Mother Finance set to transform credit access in Myanmar

Access to credit will no longer be a problem for Myanmar people thanks to an innovative consumer lending application which allows anyone with a smartphone to easily apply for a loan regardless of their financial records, according to Theta Aye, founder and chief executive of Mother Finance Co.

“Our goal is to serve unbanked customers who are unable to access formal financial services such as credit, savings and deposits and who rely mostly on friends and informal lenders,” she said in an exclusive interview.

“The market here is massive, and the demand for credit is so huge. The segments of banks are primarily like upper income and middle-class people. So, we try to tackle this market where we can serve the bottom part of the pyramid.”

She said local banks have little appetite or the expertise or infrastructure, partially due to regulatory restrictions of interest rates, to service the needs of the bottom-half of the pyramid, which happens to be the majority of the adult population in Myanmar.

After her graduation from Oxford University and Massachusetts Institute of Technology, Theta Aye returned to Myanmar in 2016 to get commercially involved in Myanmar’s finance industry. She established the company as a non-bank financial institution regulated by the Central Bank of Myanmar (CBM).

“People need access to financial systems, including credit and all the opportunity credit brings. We aim to get them engaged in the formal financial system rather than depending on informal lenders,” she said.

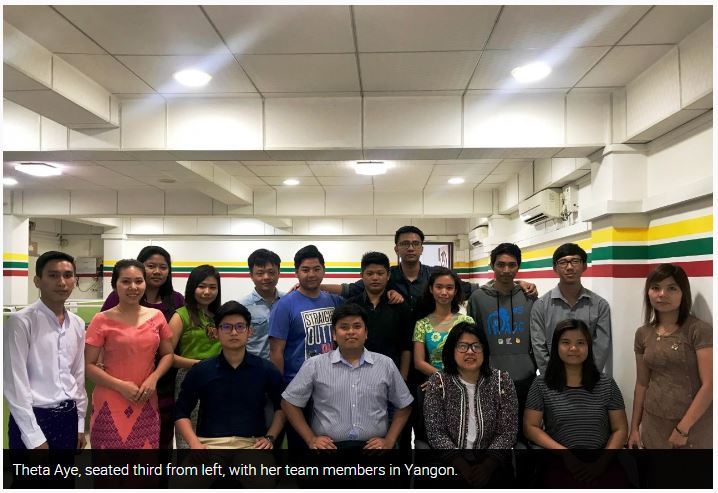

With this in mind, her team of around 20 local staff with an average age of 22 managed to launch a mobile application in late July this year. Available both on iOS and Android smartphones, the app offers unsecured loans from 50,000 to 50 million kyats (Bt1,025 to over 1 million).

Currently, the company provides two products – salary-based and short-term emergency loans – to individuals and small business owners who need money to buy goods and services such as education, tuition, healthcare, emergency funding, or working capital. Average loan size is around 600,000 kyats for employee loans, while the amount of emergency loans can be increased depending on the user’s payback records.

“We are growing very, very fast. Within three months after we launched the app, we have around 5,000 registered customers and have processed more than 800 loans,” she said, adding that the majority of the customers are Android phone users.

“We are always in need of people, as we are dispersing a lot of loans. The demand is huge, and we are going to expand our team to facilitate bigger products. We are actually helping people build a digital credit history to get them back to the formal financial sector.”

According to Theta Aye, the company usually grows by four times every month, and expects to serve around 100,000 users, dispersing an estimated loan disperse loan amount of 500 million kyats at the end of the first year of business.

“We are going to be launching e-commerce instalment loans at the end of the month in partnership with RGO47. If somebody wants to buy products from RGO47 or if they have bought from it before, we will look at some transaction data and will ask them whether or not they want some breakdowns [with some interest involved] to pay for their shopping,” she said.

“Along the way, we are also doing education loans and healthcare financing. Some educational services have done some sort of customer screening already. We are still talking to hospitals, especially for those who want to do replacement surgeries and maternity. Our next step is probably SME [small and medium enterprise] loans.”

In the long term, the company aims to be a full-fledged digital lender and the go-to app for all things financial in Myanmar – from financial news, financial knowledge, budgeting, and providing know-how to peer-to-peer lending, subject to CBM’s approval.

“Our vision is to become a one-stop platform for all financial needs of Myanmar people. We offer convenience, fast and easy loan disbursement, for which unbanked customers used to rely on pawnshops and unregulated money lenders who charge exorbitant interest rates. And we will ensure user convenience because they do not need to show any kind of documentation. On top of that, we are bringing them security and transparency.”

Loan approval typically takes less than 48 hours, while disbursements and repayments can be done through regular banking and mobile wallet channels.

With its two initial products, the company has built in the mechanism to reward good repayment with larger loans, faster disbursement, longer tenure, and lower interest rates.

“We leverage on the rapid growth of the usage of smartphones in Myanmar with our proprietary mobile credit-scoring algorithm to harness alternative data analytics and integrated technology solutions to assess the credit-worthiness of loan applicants,” she said.

She sees a tremendous opportunity for the company to utilise digital channels and help close the credit gap and contribute to the government’s plans for financial inclusion.

Source: http://www.nationmultimedia.com/detail/Corporate/30357849

Thailand

Thailand