Malaysia: Positive lift awaits debt market

PETALING JAYA: The domestic bond market is bound to see more positive activities following the boost from the removal of Malaysia from FTSE Russell’s watch list.

Malaysia has been on the list since April 2019 and every FTSE Russell review since then has kept bond investors on their toes as they feared Malaysia’s possible removal from the World Government Bond Index (WGBI).

Finance Minister Tengku Datuk Seri Zafrul Abdul Aziz (pic below) said Malaysia has been part of the WGBI since July 2007 and its reaffirmed position in WGBI is a testament to various effective policies and initiatives aimed at continuously improving market accessibility and liquidity.

“The MoF has also actively participated in many stakeholder engagement sessions in collaboration with Bank Negara and Financial Markets Association Malaysia (FMAM) to shape policies on improving Malaysia’s financial market competitiveness, underscored by enhanced governance and transparency through streamlined compliance, regulatory and operational requirements for both domestic and foreign investors, ” he said in a statement.

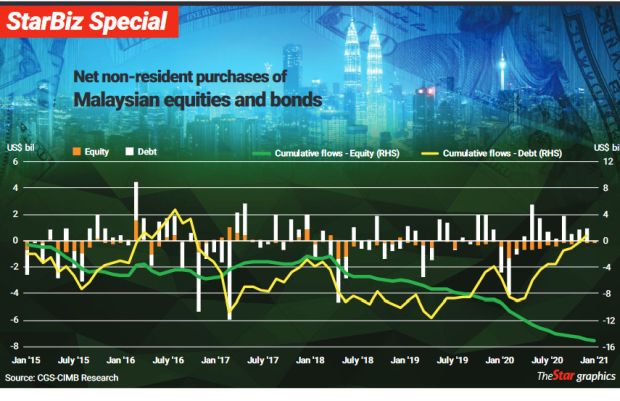

Since end-April 2019, the statement said that the cumulative foreign flow into Malaysia’s government bond market amounted to RM48.6bil, of which RM22.7bil was between end-April and December 2019, RM17.2bil in 2020 and RM8.8bil from January to end-February this year.

As at end 2020, more than half of the total foreign holdings in government bonds comprised consists long-term investors such as other central banks and governments at 31.5%, pension funds at 17.7% and insurance companies at 2.6%.

AmBank Group chief economist Anthony Dass (pic below) said the news injected much positivity into the Malaysian bond market, which has been “underweight” due to it being in the list.

“Our market will now move into the ‘overweight’ region.

“This should see more appetite from investors abroad. Now with the FTSE Russell at the back of our mind, the focus will be on the US Treasury movement, ” he said.

Malaysia’s bond market had a spectacular run in 2020 due to the downward revisions of the overnight policy rate (OPR), resulting in interest rates at multi-year lows..

And while analysts have been expecting the yields to rise, it happened earlier than expected since mid-February, tracking the US 10-year Treasury in particular.

A dealer told StarBiz that investors were cautiously optimistic in the bond market yesterday as US 10-year Treasury yields continued inching up although there was strong local demand and some foreign inflow where the 20.5-year new Government Investment Issue (GII) was well received with a solid bid-to-cover ratio of 2.56 times.

FTSE Russell announced on Monday that Malaysia’s sovereign debt market will be removed from the Watch List and have its membership retained in the WGBI based on recent market enhancements.

These included the improving secondary market bond liquidity and the enhancement of the foreign exchange market structure and liquidity.

The global multi-asset index, analytics and data provider also commended Bank Negara on its previously implemented and ongoing initiatives to address the concerns of foreign investors when accessing the Malaysian government bond market.

Meanwhile, FTSE Russell also confirmed that the Chinese Government Bonds will be included in the WGBI and its derived indexes beginning end-October 2021.

CGS-CIMB Research viewed Malaysia’s removal from the Watch List and the long phase-in period for China’s inclusion positively, providing a short-term boost to sentiment in the Malaysian Government Securities (MGS) market.

It said China will hold a weight of 5.25%, resulting in a dilution of Malaysia’s weight from 0.39% to 0.37%.

“With an estimated US$2.5 trillion in total assets under management (AUM) tracking WGBI, the new weight implies net reduction in WGBI related MGS holdings of US$500mil or RM2bil (or RM57mil per month based on 36-month phase-in), which equates to 0.5% of MGS outstanding and 1.1% of foreign holdings of MGS, ” the research house said.

Kenanga Research commented that the removal from the Watch List meant that Malaysia was no longer under threat of potential downgrade in Market Accessibility from Level 2 to 1. “This suggests that FTSE Russell is satisfied with the slew of reforms undertaken by Bank Negara during the past two years to deepen the onshore markets.

“For example, BNM has revised the rules this month to allow non-resident banks to trade ringgit interest rate swaps without any underlying positions.

“This is in addition to measures implemented last year to boost liquidity such as increased availability of off-the-run bonds to be borrowed via repo for market making, among others, ” it said.

The research house added that the development was positive from the perspective of equities as increased inflows of foreign interest in the ringgit bond market increases liquidity and reduces the yields and hence, risk-free rate.

“The risk-free rate that we used in valuing the equity market is 3.30% with some downside bias now, given an expected surge in demand, ” said Kenanga Research.

RHB Research believed that the domestic bond markets will react positively from a tactical trading perspective.

It said the main implications for markets were the recent selling pressure, notably in the back end of the MGS market, could ease temporarily.

“In the short-term, the back end could de-link temporarily from the movements in the US 10-year Treasury market.

“The interest rate spread between the MGS 3-year and MGS 10-year could ease towards 100 basis points (bps) from current levels of 121 bps.

“The technical picture on the MGS 10-year indicates that it is susceptible to close below its 90-day moving average yield of 3.34%, ” the research house said, adding that a breach below the yield would make the interest rate spread play between the MGS 10-year and MGS 3-year an attractive trading opportunity.

The Financial Markets Association of Malaysia (FMAM) said in a statement that the removal of Malaysia from the market accessibility Watch List recognised the various tangible initiatives implemented over the past two years under the leadership of the central bank.

Its president Chu Kok Wei said FMAM will continue to coordinate across different financial institutions for the common goal of developing Malaysia as a preferred investment destination.

“While we congratulate Malaysia on the FTSE Russell’s decision, the concurrent announcement of inclusion of China and reviews for inclusions of other markets are a reminder for all of us that there is no room for complacency and we need to continue to be incremental and progressive.

“FMAM will be diligent in our efforts to grow the Malaysian financial markets. While we compete intensely with each other, we are united in our common goal to grow the size and significance of the Malaysian financial markets.

“This fine balance has yielded positive results so far, and we will intensify our efforts from here”, said Chu.

Source: https://www.thestar.com.my/business/business-news/2021/03/31/positive-lift-awaits-debt-market

Thailand

Thailand