Malaysia: Rising rubber a rival for palm oil

PETALING JAYA: Exports of Malaysian rubber products could catch up with – and even overhaul – the country’s palm oil-based manufactured products, as demand for gloves and personal protective equipment (PPE) prevails with a global shortage caused by the Covid-19 pandemic.

Sunway University professor of economics Yeah Kim Leng (pic below) said global demand for rubber products will continue to grow as long as the pandemic remains unabated.

“The exceptional export demand has been driven by PPE and medical equipment that require rubber products, ” he told StarBiz.

However, Yeah said the surge could start tapering off once a vaccine is found.

“Once the virus has been contained or is better-managed, there will be lower demand for such products.

“I believe there will be a sharp drop once there is more certainty. However, given that it is a basic health necessity, demand for gloves and PPE will continue to remain strong, even after the pandemic ends. But we will not continue to see the spike in demand that we are seeing now.”

AmBank Group chief economist Anthony Dass (pic below) said the export of rubber products could ultimately outpace that of palm oil-based manufactured products if the pandemic ends up being a long-drawn-out affair.

“If the pandemic gets worse, or if a vaccine takes a long time to become universally accepted, I believe exports of rubber could outshine palm oil in the near term.

“But once a vaccine has been accepted, the demand for rubber will drop. Growth won’t be exponential like it is now, but it will grow at a steady pace.”

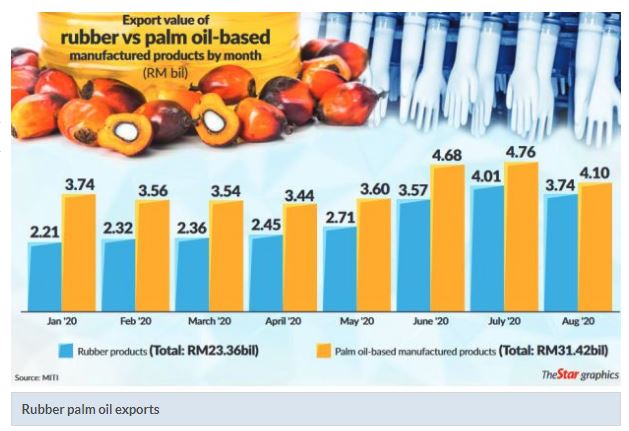

According to Malaysia’s latest trade figures, exports of rubber products surged 66.8% year-on-year last month to RM3.74bil, accounting for 4.7% of total exports.

Exports of palm oil and palm oil-based agriculture products, meanwhile, increased just 0.4% to RM4.1bil, accounting for 5.2% of total exports.

BIMB Securities Research, in a report yesterday, said Malaysia’s exports going forward will be supported by sales of selected products, particularly electrical and electronics (E&E) and rubber products.

“The turnaround in the global electronics cycle is another key catalyst for the turnaround in Malaysia’s manufacturing sector. Growing demand by certain segments such as medical and electronic devices that facilitate the new norm could see demand for E&E products continuing to increase.

“We continue to expect pharmaceutical exports to shine for the rest of 2020, whilst demand for rubber products, particularly medical gloves, will probably remain elevated.”

Earlier this month, the Malaysian Rubber Glove Manufacturers Association (MARGMA) president Denis Low (pic below) said Malaysia’s rubber glove makers have been struggling to meet soaring demand for medical gloves during the pandemic due to a shortage of workers, adding that it could cost the country dearly in export revenue.

He estimated that the industry could have lost around RM7.6bil in revenue for Malaysia due to the labour shortage.

MARGMA has revised its forecast for export revenue up by 36.7% to RM29.8bil and export volumes up by 9% to 240 billion pieces of gloves this year.

There are, however, threats facing the rubber products. Apart from waning demand once the pandemic ends, Malaysia’s rubber product exports will also face stiff competition from Thailand, the world’s largest natural rubber supplier.

Yeah said countries like Thailand have been ramping up production, especially since the start of the Covid-19 outbreak.

“One of the big changes to the industry landscape is that many companies are relocating their productions closer to markets where raw materials are in abundance. We are seeing more companies eyeing Thailand as an opportunity to grow their business.”

However, Yeah noted that some companies in Malaysia, such as Top Glove Corp Bhd , already have a presence in Thailand.

, already have a presence in Thailand.

“Some of our companies are well diversified. With Thailand ramping up production, Malaysian firms can see it as an opportunity to expand their production base, ” he said.

Last month, Bloomberg reported that Thailand was ramping up domestic production of gloves. The report said about 80% of Thailand’s rubber had traditionally been exported for further processing, with tyre makers normally the biggest customers.

However, with the pandemic driving up demand for gloves, Bloomberg said Thailand can easily double its glove market share to 26% next year.

“While Malaysian firms were quick to ramp up glove production, often using nitrile, a synthetic compound, Thailand was slower to make the pivot to local manufacturing. Now the state-owned Rubber Authority of Thailand is nudging companies to boost glove production to take advantage of the nation’s abundant supply of natural rubber.”

Rubber Authority governor Nakorn Takkavirapat was quoted as saying that Thailand wants to be “the world’s number one natural rubber glove producer”.

“There are many opportunities for us because the Asian glove market has the biggest growth potential, and we supply the majority of natural rubber to the world, ” he said.

Thailand produces about 4.8 million tonnes of natural rubber annually, far ahead of Indonesia, Vietnam and Malaysia.

Source: https://www.thestar.com.my/business/business-news/2020/09/30/rising-rubber-a-rival-for-palm-oil

English

English