Malaysia Set to Hike Key Interest Rate as Price Pressures Persist

(Bloomberg) — Malaysia is expected to raise its benchmark interest rate again Thursday, as the Southeast Asian nation seeks to cool persistently high inflation ahead of a general election due in weeks.

Bank Negara Malaysia will hike the overnight policy rate by 25 basis points to 2.75% at its last policy meeting of the year, according to 22 of 24 economists in a Bloomberg survey. The rest predict no change.

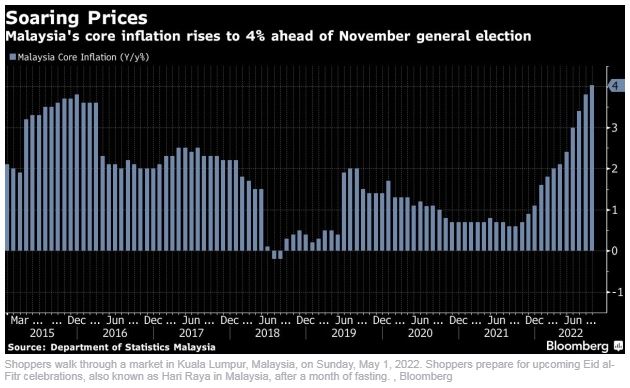

The decision will mark the fourth straight adjustment to borrowing costs since the central bank declared in May that it would begin reducing its degree of monetary accommodation. That resolve will probably be strengthened by latest core inflation numbers that surpassed a seven-year-high in September, despite BNM’s consecutive rate hikes.

The central bank is under pressure to keep inflation in check. Soaring living costs will be among the biggest concerns for Malaysians as they head to the polls on Nov. 19. Prime Minister Ismail Sabri is seeking to end years of political instability by securing a stronger mandate in the election, and that hinges on ensuring people can bring food to the table.

Here’s what to expect from Thursday’s statement:

Inflation Forecast

Price pressures may rise further given Malaysia’s plans to reduce subsidies next year. While headline inflation eased in September on government price interventions on items such as poultry and petrol, the core measure — which strips out volatile food prices — saw a spike.

“With the potential adjustments in fuel and food subsidies, the peaking of inflation could be delayed to some time in 2023,” RHB Bank economists Chin Yee Sian and Wong Xian Yong wrote in a research note. They expect the overnight policy rate to hit the range of 3% to 3.5% by the first half of next year on account of this.

BNM may revise its price forecast for the year as well, as its previous estimate of 2.2% to 3.2% headline inflation no longer matches the government’s new projection of 3.3%. For 2023, price pressures are expected to remain within the range of 2.8% to 3.3%, according to the finance ministry.

Growth Outlook

BNM may elaborate on the risks to the domestic economy in Thursday’s statement. The export-reliant nation is vulnerable to global supply chain shocks, and the slowdown in China — Malaysia’s largest trading partner — could have deep repercussions.

What Bloomberg Economics Says…

“The central bank has so far favored a gradual pace of tightening in 25-bp increments. We expect this to continue, especially with the outlook for global demand deteriorating further.”

— Tamara Mast Henderson, Asean economist

The central bank may also update its gross domestic product forecast to be in line with the government’s latest estimate. The Finance Ministry revised the 2022 GDP growth target to between 6.5% and 7%, from an initial estimate of 5.3% to 6.3%. It expects growth to ease next year to between 4% to 5% on the back of a global slowdown. BNM has yet to reveal its growth forecast for 2023.

Monetary Policy

Malaysia has been on a path toward monetary normalization since the “unprecedented conditions” brought on by Covid-19 abated in May. The central bank may reiterate its commitment to reduce its degree of monetary accommodation in a measured and gradual manner as it seeks to balance price pressures and economic growth.

Higher interest rates are also key to supporting the ringgit, which is trading near its lowest level in more than two decades, pushing up living costs in the food-importing nation.

Source: https://www.bnnbloomberg.ca/malaysia-set-to-hike-key-interest-rate-as-price-pressures-persist-1.1840924

Thailand

Thailand