Myanmar: Lower tax rates, higher liquidity expected to boost property market

Real estate developers in Myanmar are expecting a boost in the number of property transactions in fiscal 2019-20, which they hope will help jumpstart the local property market.

One reason demand will rise is as a result of a reduction in tax rates on previously undeclared income, which is expected to encourage those who have not declared all their income in the past to do so.

This should bring liquidity back into the formal economy, leading to opportunities for investors to channel their money into real estate at a time when supply in Yangon and other major cities in Myanmar has spiked with more completed units now on the market.

It will also encourage existing home owners who had purchased properties under different names in the past to officially correct or update any ownership details for future tax purposes.

According to new regulations approved for fiscal 2019-20, undeclared income of up to K100 million will be taxed at a rate as low as 3 percent. The rate subsequently rises to 5pc for undeclared income ranging between K100 million and K300 million, 10pc for income ranging between K300 million and K3 billion and 30pc for income above K3 billion.

In the previous fiscal year, the tax rates on undeclared income were much higher, ranging between 15pc and 30pc.

To qualify for the lower tax rates this fiscal year, all the income declared must be invested in business or capital goods such as property.

The lower tax rates will come at a time when home financing in Myanmar is becoming simpler and more feasible.

Since the start of 2019 in fact, real estate transactions have already been on the rise with more financing options available from banks. According to U Kaung Thu Win, managing director of Shwe Property, 80pc of existing buyers are now taking advantage of mortgage schemes to finance their investments.

“The option to apply for mortgages has made home ownership more affordable and convenient. It has also given the second hand market a new lease in life,” U Kaung Thu Win said.

U Nay Min Thu, managing director of iMyanmarHouse, said demand for apartments and condominiums valued up between K20 million and K100 million has risen the most since home loans were made available.

Moving forward, property investors and home buyers are expected to take more interest in the real estate market, where prices have also been declining over the past few years despite the enactment of a long-awaited property law to attract foreign investors in 2016, brokers told the Myanmar Times.

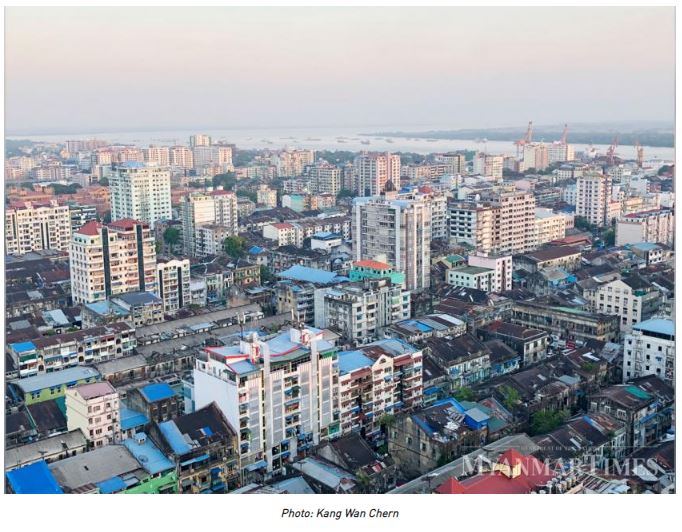

Currently, Yangon remains the largest property market in Myanmar, with Dala township being the latest hotspot for property investors. Brokers said prices at Dala have increased sharply after construction of the Dala Bridge linking Dala to downtown Yangon began this year. However, the volume of transactions has yet to catch up.

Most buyers are also interested in San Chaung, Kyee Myin Daing, South Okkalapa, Dawbon and Thaketa townships, where there are many apartment and condominium buildings with affordable units and rental value under construction, said U Htoo Myat Naing, a broker from Estate Myanmar.

Meanwhile, land buyers are interested in land lots in Bahan, Hlaing Tharyar and Shwe Pyi Thar townships, where the bulk of land purchases currently takes place, according to property business owners.

But U Nay Min Thu said demand for property in Mandalay, Myanmar’s second largest city, is also on the rise. He said interest in Mandalay real estate is actually three times higher than in Yangon.

Buyers are also interested i cities such as Pyin Oo Lwin, Kalaw, Pathein and Mawlamyine, which are seeing increasing property market opportunities, said U Nay Min Thu.

– Translated

Source: https://www.mmtimes.com/news/lower-tax-rates-higher-liquidity-expected-boost-property-market.html

Thailand

Thailand