Malaysian stocks stage strongest rise in Asia

PETALING JAYA: The FBM KLCI put up strong gains in yesterday’s trading session, rising 19.62 points or 1.15% to 1,726.18 points by the end of the day, recording its third day of gains.

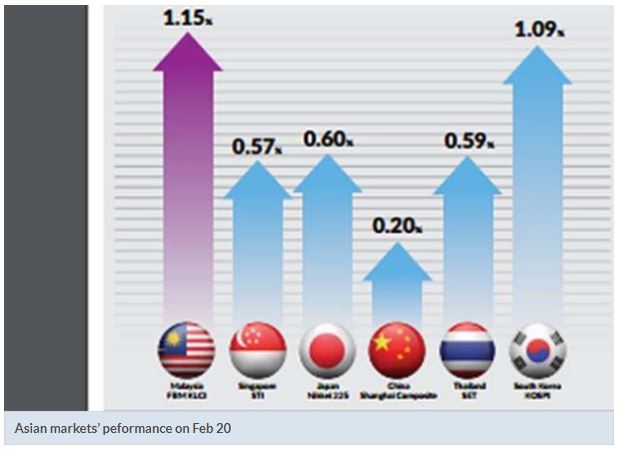

All Asian markets with the exception of Australia’s ASX rose, with gains in Malaysia being the strongest compared to other Asian markets.

The local benchmark index also rose in line with increased risk sentiment in nearly all Asian markets after US president Donald Trump indicated that he might be willing to push back the trade talk deadline with China from March.

The FBM KLCI has been rising for the past three days since the trading week began on Monday, racking up gains of 32.26 points from Monday’s open to Wednesday’s close.

Gains were broad-based in yesterday’s trade, as all segments of the market were in the green.

All indices of Bursa Malaysia posted gains yesterday, with the Bursa Malaysia Construction index rising the most by 3.91% closely followed by the Bursa Malaysia Energy Index going up 3.27% and the FBM Palm Oil Plantation Index gaining 2.35%.

InterPacific Securities research head Pong Teng Siew told StarBiz that while gains have been seen since Monday, the big upward move materialised from Tuesday to Wednesday’s trade.

“I believe the catalyst came from Wednesday’s news that the country was making progress in talks with China to revive the earlier scrapped East Coast Rail Link (ECRL) project. The biggest gainers on Bursa Malaysia for both Tuesday and Wednesday came from the construction index,” Pong said.

“And also, there are other factors coming into play right now, including rising oil prices as we see Brent crude oil rising to its three-month high,” he added.

As at press time, Brent crude oil was near its three-month high of US$65.89 per barrel.

The commodity, which is still essential to the health of the Malaysian economy, has been rising since Christmas last year.

Dealers contacted by StarBiz said it would appear that foreign money is buying into Malaysia once again.

“We saw the data and this is what it showed. These are the big boys that are buying in again. The reason could be due to the Malaysian growth story, but this has yet to be confirmed on my end,” a dealer said.

Locally, Finance Minister Lim Guan Eng had said in his speech in a government function in Kuala Lumpur City Centre on Monday that it was now the “best time” to invest in Malaysia, especially in the small and medium enterprises segment of the economy.

“I strongly encourage you to buy into the Malaysian growth story as soon as possible before we fully recover in three years, in which it would be too late by then. If you had yet to invest in Malaysia and had waited for three years, I would hate to tell you I told you so,” Lim said.

Malaysia last week announced that its fourth-quarter economic growth had surpassed expectations with gross domestic product (GDP) growing at 4.7% compared with the same quarter of the previous year.

This marks the local economy’s first acceleration in growth over the last one year, following the continued slowdown in GDP growth after the third quarter of 2017 where it registered a 6.2% growth.

Lee Heng Guie, an economist and the executive director of the Socio-Economic Research Centre, said the better FBM KLCI performance in January and the recent days of February had been fueled by several factors, including the better reading of the fourth-quarter GDP growth, which indicates that the Malaysian economy was coming out of the trough.

“There is also renewed investor interest in Malaysian equities, as the stocks look attractively valued aided by the prospect of the ringgit’s appreciation; investors generally are positive about Khazanah Nasional Bhd’s divestment plan as it improves market liquidity,” Lee said.

“Other than the ECRL, which would benefit many of these contractors, there are also other factors coming in.

“I am looking at penny stocks and the oil and gas (O&G) stocks that have also risen along with the technology sector. Namely, there are stocks that are below the RM1 level in the O&G sector that are jumping on the rising crude oil theme,” Pong said.

Among the active stocks yesterday were from the O&G space, including Sapura Energy Bhd which rose 4.84% to 32.5 sen, Hibiscus Petroleum Bhd that added 2.86% to RM1.08, and Bumi Armada Bhd that gained 4.65% to 22.5 sen.

Top gainers were from the consumer sector, including Nestle (M) Bhd which rose RM1.50 to RM150.00, Fraser & Neave Holdings Bhd adding 90 sen to RM35.90, and Carlsberg Brewery Malaysia Bhd gaining 60 sen to RM23.74.

Pong said these consumer stocks have been posting strong dividends on the back of commendable financial performance, and hence, investors were buying into their stocks.

On whether the gains could continue and be sustained, Pong said that it would ultimately have to boil down to earnings, which he said have not been too bad.

“The fourth quarter is turning out to be more mixed than many had thought.

The third quarter was a disaster in terms of earnings and for things like the ECRL. Many of these stocks (in the construction sector) have been beaten down and are at very cheap levels now. If the project is reinstated, then these companies stand to benefit,” Pong said.

Source: https://www.thestar.com.my/business/business-news/2019/02/21/hattrick-for-bursa/#JQA3uqeZLdu6epBW.99

Thailand

Thailand