Malaysia: Right track to recovery

PETALING JAYA: Malaysia’s economy is expected to stage a healthy growth by year-end, underpinned by pent-up consumer demand, robust exports and the lifting of Covid-19 restrictions domestically and abroad.

Economists are in sync with the government’s projection of between 3% and 4% of gross domestic product (GDP) growth for 2021.

AmBank Group chief economist Anthony Dass said with pent-up demand, coupled with high commodity prices and robust exports, the economy is expected to show a healthy growth for the full year.

For the final quarter of 2021, the economy was projected to expand by 2.9% year-on-year (y-o-y) and 3.5% y-o-y for the full year.

Based on the bank’s forecast, he expected a monthly GDP growth of 1.2% for the month of October.

The government projected GDP growth in 2021 at between 3% and 4%, compared with contraction of 5.6% in 2020.

Next year, GDP growth is forecast to be around 5.5% and 6.5%.

The economy shrank 4.5% y-o-y in the third quarter of 2021, which was markedly worse than the median forecast for a 1.3% contraction based on a Reuters survey of economists.

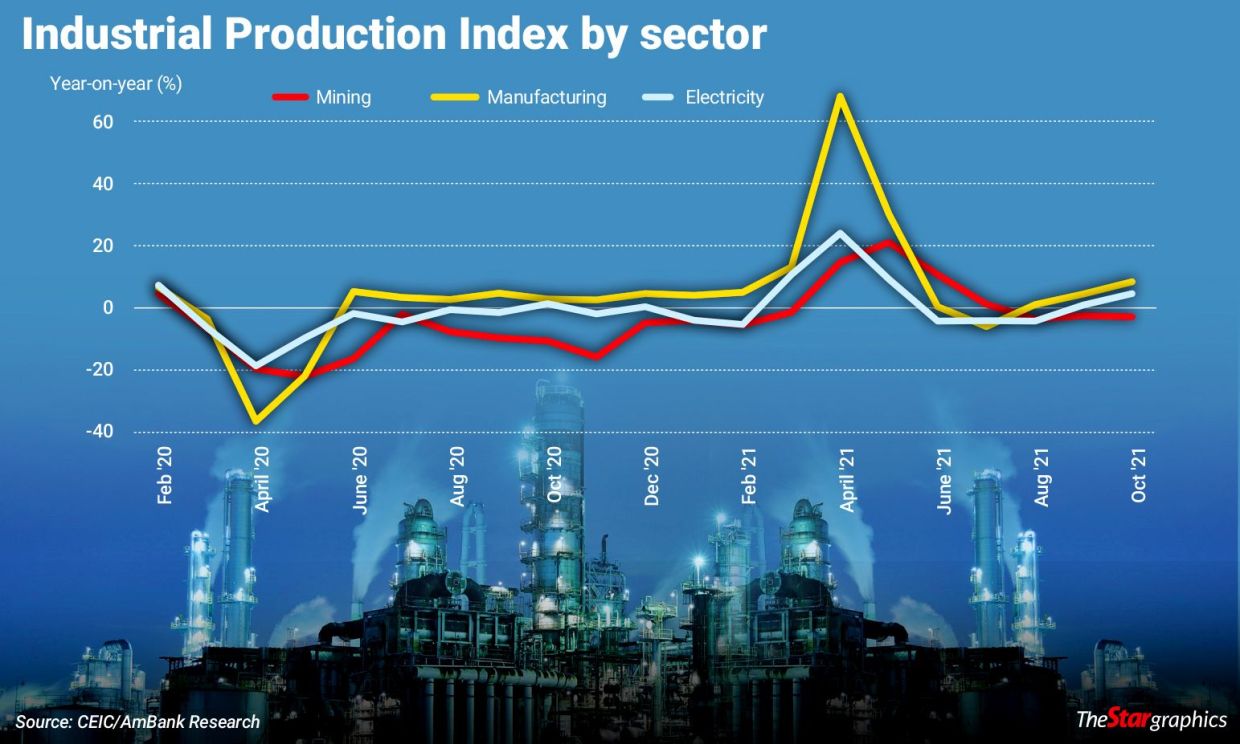

The indication of the health of the local economy for this year could also be gauged by the latest performance of the industrial production index (IPI)

For October, Malaysia’s IPI reached its highest since May 2021 at 5.5% y-o-y, much higher than 2.5% y-o-y during the previous month. On a monthly basis, the same headline index grew 4.8%.

The growth was driven by the manufacturing index growth at 8% y-o-y and electricity index at 4.1% y-o-y, but being offset by the decline in mining of 3.5% y-o-y.

The manufacturing output increase could be attributed to electrical and electronics (13.6% y-o-y), food, beverages and tobacco (9.3% y-o-y) and petroleum, chemical, rubber and plastic products (6.3% y-o-y).

Distributive trade also grew, expanding at 5.4% y-o-y from a 2.6% contraction, and after four months of decline.

AmBank noted this was broadly expected as the economy reopens and the high vaccination rate allows the economic sector to function properly in the new normal.

Furthermore, Dass said the exemption of new vehicles’ sales and services tax (SST), which is extended to June 2022 under Budget 2022, would help buoy the automotive market after being heavily affected during the lockdown.

This could be seen in the double-digit growth of its sales value and volume in the sale of motor vehicles, he added.

Nevertheless, he said caution remains on the possibility of the emergence of deadlier and more severe new Covid-19 variants.Meanwhile, Hong Leong Investment Bank (HLIB) Research said it is maintaining its GDP forecast of 3.5% y-o-y for this year.

Despite headwinds, the lifting of Covid-19 restrictions domestically and abroad is expected to further improve demand conditions and support local manufacturing activity, it added.

TA securities said the overall output (IPI) indicated a promising performance in the final quarter of 2021 following the strong October growth.

It said for the 10 months, the IPI recorded an expansion of 7.3% compared to the same period in 2020.

“The increment was influenced by the rise in all components – manufacturing, mining and electricity indexes.

“These support our view that the fourth quarter GDP growth for this year will be better, following the lifting of Covid-19 restrictions,” the research house said.

Source: https://www.thestar.com.my/business/business-news/2021/12/14/right-track-to-recovery

Thailand

Thailand