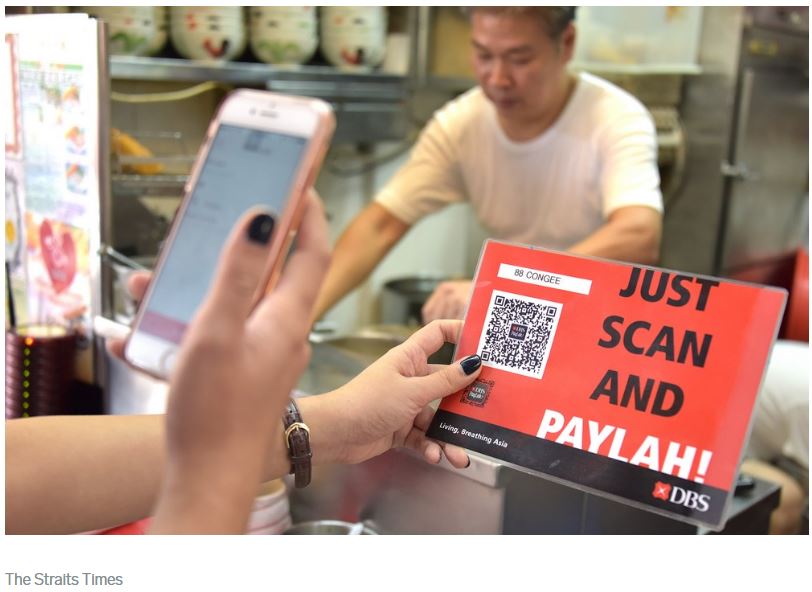

New small businesses benefit the most from the convenience of QR payments in Singapore: NUS study

New small businesses have benefited the most from QR payment technology in Singapore, a study by the National University of Singapore (NUS) has found.

The low-cost and convenience offered by the new technology has allowed newly set-up small stores to increase monthly card sales amount by 11 per cent, compared with 2.1 per cent growth among the more established small merchants, NUS’ Business School said.

The study – based on an anonymous data set of 250,000 consumers’ bank activities from Jan 2016 to Dec 2017 – also found that the introduction of the QR code payment system PayLah has helped to double the number of mobile payments in Singapore.

According to the report released on Thursday (Dec 13), mobile wallet usage immediately increased after DBS introduced PayLah on Apr 13, 2017.

The weekly count of small-amount mobile payment transactions under S$100 increased by 114 per cent since DBS’ launch of the payment system. Larger transactions for sums above S$100 also saw an increase of 88 per cent.

In addition, the NUS study also found that small merchants receiving small-sized payments experienced a significant increase in monthly card sales amount by 7 per cent after the adoption of QR code technology.

Small merchants also saw an average increase of 3.4 per cent per month in the value of credit and debit card sales during the nine-month period after the technology was introduced.

Improved payment convenience of mobile wallets had a spillover effect on goods of all categories, including discretionary items such as durable goods, apparel and entertainment.

Among small merchants, dining establishments such as single non-chain restaurants saw the largest spillover effect in the form of increased retail traffic, with a 12.6 per cent increase in total card sales.

But while the convenience and efficiency of the payment technology promoted sales growth primarily for new businesses by facilitating customer acquisition, it was not obvious from the findings that mobile payments – specifically the introduction of the QR code – helped merchants to grow sales, the researchers said.

Nonetheless, the development of mobile payments plays a critical role in Singapore’s goal of becoming a cashless society, said Professor Sumit Agarwal, who led the study.

“The findings also provide important input for discussions about fintech and digitisation by offering new insights on the real economic effect of improved payment convenience and efficiency,” he said.

Source: https://www.businessinsider.sg/new-small-businesses-benefit-the-most-from-the-convenience-of-qr-payments-in-singapore-nus-study/

Thailand

Thailand