Malaysia: Retail investors can play big role in ESG priorities

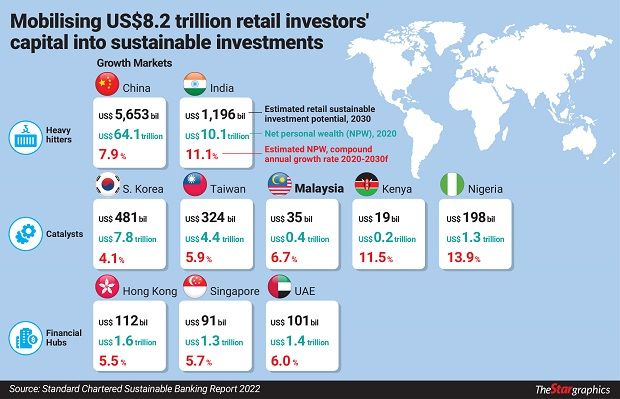

KUALA LUMPUR: Malaysian retail investors have the potential to channel US$35bil (RM165bil) towards top environmental, social, and governance (ESG) priorities, particularly the financing of climate transition by 2030, according to Standard Chartered.

Its “Sustainable Banking Report 2022: Mobilising retail investor capital” found that US$8.2 trillion (RM38.7 trillion) of investable retail wealth could be channelled into sustainable investments by 2030 to finance ESG objectives in 10 growth markets across Asia, Africa and the Middle East, Bernama reported.These markets are mainland China, Hong Kong, Taiwan, South Korea, Singapore, Malaysia, India, the United Arab Emirates, Nigeria and Kenya.

In a statement yesterday, Standard Chartered Malaysia said this capital could also play a critical part in bridging funding gaps in Malaysia’s other ESG priorities such as pollution and waste management.

According to the research, Malaysia has high potential for growth in sustainable investing, largely due to its significant population and rising domestic wealth. Across the country, 36% of investors want to put their money towards addressing climate issues.

“Greater access and transparency in the sustainable investment ecosystem could mobilise Malaysia’s retail capital potential in reaching its carbon neutrality targets, aside from other ESG issues of concern to retail investors, such as pollution, waste management and energy security,” it noted.

Source: https://www.thestar.com.my/business/business-news/2022/10/19/retail-investors-can-play-big-role-in-esg-priorities

Thailand

Thailand