Malaysia: Trade momentum remains positive

KUALA LUMPUR: Despite a sustained growth momentum in Malaysia’s exports seen last month, there are mounting expectations that this growth could see a moderation moving forward.

Overall, while the sentiment remains cautious, Malaysia’s exports performance in February 2023 generally still has outperformed other country peers despite a gloomier global trade outlook.

Another possible drag would be from the economic outlook ahead as it is currently being weighed by the “still developing” situation in the United States banking system, which had recently begun to unravel.

While the local banking system remains isolated from this latest development and fundamentally sound, economists said Malaysia is a country that is highly reliant on trade to drive its gross domestic product (GDP) growth.

It is also notable that growth in Malaysia’s exports last month was mainly been driven by exports to the United States, which is the biggest gainer after countries in the Asean region.

In a statement, the Ministry of International Trade and Industry (Miti) pointed out that electrical and electronics (E&E) exports to the United States had bolstered February’s exports.

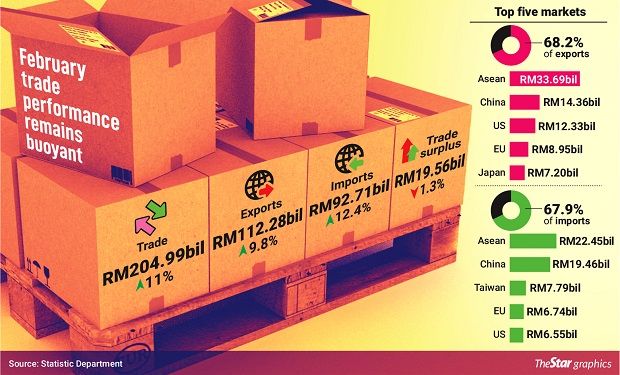

“Trade with the United States in February 2023 had absorbed 9.2% of Malaysia’s total trade and rose by 9.8% year-on-year (y-o-y) to RM18.89bil.

“Exports registered a double-digit expansion of 18.7% to RM12.33bil, assisted by strong exports of E&E products,” Miti said.

The strength lied in trade with the Asean region as statistics showed that it took up 27.4% of Malaysia’s total trade last month and rose by 10% yoy to RM56.14bil.

“Asean exports grew by 14.8% to RM33.69bil, the 19th straight month of double-digit expansion, underpinned by higher exports of petroleum products and E&E products. Imports from Asean expanded by 3.5% to RM22.45bil,” it added.

According to Socio-Economic Research Centre executive director Lee Heng Guie, there will be little to cheer about on the country’s exports front in the months ahead.

“High levels of exports recorded throughout March-September in 2022 will work against the annual growth comparison for the corresponding period of 2023,” Lee told StarBiz.

“We estimate exports to grow by 1.8% in 2023 after registering two years of strong double-digit growth of 25% in 2022 and 26.1% in 2021,” he added.

Malaysia recorded a trade growth of 11% to RM204.99bil in February this year from the same month in the previous year as both export and import values rose to their highest for the month.

Miti said the country’s exports rose 9.8% to RM112.28bil on the back of strong exports of petroleum products, E&E products and liquefied natural gas (LNG).

Imports meanwhile increased 12.4% y-o-y to RM92.71bil, which means a trade surplus of RM19.56bil last month, Miti statistics showed.

Compared with January 2023, the trade surplus was up 7.9% while trade, exports and imports were lower by 1.1%, 0.3% and 1.9% respectively, due to the lesser working days in February.

Lee also expects exports will still face many headwinds in the months ahead on likely further rises in interest rates and worries about economic slowdown on the horizon.

“The still developing banking turmoil in the United States and Europe could lead to a more cautious approach to lending for consumers and businesses.

“These negative forces together with softening energy and commodity prices are expected to weigh on the global demand for Malaysia’s exports,” explained Lee.

Malaysia may also soon register a decline in exports for some months going forward, following in the footsteps of other regional peers such as Singapore, Thailand and South Korea, Lee noted.

Meanwhile, HSBC Research was more upbeat on the situation.

The research house in its latest note said Malaysian exports have shown some resilience in the face of an ongoing global technology slowdown.

“Malaysia’s exports rose over 5% y-o-y in the first two months of 2023, thanks to its favourable mix of export products.

“Defying a cooling global tech cycle, robust electronics products remain the main pillar of growth in exports,” HSBC Research said.

The research house said this was different than what is happening in Singapore, where there was a recent 30%-odd y-o-y plunge in semiconductor exports.

“Malaysia’s electronics shipments continued to grow by around 8% y-o-y.

“Part of the resilience is due to its unique position as a large producer of automotive chips, where demand has stayed much more resilient than that for other consumer electronics,” the research house noted.

“The other part of the equation is structural, as Malaysia has gained substantial market shares in certain semiconductor categories, thanks to consistent tech foreign direct investment inflows,” it added.

While the country’s exports have slowed in the year-to-date for 2023, following a growth of 25% in 2022, HSBC Research said this needs to be assessed in a broader context of a significant global trade slowdown.

“In fact, Malaysia’s external sector has displayed enormous resilience with positive growth, when regional peers have suffered from plunging exports, albeit at smaller-than-expected magnitudes recently,” it said.

Apart from electronics, the country’s exports are also holding up well due to commodities although the outlook may be mixed on this front moving forward, the research house said.

“Petroleum products for both crude and refined, as well as LNG shipments have benefited in both value and volume terms.

“However, the drag came from palm oil shipments, which mainly reflects a price correction from its peak last year,” it noted.

HSBC Research said the outlook moving forward may see a deterioration on the high-base effect from last year and the intensifying global trade headwinds.

“Malaysia’s external sector can only stay resilient to a certain extent, but it is holding up better than others.

“After claiming Asia’s growth champion with 8.7% growth in 2022, it is not surprising that Malaysia will likely see moderating growth. We expect to see growth to slow to 4%,” the research house added.

Commenting on imports, MIDF Research said this area had seen a stronger growth compared with 2.2% y-o-y in January on the low base effect.

“As domestic demand is expected to continue growing, we believe imports will grow further as companies expand their investment and increased purchases of raw materials in view of increasing demand,” it said.

Source: https://www.thestar.com.my/business/business-news/2023/03/21/trade-momentum-remains-positive

Thailand

Thailand