‘No way’ Thailand is a currency manipulator

Thailand’s risk of being labelled a currency manipulator by the US is “de minimis” or unlikely as the baht movement is in line with other Asian currencies, says an executive at Citibank.

Movement of the local currency has not been as volatile as it could have been based on domestic political events the past few years, while Thailand’s regional trade position is reflected through how the baht movement is synchronised with other Asian currencies, said Darren Buckley, the Bangkok-based country head of Citibank and chairman of the Association of International Banks.

“I talked to people in the US Treasury about this matter and I would be surprised if there is anything of material substance to the currency manipulation charge,” said Mr Buckley.

“At the end of the day, it would be a stretch to believe Thailand is a currency manipulator. I just do not think there is any evidence.”

Thailand’s trade surplus is the 11th-largest for the US, coming in at UScopy9 billion last year, according to the Office of the US Trade Representative. A trade surplus occurs when the value of a country’s exports exceeds that of its imports.

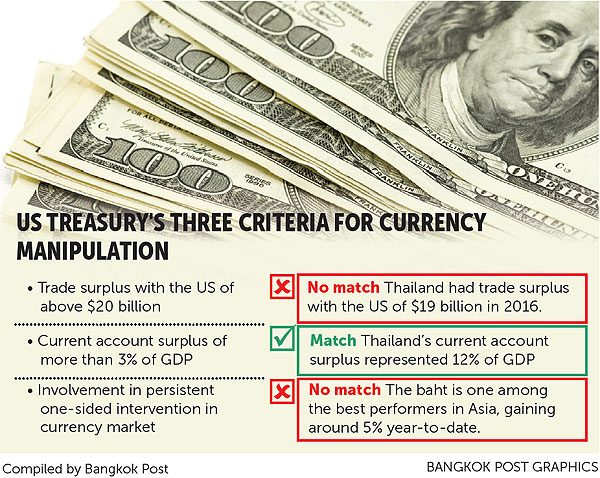

US President Donald Trump’s executive order in March to probe 16 countries, including Thailand, that ran the largest bilateral trade deficits with the US poses a risk for export-dependent Thailand and complicates the Bank of Thailand’s currency policy.

Earlier, Bank of Thailand governor Veerathai Santiprabhob admitted sporadic intervention in the foreign exchange market was largely attributed to “intense capital inflows we received,” but stressed the baht strengthening against the greenback relative to regional peers indicated no intention to keep the currency weak for export gains.

Although there are many reasons a country’s trade may record a deficit or surplus, if a surplus continues for the long term, there could be something structurally wrong in the trade balance between countries, said Mr Buckley.

“I think what this is really about is President Trump and his team, and even [Robert] Lighthizer, the US Trade Representative, are saying the bilateral trade deficits are something that need to be looked at and if there is an opportunity to address them, they should do so,” he said.

“I do not think there is anything wrong with that. I think it would be beneficial for Thailand to see some of that imbalance rectified and, at the end of the day, it could lead to an increase in trade on both sides.”

Currency manipulation is not currently as contentious an issue in Washington as it once was, said Alexander Feldman, president and chief executive of the US-Asean Business Council. The main reason these 16 countries were put on a watch list is trade surpluses exceeding copy0 billion with the US, he said.

“There is almost no way Thailand will be labelled a currency manipulator, at least given what we know right now,” said Mr Feldman.

Thailand could be designated a currency manipulator based on the US administration’s interpretation of trade balances between the two countries and Thailand’s augmented foreign reserve accumulation, said Jitipol Puksamatanan, market strategist at Krungthai Bank.

But it is not the central bank’s intention to accrue foreign reserves to gain export competitiveness as it has to manage baht appreciation via foreign exchange intervention, he said.

The US is not likely to “cherry-pick” Thailand as a currency manipulator given that the world’s largest economy has continued to run a large bilateral trade deficit since Thailand was singled out by Mr Trump, said Mr Jitipol.

The baht has appreciated around 5% year-to-date against the US dollar, in the top three among Asian currencies behind the new Taiwan dollar and Korean won, he said.

Source: http://www.bangkokpost.com/business/finance/1275651/no-way-thailand-is-a-currency-manipulator

Thailand

Thailand