Malaysia: Rising pressure on debt with recession risks

PETALING JAYA: While the government’s current debt level is manageable, there is rising pressure for the debt load to surge in the wake of the looming recessionary risks in the United States and developed economies.

Exacerbated by the stronger global inflation, economists concurred that embarking on the right strategies are necessary to keep the debt level at bay in the medium to long term.

The government has started the ball rolling by announcing the austerity drive, but more is needed, they said, noting that rising debt levels would impact the fiscal space and lead to higher debt service charges.

The federal government’s debt as at the end of June 2022 stands at RM1.045 trillion, or 63.8% of the gross domestic product (GDP).

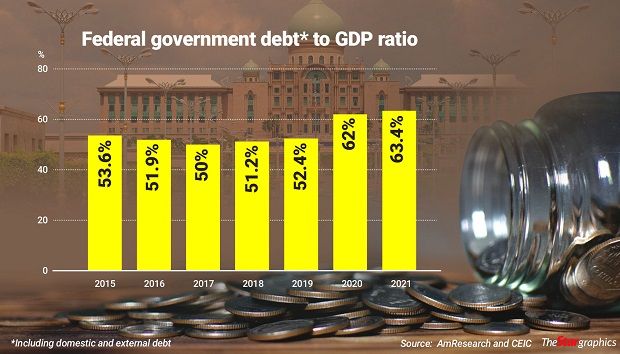

AmBank Group chief economist Anthony Dass told StarBiz that while the government’s debt had fallen slightly to 63% of GDP in the first quarter (1Q22), from 63.4% in 4Q21, there is still pressure for the overall debt load to rise this year. This could happen if the fiscal deficit widens above 6%, he said.

The government is targeting the fiscal deficit to be in the range of 6% of GDP for the year, an improvement from 6.4% in 2021.

Dass, who is also a member of the Economic Action Council Secretariat, said: “Even if Malaysia’s government debt burden rises, it is unlikely to exceed its debt-to-GDP ceiling of 65% in 2022. The debt burden threshold is benchmarked at a debt-to-GDP ratio of 70% and gross financing needs-to-GDP of 15%,” he noted.

Increasing debt level would lead to higher debt service charges, he said, noting that this would have a knock-on impact to retain the government’s capacity to allocate for other expenditures.

“What is crucial now is for the government to reaffirm its commitment to a concrete medium-term fiscal consolidation plan to bring its budget deficit down to pre-Covid-19 pandemic levels.

“There is a need to re-emphasise on the commitment to fiscal consolidation in the medium term as outlined in the 12th Malaysia Plan with a deficit target of 3.5% to GDP by 2025.

“The continuous provision of fiscal support in the medium term is projected to lead to a more gradual pace of fiscal consolidation, resulting in a more moderate decline in the debt-to-GDP ratio.

“However, the planned fiscal reforms, anchored by the introduction of the Fiscal Responsibility Act, adoption of Medium-Term Revenue Strategy and expenditure reviews, will accelerate the resumption of fiscal consolidation post-crisis,” Dass said.

These initiatives, he said, would build sufficient buffers in ensuring fiscal and debt sustainability in the medium and long term.

Meanwhile, Fitch Solutions Country Risk and Industry Research has revised its fiscal deficit forecast for Malaysia for 2022 to 6.5% of GDP, from 6.3% previously.

It expects the overall government’s debt load to rise this year, especially in light of the anticipation of wider fiscal deficit for this year.

Fitch Solutions has also revised up its expenditure forecast for 2022 to RM364bil (21.7% of GDP), from RM334bil (21% of GDP) previously, in order to reflect additional spending by the government to maintain fuel and food subsidies.

It noted that the government’s lack of a concrete medium-term fiscal consolidation plan to bring its budget deficit down to pre-pandemic levels poses downside risk to debt sustainability.

Juwai IQI global chief economist Shan Saeed said there are two options the government could take to manage its debt. It could either undertake debt restructuring or debt structure profiling.

He said the former modifies the financial structure of liabilities to reduce their net present value. The latter addresses the aggregate schedule of the country’s present and future repayments via refinancing, debt substitution and renegotiation with financial institutions and multilateral institutions.

Furthermore, he said pre-emptive negotiations are becoming in vogue to avoid default risk.

However, Shan does not foresee higher debt-to-GDP ratio for this year. With higher oil and commodities prices, upsurge in the trade and commerce, and increase in GDP size, he said debt levels would get lower, and the government would be able to consolidate the fiscal side of the balance sheet.

“Debt-to-GDP number can be expected to come down to 61% or 62% while the budget deficit will remain under 6% from the current level of 6.4% this year.

“Any debt to GDP level above the 90% threshold can lead to economic disaster for the country. Malaysia sovereign debt level is way below from the threshold stage. Furthermore, investors have strong confidence in the country and its leadership,” he said.

On another note, he said he expects the government’s statutory debt to remain at 60.4% of GDP, thanks to higher commodities prices and strong trade performance.

Under the Temporary Measures for Government Financing (Coronavirus Disease 2019) (Amendment) Act 2021, it is stipulated that the statutory debt limit should not exceed 65% of GDP.

OCBC Bank economist Wellian Wiranto said in the near term, the move to make the higher debt ceiling arrangement permanent would give the government more breathing space, especially in light of the need to subsidise food and fuel items due to the inflation risk.

“Over the medium term, however, more needs to be done to remedy the root cause of the issue, which is undiversified sources of government revenue that contributes to high fiscal deficit.

“To finance such a deficit shortfall, the government inadvertently has to borrow more, resulting in a net addition to the already relatively high stock of debt.

“Hence, to that end, we see the likelihood of a goods and services tax reintroduction to plug the fiscal gap, and ultimately reduce the marginal addition to the debt pile,” Wellian said.

Economist Shankaran Nambiar said the government needs to carefully manage its debt, fiscal policy and its growth trajectory carefully as managing debt is not the same as avoiding debt.

He said with the United States expected to go into recession next year, it is even more important to keep an eye on Malaysia’s debt level and be prepared with the right strategies for debt accumulation and management.

“It is equally necessary to prepare a strategy for reducing debt and returning to balanced books,” said Nambiar, who is the head of research at the Malaysian Institute of Economic Research.

HELP University economist Paolo Casadio said the optimal debt level and management depend on the scenario the country is in.

“In our slow growth baseline scenario, we should think about selected measures to stimulate the economy with a good cover over the total debt-to-GDP level.

“In the riskier scenario, where there could be a downturn in growth, the government should be ready to intervene in a much more decisive way, with extra budget to avoid a hard landing of the economy,” he said.

Malaysia University of Science and Technology professor Geoffrey Williams said the government must reform the subsidies process by introducing initiatives such as tiered pricing for petrol and significant supply-side reforms to remove monopolies, cartels and regulatory restrictions.

“We must not follow a narrative that the solution to the current problems are higher interest rates, austerity or cuts on government spending and debt.

“The solution lies in supply-side reforms, freeing the market and having an accommodative policy stance while making those reforms,” Williams said.

Casadio foresees the economy to slow down or go into a recession in the second half of the year, while Williams is maintaining his growth forecast of around 3.5% for the year.

Source: https://www.thestar.com.my/business/business-news/2022/07/25/rising-pressure-on-debt-with-recession-risks

Thailand

Thailand