Malaysia: Strengthen reforms, transparency

PETALING JAYA: With Malaysia hit by its first rating downgrade in over 20 years, there is an urgent need for the government to address concerns raised by one of the world’s largest rating agencies.

Among others, these concerns include domestic political uncertainties, weakened public sector finances and still-fragile economic growth.

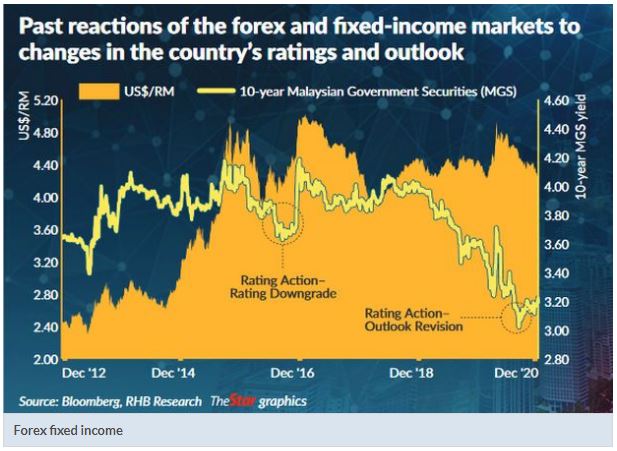

Failure to sufficiently address the concerns of Fitch Ratings, after it downgraded Malaysia to BBB+ on Dec 4, would have negative implications on foreign investor confidence and in turn affect the domestic capital markets and the ringgit.

AmBank Research said that the downgrade from A- ratings highlights the need to further strengthen Malaysia’s reforms, transparency and inclusiveness.

It added that the downgrade would raise the country’s borrowing costs. Fitch said on Dec 4 that political uncertainty following the change in government last March weighed on the policy outlook, as well as prospects for further improvement in governance standards.

Deterioration in governance and continued political uncertainty could dampen investor sentiment and constrain economic growth, it added

“The new government continues to implement some transparency-enhancing measures launched under the previous coalition, and corruption trials of former officials have continued, but the government’s thin two-seat parliamentary majority implies persistent uncertainty about future policies, in Fitch’s view.

“After a significant improvement in 2019, Malaysia’s World Bank governance score weakened slightly in 2020, to the 64th percentile, and is closer to the BBB median of 58th percentile than the A median of 76th percentile, ” according to Fitch.

Following the move by Fitch to downgrade Malaysia’s long-term, foreign-currency issuer default rating, all eyes are on whether the other two global ratings agencies – Standard and Poor’s (S&P) as well as Moody’s – would follow suit.

Currently, Moody’s credit rating is A3 with a stable outlook and its next review is expected to be in the first quarter of 2021. Meanwhile, S&P has a A- with a negative outlook for Malaysia, with its next review expected to be in the second quarter of next year.

RHB Research, for one, is of the view that Fitch’s rating downgrade is unlikely to be followed by S&P and Moody’s in the next few months.

‘We believe, post Covid-19 pandemic, Malaysia’s fiscal authorities are likely to engage in a comprehensive fiscal consolidation strategy. Currently, based on our medium forecasts for gross domestic product or GDP growth, inflation, interest rates and exchange rates, we view Malaysia’s general government debt trajectory as sustainable, ” RHB Research said.

Further downgrades would only weaken the country’s credit profile at a time when Malaysia is already on the brink of potential exclusion from the World Government Bond Index.

Economists are mixed on the ratings downgrade by Fitch, with MIDF Research calling it a “surprise”.

However, generally, economists do not think the downgrade would have a major impact on the economy or the capital market, although a knee-jerk reaction is expected.

Hong Leong Investment Bank Research said that even a knee-jerk reaction could lead to capital outflows.

“Non-residents currently hold 24.6% of Malaysia’s government bonds valued at RM202.1bil. Out of which, long-term holders (central bank and pension fund holders) account for 51% of total.

“The rest are held by foreign banks, insurance companies, asset management companies and others, ” it said.

The ringgit opened weaker against the US dollar yesterday as the market reacted on the ratings downgrade, among other factors. However, by the end of the day, the selling pressure of the ringgit appeared to have eased.

Earlier last week, the local currency gained higher amid firmer crude oil prices.

RHB Research said that any knee-jerk retracement of the US dollar-ringgit exchange rate to around 4.10 will be temporary.

It also said the rating downgrade by Fitch was unlikely to impact Malaysia’s financial markets on a sustained and significant basis.

“At the long end of the curve in the government bond market, any knee-jerk reaction of a five to 10-basis-point rise in yields as the market digests the ratings news in the early part of the week is an opportunity to long the 15-year Malaysian Government Securities.

“We expect the ringgit bond market to remain supported as bond dynamics are healthy on the back of continued support from onshore real money investors and still-compelling real yields, ” according to RHB Research.

Meanwhile, MIDF Research believes that the new BBB+ ratings have been priced into Malaysia’s credit default swap (CDS) spread.

A CDS is a financial derivative that allows an investor to “swap” or offset its credit risk with that of another investor. In other words, it acts similar to insurance. The higher the CDS spread, the riskier the credit profile.

“Based on our observation, Malaysia’s CDS spread has not spiked up significantly prior to the downgrade, ” stated MIDF Research.

The research house further pointed out that previous rating actions did not have a long-term impact on equities.

“We expect that there will be a knee-jerk negative reaction to Malaysia’s downgrade, but we expect that the overall upward trajectory of the market remains intact, ” it said.

It is noteworthy that the last time Fitch downgraded its ratings for Malaysia was during the 1997/98 Asian Financial Crisis.

Malaysia is not the only country hit by a rating downgrade this year. Notably, countries or territories with stronger credit such as the United Kingdom and Hong Kong have also suffered downgrades by Moody’s and Fitch.

“In some way, it is understandable that rating agencies are revising their sovereign ratings, given the deep impact that the Covid-19 pandemic has had on economies around the world.

“We should note that BBB+ (Malaysia’s rating) is still investment-grade, ” said MIDF Research.

A bond is considered investment-grade if its credit rating is BBB- or higher. Bonds with lower ratings would be considered “junk bonds”.

Source: https://www.thestar.com.my/business/business-news/2020/12/08/zero-impact-from-fitch-downgrade

Thailand

Thailand