Malaysia: No cut in OPR seen

PETALING JAYA: Bank Negara is unlikely to cut the overnight policy rate (OPR) at its monetary policy committee (MPC) meeting today amid cautious optimism that an economic recovery is already taking hold in Malaysia, according to most economists.

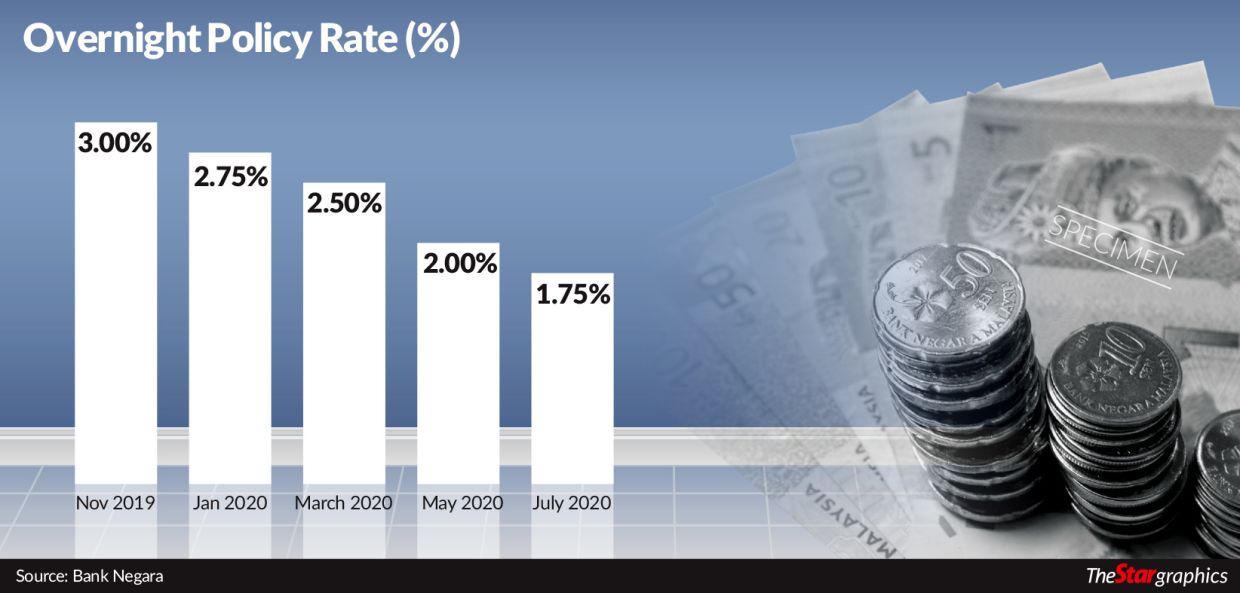

The majority of them expect the central bank to keep the OPR – which is the rate on which commercial banks based their deposit and lending rates – unchanged at 1.75% for now, as further easing of movement restrictions, amid the declining number of new Covid-19 cases and the recently launched vaccination programme, has helped improve the outlook for the economy.

Alliance Bank chief economist Manokaran Mottain told StarBiz that while Malaysia’s gross domestic product (GDP) would likely remain in negative territory in the first quarter of this year, Bank Negara would not resort to cutting the benchmark interest rate for the time being to support the economy.

“We are expecting no change to the OPR today. This is in contrast to our earlier expectation of a 25-basis-point (bps) cut, which was premised on the possibility of the second movement control order (MCO 2.0) being extended beyond March 4, ” Manokaran explained.

“But now, with the Covid-19 numbers moderating, and the government deciding to relax the movement restrictions and implement the conditional MCO, and even more industries being allowed to operate, we think Bank Negara is likely to stand pat today on the OPR, ” he added.

However, Manokaran said he would not rule out the possibility of a 25-bps cut in the OPR in the next MPC meeting, which will be held on May 6.

Also expecting Bank Negara to stick to the OPR at 1.75% today is Bank Islam Malaysia Bhd chief economist Mohd Afzanizam Abdul Rashid, who noted that there were signs that global economic recovery was taking hold.

For instance, Malaysia saw its exports grow by 6.6%, which exceeded the median estimates, he noted, adding that data from the United States had also been encouraging, with the Institute of Supply Management’s manufacturing purchasing managers’ index and new order index rising last month to 60.8 points and 64.8 points, respectively, signalling economic activities are picking up at a healthy pace.

There was also the rise in bond yields, whereby the 10-year US Treasury yield is currently at around 1.4%, compared with 0.91% in early January, and the 10-year Malaysian Government Securities yield is hovering at more than 3%, Mohd Afzanizam argued.

“In that sense, we have economic data that is pointing to an ongoing recovery process and there is also market data suggesting that interest rates would go higher at some point in the future. So perhaps, Bank Negara would want to maintain its benchmark rates and continue to assess the incoming data, ” he explained.

“In all honesty, the economic situation is still highly fluid. On one hand, we are encouraged by the vaccination programme, and the gradual relaxation of the MCO, which indicates that economic activities would pick up. But on the other hand, herd immunity would take a while to materialise, and along the way, events could take on a different turn and sway market sentiment, ” he added.

Overall, a Reuters poll of 15 economists showed 11 of them expecting Bank Negara to leave the OPR unchanged at 1.75%, while only four are forecasting a 25-bps cut today to a new record low of 1.50%.

Among those with a contrarian view is RHB Investment Bank senior economist Ahmad Nazmi Idrus, who expects a 25-bps OPR cut today.

“While there are bouts of positive developments related to the vaccine rollout and gradual easing of the MCO2.0 restrictions, we are not so optimistic over the growth trend. So far, domestic demand is still quite weak, marred by high unemployment and still-record low core inflation. In addition, banks are still cautious about lending, especially for the construction, property, and SME sectors, which makes returning to normal difficult, ” he explained.

Noting the country’s fiscal constraints, Ahmad Nazmi argued more support on the monetary side was needed.

The central bank had in total cut the OPR by 125bps last year to boost a slowing economy and mitigate the impact of the Covid-19 fallout.

Malaysia’s GDP contracted by 3.4% in the fourth quarter of 2020, bringing the overall performance of the year to -5.6%. That’s the worst contraction for the country since the 1998 Asian financial crisis as growth across all economic sectors – except for manufacturing – declined significantly.

Source: https://www.thestar.com.my/business/business-news/2021/03/04/no-cut-in-opr-seen

Thailand

Thailand