Myanmar E-commerce Current Scenario

There was a time in Myanmar around 2002 the internet was only available in selected major cities costing K 500-1500 for 1 hour the connection is normally slow and often interrupts. Those painful days are in the past, now the internet is easily accessible through the phone at the cheaper rates with ultra-high-speed.

In 2013, Myanmarmobile penetration rate was12%, it went to exponential growth in 2018 reaching 105% mobile phone penetration and 80% smartphone penetration according to realizing digital Myanmar economy report.

The easy access to high-speed internet is bringing opportunities for all sizes of the businesses to flourish on the new platform, where they can buy and sell their products and services with the minimum investment.

Digital 2020 Myanmar, Thailand, Malaysia, Vietnam-Hootsuite reports

Digital 2020 Myanmar, Thailand, Malaysia, Vietnam-Hootsuite reports

In Myanmar, over 39% of the population is on Facebook, quickly it is becoming the platform where you can find the highest potential consumer. With its’ promising potential and easy page, setup facebooks, buying and selling are gaining momentum in Myanmar. Even for the well-established eCommerce sites, their majority of the sales traffic is coming from Facebook. Along with the rise of “Facebook shopping” local and international companies are rushing to launch their online market platform in the frontier market. In 2018 Alibaba acquired German base rocket internet which also operates Shop.com.mm in Myanmar and in 2019 Daiwa PI invested an undisclosed amount in rgo47.com. In the same year Yangon based investment firm has invested in an eCommerce startup Ezay which aims for rural retailers. And in 2020 kyarlay.com specialized in baby products secured the funding from Emerging Markets Entrepreneurs, an early-stage venture capital firm.

Source: MMTimes.com

Source: MMTimes.com

There are numbers of well-established eCommerce platforms are operating in Myanmar among the players shop.com.mm receives the highest daily site visitors estimating 296,315 numbers of daily unique visitors. While Thailand’s one of the largest online retailer Lazada.co.th receives 3,014,000 numbers of daily unique visitors.

Despite the promising potential, Myanmar e-commerce market is still in the early stage in 2018 AEC estimated that Myanmar eCommerce market size stood at US$ 6 Million it is expected to grow within the coming 5 years.

Source: siterankdata.com Access on 772020 440 PM

Source: siterankdata.com Access on 772020 440 PM

In 2019 Myanmar ranked 126rd out of 152 economies on the readiness of countries to engage in online commerce UNCTAD-B2C e-commerce index which measure based on the four indicators: Internet use penetration, secure servers per one million inhabitants, credit card penetration, and a postal reliability score. In the same year, Malaysia ranked 34th, Thailand 48th, Vietnam 64th, Indonesia 84th, the Philippines 89th, Laos 113th, and Cambodia 122nd. There are several challenges that need to be addressed to speed up the Myanmar e-commerce sector.

Source: siterankdata.com Access on 772020 440 PM1

Source: siterankdata.com Access on 772020 440 PM1

Payment: Underdeveloped payment processing systems remain a major barrier for Myanmar’s eCommerce. However, the availability of digital payment service providers has increased drastically compared to five years back. Due to the lack of a well-developed payment processing system, currently, most of the online vendors are operating cash on delivery payment systems. A recent report of Digital 2020 Myanmar stated that only 3.6% of the adult 15+ make online purchases and/or pays bills online. While 19% of Thailand adult make online purchase/pay bills online.

Logistics: Undeveloped logistics networks across Myanmar is hampering the growth of eCommerce in Myanmar. At the current stage, most of the online vendors are using the exiting high way express bus networks to send the parcel across the country which is the quickest way to deliver but it is expensive compared to traditional logistics sometime consumer end up paying 80% of the buying cost especially for the products under 10,000 MMK.

Rules & Regulations: As a consumer, if something happened on their online purchasing process it is hard for them to trace back the seller. Due to the lack of online business registering and operating law (eCommerce) in Myanmar, it is hard to regulate the online business and losing tax for the government, and for customers, if something happened on their online buying process it is hard to trace back the seller. In 2018 Ministry of Commerce announced to draft Myanmar’s eCommerce law but after that, no further information has been released. In 2020 Jun an interview with U Nyi Nyi Aung and the state-owned newspaper, he mentioned that eCommerce guidelines will publish within 2020 under the guidelines Voluntary Registration System will include where the online shop will be able to register online easily. In 2020 lead by the eCommerce industry stakeholders formed The E-Commerce Association of Myanmar (ECAM) to support the industry.

Covid-19 and E-commerce

When more and more people are practicing social distancing in recent months due to the ongoing pandemic. Suddenly the demand for eCommerce went high. The numbers of a startup have emerged and come up with the door to door delivery service for the major use of grocery items. While people are staying at the home, the delivery truck and the bike are taking over the city’s road. Some of the delivery companies are even hired bikes and taxi car owner on a freelance basis to keep up with the growing demand. The government sees it as the right time to pave the development of eCommerce in Myanmar. COVID-19 Economic Relief Plan (CERP) which outlines immediate and short-term actions to be applied before year-end. The plan outlines the specific actions for technology and eCommerce with the aims to promote the innovative products and platforms including the use of digital payments encouraging retail trade to operate online and promoting delivery and logistics firms.

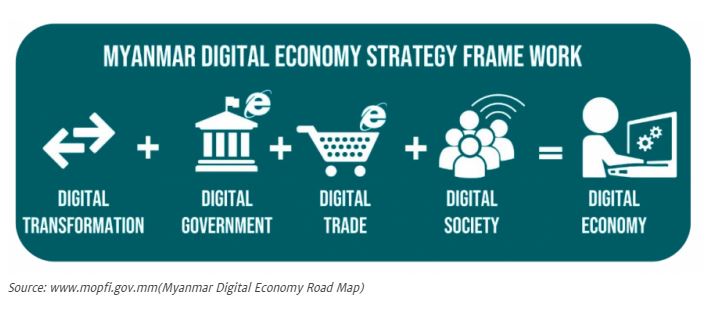

Source: www.mopfi.gov.mm(Myanmar Digital Economy Road Map)

Source: www.mopfi.gov.mm(Myanmar Digital Economy Road Map)

Myanmar is currently on the route of Digital Economy Road Map 2018-2025 which aims to promote the Myanmar digitization process toward a digital economy across all sectors for inclusive and sustainable socio-economic development. The road map is targeting to employ 300,000 employees in the digital economy by 2025 and foreign direct investment US$12 Billion in the digital industry by 2025. In addition, Myanmar remains one of the highest potentials for eCommerce growth in the regions. With the increasing internet penetration and emerging, middle-income families and their changing daily lifestyle will shape the future of Myanmar eCommerce. In 2018 Myanmar ratified the ASEAN eCommerce agreement. It aims to deepen cooperation among member states and to help businesses, especially small and medium-sized enterprises, overcome obstacles and take advantage of electronic commerce to drive economic growth and social development in the region.

Rajan Acharya is an Independent Consultant. He provides in-depth market insight for local and multinational companies on a project basis. He can be reached at [email protected]

Source: https://mmbiztoday.com/myanmar-e-commerce-current-scenario/

Thailand

Thailand