Malaysia: Slow and steady improvement

PETALING JAYA: Like how all good things shall come to an end, consumers and businesses will soon have to bid goodbye to the six carefree months when they did not have to worry about their monthly financial obligations.

The blanket bank moratorium, which has held the economy together for the past six months, will be losing its grip next Wednesday as the period from April 1 comes to an end, rather timely as the Malaysian economy starts picking up momentum.

Banks would likely see an improvement in their performance post moratorium but experts were of the view that it would be gradual.A banking analyst said the sector’s performance would not be able to hit pre-pandemic levels yet and this would likely be the situation for the next one to three years as the improvement in banks’ earnings is premised on an economic recovery, which is still marred with uncertainties.

Financial institutions felt the brunt of the pandemic in the second quarter of the year, which took on the full effect of the movement control order (MCO) that was put in place due to the coronavirus disease (Covid-19) outbreak.

“It is a good thing that the moratorium is ending as banks should see higher repayments from those who can afford it but took advantage of the automatic moratorium.

“We should not be seeing a sudden spike in gross impaired loans (GILs). They may increase, but only gradually because the banks are offering rescheduling and restructuring (R&R) packages to the borrowers.

“Unless banks relax their underwriting standards, GILs should be manageable, ” he told StarBiz yesterday.

He added that it is still a long road to recovery for the economy because elements such as business closures and unemployment are set to kick in post-moratorium.

MIDF head of research Imran Yassin Md Yusof (pic below) said it was difficult to anticipate what the situation would be post-moratorium due to the lack of visibility and guidance from banks.

A spike in non-performing loans and provisions was expected but with banks intensifying their R&R efforts, this might limit some of the risk.

“As for the earnings in the third quarter, we believe that on a sequential quarter basis, we are looking at a better quarter as we expect provisions may be lower.

“There could also be improvements in terms of net interest margins (NIMs) with the repricing of deposits following the overnight policy rate (OPR) cuts.

“We also saw robust loan growth as well in the third quarter of this year due to the Penjana stimulus among others, which will give some support to the net interest income, ” he said.

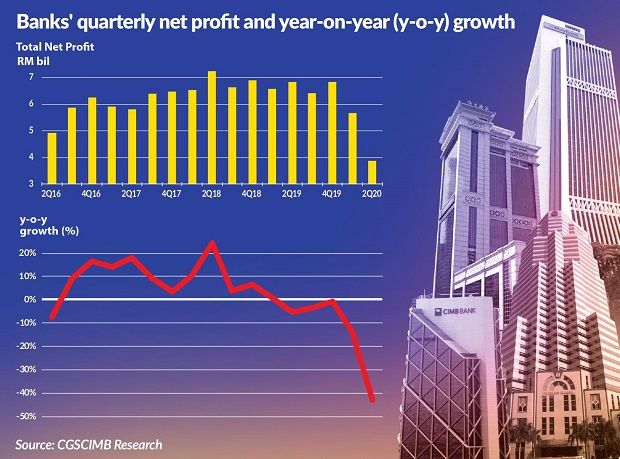

The research house is looking at 25% to 30% quarter-on-quarter earnings improvement but on a year-on-year (y-o-y) comparison against 2019, it is expected to contract by 20% as provisions remain elevated.

Imran said fourth quarter earnings could be weighed down by the increase in provisions due to the end of the moratorium but it was difficult to provide any estimate.

“In the longer term, we expect earnings of banks to improve in tandem with the recovery of the economy, due to the fact that the financial sector is strongly correlated with economic performance.

“Hence, we expect interest income will gradually improve, while provisions will start to normalise by the second half of next year, ” said Imran.

CGS-CIMB Research upgraded its rating on the banking sector from “neutral” to “overweight” as it believed that the market has priced in most of the bad news affecting banks’ earnings this year.

It said this was reflected in the year-to-date underperformance of the KL Financial Index against the benchmark FBM KLCI by 15%.

The research house projected the banks’ bottom line to grow by 14.7% in 2021 compared with a contraction of 18.7% in 2020.

“This will be driven by the bottoming of the OPR which would lead to a stabilisation of NIM and the declining loan loss provisioning (LLP) in 2021 as provisions due to Covid-19 would have been mostly captured in 2020.

“Another factor is also the recovery in loan growth, driven by the expectations of a 7.5% gross domestic product (GDP) growth in 2021, ” it said in a report yesterday.

It added that the second quarter net profit would be the worse for banks during the current economic downturn, triggered by Covid-19 and a gradual recovery is expected in the coming quarters.

CGS-CIMB is also of the opinion that the sector is trading at attractive valuations with a price-to-book value of only one time and a forward price to earnings (P/E) ratio of 10.5 times, the lowest since February 2013, suggesting that it is ripe for picking for earnings recovery.

Meanwhile, Imran said that while valuations of banks seem attractive, investors should still be very cautious due to the uncertainties surrounding the moratorium.

“We believe that it’s better to wait until the situation becomes more certain.

“However, there are a few notable banks that we believe that can weather the uncertainties, such as BIMB Holdings Bhd due to its borrowers profile, which will mitigate any pressure on asset quality and also, RHB Bank Bhd, ” he said.

due to its borrowers profile, which will mitigate any pressure on asset quality and also, RHB Bank Bhd, ” he said.

He pointed out that banks would likely want to retain more capital due to the uncertainties, especially as provisions might remain elevated until the first quarter of next year.

Source: https://www.thestar.com.my/business/business-news/2020/09/22/slow-and-steady-improvement

Thailand

Thailand