Opportunities in Indonesia’s Industry 4.0

Enterprise Singapore’s regional group director (Indonesia) Khairul Anwar looks at the latest developments in Indonesia’s Industry 4.0 and gives advice for Singapore companies thinking of entering the market.

1. What are some of the latest developments in Indonesia’s Industry 4.0 (I4.0) scene right now?

With the presidential elections over, the new Administration is likely to push ahead with its plans to make Indonesia a manufacturing hub for Southeast Asia. This aims to raise the GDP contribution of the manufacturing sector from 20% to 25% by 2025, helping to increase Indonesia’s exports and address its current account deficit.

The Making Indonesia 4.0 Roadmap is central to this goal. It seeks to boost the industry’s competitiveness by incorporating major innovations such as artificial intelligence, robotics and sensor technology. The roadmap was launched in April 2018 and focuses on the capability upgrading of five manufacturing sectors, namely F&B, automotive, electronics, chemicals, and textile and garment.

To better guide the companies on their industrial transformation, Indonesia rolled out the Indonesia Industry 4.0 Readiness Index (INDI4.0) in early 2019 to help manufacturers assess their level of productivity. This can be a good start for Indonesia’s industrialisation drive and shows the commitment of the government in working with the local manufacturers to upgrade their manufacturing capabilities.

Singapore is also keen to exchange learnings with Indonesia based on our experience in using the Smart Industry Readiness Index (SIRI) to support Singapore companies in the upgrading of their manufacturing capabilities.

Interested companies should also take note of developments in the government measures to boost the manufacturing sector, including the relaxing of the negative investment list and labour law reforms. Enterprise Singapore also engages Indonesian manufacturers based in Java, Sumatra and Sulawesi to understand their technology needs and connect them with Singapore solution providers.

2. What is the Indonesia government or private sector looking for in partners, and how can Singapore companies work with Indonesia on this specifically?

To prepare for the potential disruption that I4.0 will bring to regional supply chains, Indonesia has been engaging partners to exchange information and best practices. To this end, Enterprise Singapore is working with Indonesia’s Ministry of Industry (MOI) to help facilitate partnerships between Indonesian manufacturers and Singapore I4.0 solutions providers to boost the manufacturing competitiveness and

labour productivity of these firms.

Singaporean and Indonesian companies have a strong history of cooperation, including in manufacturing. For instance, Lin Wah Engineering has a long-standing relationship with Indofood since 2012 to implement automation for flow-wrapping, packaging and palletising processes.

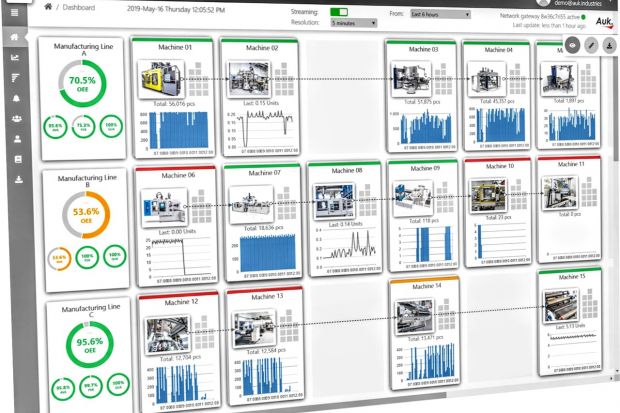

With Indonesia placing an emphasis on growing high-value sectors such as electronics and food manufacturing, companies are also looking to decrease the margin of error or possibility of contamination. For example, our Singapore Industrial Internet of Things (IIoT) solution provider AUK Industries recently deployed its plug-and-play edge devices in manufacturing giant PT. Dua Kelinci’s production line. In doing so, high-resolution machine data is captured on a user-friendly digital interface, allowing production managers to easily identify areas for improvement in the manufacturing processes.

Singapore can also collaborate with Indonesia to prepare the labour force to be I4.0-ready. To equip workers with the necessary skills to excel in the I4.0-enabled production floor, Singapore Polytechnic (SP) is working with MOI to develop curated training programmes. The first programme on cybersecurity was conducted for MOI polytechnic lecturers late last year. This is to ensure that users are equipped with

the knowledge to protect information online since processes will be digitalised in the adoption of I4.0. The government is also planning to introduce tax deductions for firms that invest in the upskilling of their workers, thus creating a demand for specialists in vocational training to service the expected spike in trainee numbers.

3. What is your top advice for Singapore companies thinking of entering Indonesia’s I4.0 market?

It is especially important for Singapore companies to find and develop the right talent who understands market nuances, and can speak the local language in order to connect with the locals. This is because optimising and upgrading existing manufacturing lines is a major exercise for any manufacturer, especially those who are new to I4.0. Singapore companies need to patiently engage their business

partners at all levels of the company. They may have to spend time walking the plant floor with the local plant manager (who will likely only speak Bahasa Indonesia) to do a proper diagnosis on their needs, before pitching to the business owner on the proposed solutions. Enterprise Singapore also works with our companies to identify Indonesian distributors with deep links to specific manufacturing verticals such as automotive or electronics to help them better understand emerging technology needs and establish their solutions in the market.

It is also important to have the right expertise to diagnose the bottlenecks in the manufacturing processes, and who know which I4.0 solutions to deploy to achieve the highest productivity gains. For example, Singapore system integrators such as Pumas Automation and Plant Werx have leveraged their strong diagnostic capabilities to successfully provide I4.0 solutions to the automotive and electronics

industries in Indonesia.

Transforming to an I4.0-enabled production floor is a long-term, strategic move that requires commitment. Singapore companies could explore small-scale pilots with their potential clients or capital-light business models that do not require the clients to pay large upfront payments for recurrent operational expenditure.

Successful transitions also require the support of workers on the shop floor. Singapore companies should work closely with their potential clients on ensuring that their workers understand the upgrading procedures by providing upskilling programmes. Manufacturers are often key employers in their regions and the labour law requires local workers to be unionised, making employees a key stakeholder who

needs to be considered in the tech deployment process.

Successful technology adoptions by manufacturers can create further opportunities for Singapore companies to offer solutions to their partners. A large manufacturer may request for its suppliers to adopt a similar technology, as the full value of an I4.0 solution is often only realised when adopted across the entire value chain.

4. What resources can Singapore companies tap on to make their entry easier?

Enterprise Singapore signed a Memorandum of Understanding (MOU) with Indonesia’s MOI last year to facilitate partnerships between Indonesian manufacturers and Singapore manufacturing innovation enablers. Companies looking to connect with Indonesian manufacturers or system integrators can approach Enterprise Singapore, or even the relevant manufacturing-related associations such as Singapore Precision Engineering and Technology Association (SPETA).

Companies should also participate in the upcoming Industrial Transformation Asia Pacific (ITAP) taking place in Singapore in October 2019, where they can exhibit their offerings and engage with regional clients, including those from Indonesia. For more information, companies can reach out to SingEx, the organiser of ITAP, or the economic agencies supporting the event, such as Enterprise Singapore and

Economic Development Board.

Thailand

Thailand