5 billion from P11.7 billion previously. The transaction will be done via a property-for-share swap at a price of P32 per share.

Once the deal is completed, Ayala Land would obtain 483.3 million more shares in AREIT, effectively hiking its ownership in the REIT firm to 66%. AREIT, on the other hand, would see its leasing portfolio grow to 549,000 sq. from 344,000 sqm once it receives the new properties from its parent.

Ayala Land did not name the properties it will give to AREIT, but earlier it said these assets are “primarily composed of office leasing properties.”

A bigger portfolio means more sources of income for AREIT and, in turn, higher rewards for investors. This is because REIT firms are mandated by the law to declare 90% of earnings from its property ventures as dividends to shareholders.

“The new assets are expected to contribute significantly to earnings in the succeeding periods, thereby increasing the potential dividend per share for AREIT shareholders,” Ayala Land said.

Source: https://www.philstar.com/business/2021/10/11/2133378/ayala-land-areit-get-regulators-nod-property-share-swap

Thailand

Thailand