Malaysia: Looking at the bottom line

PETALING JAYA: With all eyes on the ongoing fourth-quarter 2020 (Q4) earnings season, the FBM KLCI is expected to trade range-bound this week after notching over 40 points since the start of February.

Analysts believe that investors would take a wait-and-see approach as they monitor carefully the Q4 financial results that will be concluded by month-end.

Following several quarters of under-performance, there are expectations for corporate earnings to gradually recover in Q4.

“The upside (for the FBM KLCI) is likely to remain capped by the 1,618-point to 1,628-point hurdle as the Q4 earnings season begins, ” HLIB Research said yesterday.

Nevertheless, it said that market sentiment may continue to be supported by the ongoing rally in the crude oil and crude palm oil futures prices.

In addition, the expectations of an effective implementation of the National Covid-19 Immunisation Programme beginning early March will help restore consumer sentiment and boost Malaysia’s economic growth.

Meanwhile, TA Securities Research said the range-bound trading may be possible as investors digest the country’s weaker-than-expected Q4 gross domestic product (GDP) figures announced last Thursday.

The GDP in the October-December 2020 period contracted by 3.4% year-on-year, greater than the consensus expectations of 3.1% and Q3’s revised contraction of 2.6%.

“No doubt, the outlook for 2021 remains challenging with increasing downside risks to growth coming from the domestic side due to the reimplementation of the movement control order (MCO) throughout the country, except Sarawak, until Feb 18, ” it said in a note.

Yesterday, Fitch Solutions slashed its 2021 GDP forecast for Malaysia to 4.9% from 10% previously, in view of the MCO measures.

“The domestic demand outlook has been derailed in our view, with the lockdown measures likely to cause a resurgence in unemployment, and delay any recovery in tourism-related sectors.

“This would in turn result in even more unused capacity and negatively affect the investment outlook.

“We expect a further extension of lockdown measures, and do not rule out further downward revisions to our growth forecast over the coming months, ” it said.

Looking ahead, TA Securities Research said investors should look beyond past weaknesses and anticipate a stronger recovery, as the positive impact from stimulus measures and Covid-19 recovery become more visible in the second half of 2021.

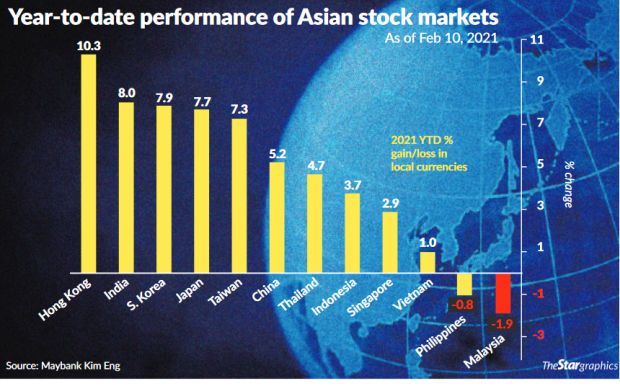

“The strong performance in the external equity markets and sustained strength in crude oil prices should provide sufficient lead for the FBM KLCI to play catch-up with other regional markets eventually.

“This should be augmented by the arrival of the Covid-19 vaccines on Malaysian shores later this month and the start of the vaccination process, ” it said.

However, the research unit also cautioned that market volatility may rise as the 15th general election nears, presumably as soon as the domestic virus outbreak is better contained by January 2022.

“On the flip side, the popular belief that there is a window of opportunity now for some to play up the market to fund election campaigns could also ignite positive sentiment, ” it said.

Commenting on the continued net outflow of foreign funds from the Malaysian stock market, the research house said the downside risk for local equities appears to be limited.

TA Securities Research pointed out further that the current foreign shareholding in the local bourse of around 20.6% is almost at a decade-low.

“In fact, the improving outlook for the crude oil price, the corresponding strength in the ringgit and the local market’s laggardness vis-a-vis its regional peers could be valid factors to convince more foreign funds to return.

“This expectation can be more conclusive if the ongoing results reporting season and feedback from public-listed companies point to a reversal in trend and better quarters ahead, ” it said.

Based on MIDF Research’s weekly fund flow report, foreign investors were net sellers for the week on Feb 12, with an outflow to the tune of RM40.57mil.

A week earlier, foreign funds were net buyers with an inflow of RM117mil.

“Since the beginning of 2021, cumulatively, retailers are the only net buyers of our equity market to the tune of RM2.11bil.

“Local institutions and foreign investors are net sellers to the tune of RM1.35bil and RM760mil respectively, ” according to MIDF Research.

Meanwhile, Maybank Kim Eng Research in an earlier note last week pointed out that net foreign fund outflows had continued for the 18th consecutive month in January 2021, totaling RM800mil.

In comparison, the net foreign fund outflow in December 2020 was slightly lower at RM600mil.

Looking ahead, Maybank Kim Eng Research expects the market to see positive inflections in the earnings outlook and investor sentiment.

Hence, the research house said it has turned more balanced in its stock positioning as compared to a defensive stance previously.

Maybank Kim Eng Research prefers a mixed portfolio of value and growth stocks, with a continuing dividend yield focus.

Its preferred sectors are mid-cap financials, automotive, construction, utilities, plantations, healthcare, exporters such as glove manufacturing and technology as well as large-cap oil and gas counters.

Source: https://www.thestar.com.my/business/business-news/2021/02/16/looking-at-the-bottom-line

Thailand

Thailand