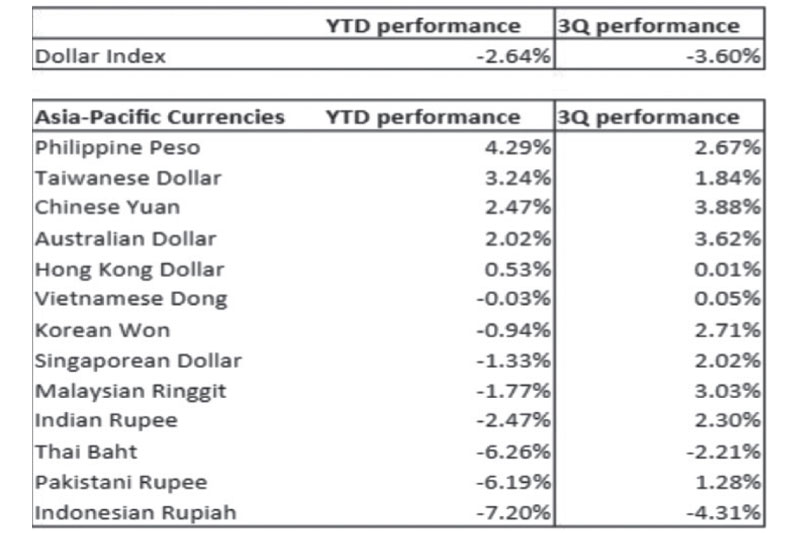

Philippine peso, Chinese yuan: Best quarter in a decade

The Chinese yuan and the Philippine peso are two of the strongest currencies in Asia this year. The yuan outperformed its regional peers in the 3rd quarter, recording its best quarterly gain in 12 years. The peso, Asia’s frontrunner this year with a year-to-date gain of 4.29 percent, posted its best quarter in a decade.

Riding high on China’s economic recovery

The yuan strengthened on the back of a V-shaped recovery of its economy. It advanced 3.88 percent against the US dollar in Q3 2020, the most since early 2008. China is the first country that got hit by the pandemic and the first one that got out of it. Its GDP expanded 3.2 percent in Q2 2020, reversing a 6.8 percent percent decline in Q1 2020. Industrial production and retail sales have been accelerating, suggesting a sustained recovery. The latest Chinese manufacturing purchasing manager’s index (PMI) showed that the manufacturing and services industries had shown robust economic activity for seven consecutive months.

Foreign peso forecast

The Philippine peso registered its best quarter since the latter half of 2010, gaining 2.67 percent in Q3 2020. Some foreign banks have cited the country’s expanding balance of payment surplus, increasing foreign reserves, and an unexpected rebound in remittance as reasons for the peso’s appreciation. Credit Agricole Strategist, Eddie Cheung, sees the peso appreciating to 48 by yearend due to positive fund flows and improving balance-of-payments picture.

Meanwhile, Nomura’s Dushyant Padmanabhan forecasts the peso to reach 47.50 by yearend. Nomura cited the jump in OFW remittances and the weak dollar environment as the peso’s main driver.

‘Peso will be steady at around current levels’ – Diokno

BSP Governor Benjamin Diokno does not see the peso significantly stronger, saying that it will likely trade between 48.50 and 48.70 in the near-term. “We can assure our countrymen that the value of the peso will be steady around current levels,” he said in an interview last week. The BSP has been proactive in stabilizing the peso and preventing wild swings despite the general US dollar weakness. Exporters and many business groups have been pointing out that the peso is too strong and is detrimental for their businesses.

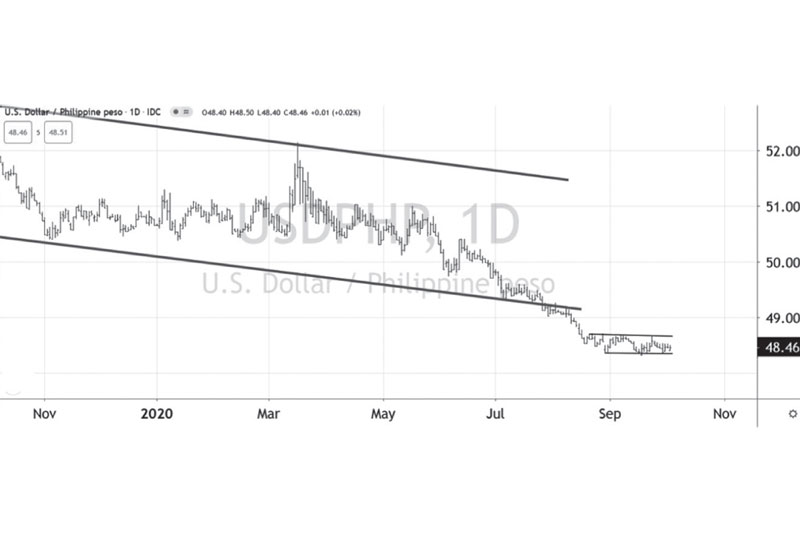

Following the biggest quarterly gain in a decade, the USD PHP rate has been steady the past six weeks. It closed at 48.48 last Friday. The 48 – 48.50 range is considered a significant and strong support for USD PHP.

USD PHP rate chart: Stable the past six weeks

COVID-positive Trump fuels further uncertainty

While the peso has recently stabilized, global financial markets were in mild disarray last Friday. With barely a month before the election, the president of the world’s most powerful nation tested positive for COVID-19. Risk assets immediately sold off after Donald Trump announced that he and First Lady Melania Trump tested positive for the coronavirus. After news reached the markets, the Dow futures instantly tumbled 500 points, and oil prices plunged 5 percent.

2020: Unprecedented, unpredictable, and turbulent year

Many unexpected events happened during this year of the pandemic. COVID-19 is a very contagious, aggressive, and treacherous virus. It has caused economies to slow down and generated massive unemployment. It has forever changed people’s lives. It has altered the way we work and the way we live. And now we have a US president, during his reelection campaign, testing positive for the virus.

What happens next? It puts the Republican Party’s election campaign in disarray. But what happens if Trump’s COVID gets worse? At his advanced age, will he still be able to govern? Things get murkier as you add more “What ifs.”

The US markets are down more than 10 percent the past month, exacerbated by signs of a second wave of the COVID-19 pandemic. Trump’s exposure causes a new wave of uncertainty and market volatility. But it’s 2020; a truly unprecedented, unpredictable, and turbulent year.

Source: https://www.philstar.com/business/2020/10/05/2047157/philippine-peso-chinese-yuan-best-quarter-decade

Thailand

Thailand