Malaysia: Recovery catalyst

PETALING JAYA: The government’s latest stimulus package of RM20bil, dubbed the People and Economic Strategic Empowerment Programme (Pemerkasa), is expected to accelerate the recovery across several key economic sectors that have been affected following the second round of the movement control order (MCO) that began in January.

Experts welcomed the targeted stimulus package, pointing out that it would help improve market sentiment and provide further support to job creation.

The stock market also responded positively to the stimulus package, which was announced by Prime Minister Tan Sri Muhyiddin Yassin on Wednesday.

Yesterday, the FBM KLCI rose by 3.02 points or 0.19% to 1627.99 points, marking an increase for the fourth consecutive trading day.

Speaking with StarBiz, Bank Islam Malaysia Bhd chief economist Mohd Afzanizam Abdul Rashid (pic below) said the construction sector will be one of the beneficiaries under the Pemerkasa plan, especially for small-scale contracts.

“The others would be food and beverages, retail and tourism-related sectors, given the extension of wage subsidies, business grants and microfinancing.

“These measures give them more breathing space and allow those businesses to better plan their working capital requirement and capital expenditure in order to expand their businesses, especially when the economic recovery is anticipated to recover gradually, ” he said.

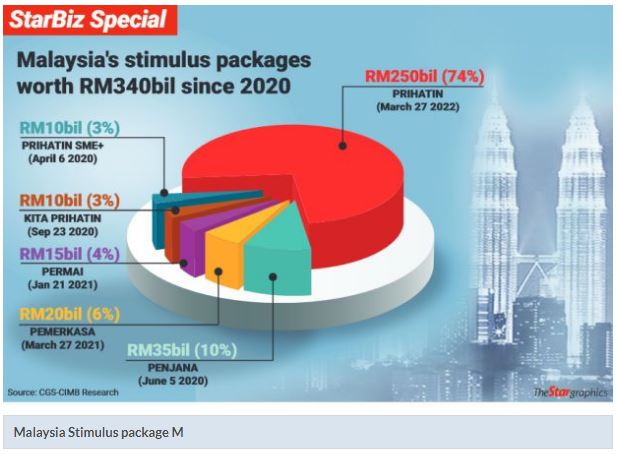

Pemerkasa is the sixth stimulus package since 2020, bringing the total value announced so far to RM340bil.

Under the latest package, 20 initiatives focussing on five areas have been outlined to further strengthen the country’s competitiveness where the focus is on attracting investments, boosting external trade and increasing the use of digital technology.

MIDF Research said in a note that the consumer sector would likely benefit the most from the Pemerkasa package, given the increased cash handouts and additional support from the government to susceptible groups.

As for other sectors, the impact is expected to be indirect in nature, driven by the stimulus package’s measures to ensure the herd immunity target could be achieved ahead of schedule.

“In our reckoning, the Pemerkasa programme is more of a back-stopper to the economic recovery effort.

“With lesser downside risks to the macro trajectory, any weakness in the equity market should be seen as a buying opportunity, thus we maintain our FBM KLCI year-end 2021 baseline target at 1,700 points, ” according to MIDF Research.

Meanwhile, Hong Leong Investment Bank Research said the automotive, banking, payment services and the real estate investment trust (REIT) sectors, among others, would see positive impact from the new stimulus package.

Within the telecommunication sector, HLIB Research believes that fixed line operators would benefit from Pemerkasa.

As the Malaysian Communications and Multimedia Commission will be allocating RM3.2bil to upgrade existing towers and expand the reach of fibre, the research house said wired players, especially Telekom Malaysia Bhd , would enjoy a lighter capital expenditure outlay.

, would enjoy a lighter capital expenditure outlay.

“Introduction of tax deductions for companies that pay for employees’ Covid-19 tests should offer some aid to manufacturers (gloves, electronic manufacturing services, furniture and others), construction and plantation.

“For tourism related initiatives, such as the exemption of tourism tax and sales and service tax, individual tax deductions for tours and 10% electricity bill discount, this should help out hotels and REITs, Genting Bhd and aviation.

and aviation.

“The extension of the listing fee waiver or rebates offered by Bursa Malaysia is a slight negative to its earnings but we note that the key driver remains average daily volume, which remains robust, ” stated HLIB Research.

Meanwhile, CGS-CIMB Research said the stimulus package was broadly neutral for corporate earnings, based on its initial assessment.

“The government plans to raise the allocation from RM150mil to RM300mil for e-wallet credit under the e-Belia programme, which will drive e-wallet penetration and total processing value for e-wallet service providers like GHL Systems Bhd .

.

“We gather that the 10% discount offered on electricity bills, which was extended to Apr-Jun 2021 from Jan-Mar 2021, for six sectors could cost RM135mil and Tenaga Nasional Bhd ’s (TNB) contribution will be limited to a max of 10% of the total, which works out to only RM13.5mil, minimal relative to TNB’s earnings base of RM5bil for FY21, ” it said.

’s (TNB) contribution will be limited to a max of 10% of the total, which works out to only RM13.5mil, minimal relative to TNB’s earnings base of RM5bil for FY21, ” it said.

CGS-CIMB Research has maintained its end-2021 FBM KLCI target of 1,759 points, following the stimulus package announcement.

Source: https://www.thestar.com.my/business/business-news/2021/03/19/recovery-catalyst

Thailand

Thailand