Malaysia: IPI seen to rebound in second quarter

PETALING JAYA: The industrial production index (IPI), a measure of the rate of change in the production of industrial commodities, will likely stage a rebound in the second quarter but at the same time, there may be a challenge for the economy to achieve the Budget 2021 growth target.

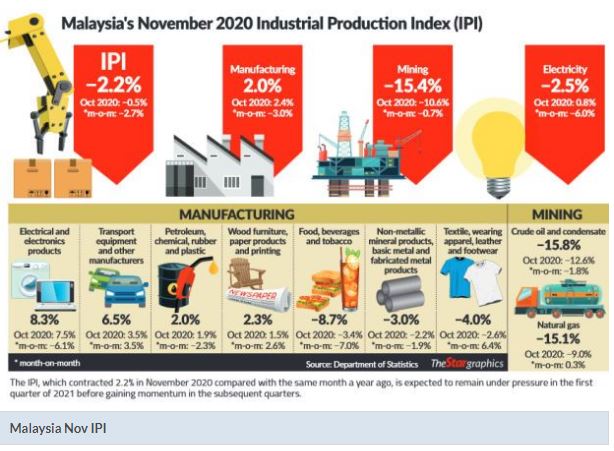

The IPI contracted 2.2% in November 2020 compared with the same month in the previous year. It is expected to come under pressure in the first quarter of 2021 before gaining momentum in the subsequent quarters.

The IPI measures the rate of change in the production of industrial commodities in real terms over time for the manufacturing, mining and electricity sectors.

According to economists, the Covid-19 resurgence would impact the IPI figures at least in the first quarter.

The current movement control order (MCO), which was implemented in six key states, contributes over 60% of the national economy. The two-week MCO started on Jan 13 until Jan 26, subject to further reviews. They six states involved are Selangor, Penang, Johor, Sabah, Melaka and the three federal territories (Kuala Lumpur, Putrajaya and Labuan).

Sunway University professor of economics Yeah Kim Leng (pic below) told StarBiz the current trend suggested the latest MCO would likely see the IPI remaining in slightly negative territory in the first quarter and turn positive in the second quarter, largely due to the low-base effect.

“The manufacturing sector, which carries nearly 70% weightage in the IPI, continues to show positive growth of 3.1% in the third quarter and an estimated 2.1% in the fourth quarter.

“With manufacturing exports likely to stage a stronger rebound on the back of the anticipated global recovery powered by China and US, the outlook for Malaysia’s industrial production in 2021 remains favourable despite the latest MCO, ” he noted.

The IPI is estimated to fall by -3.5% in 2020, he said, adding that it is forecast to expand by 4%-5% this year, supported by the recovery of domestic and global demand.

The resurgence of the pandemic would at the same time make it more challenging to hit the 6.5%-7.5% gross domestic product (GDP) growth expected in Budget 2021, he said.

Given the continuing pandemic threat, the likelihood of MCO extension and the time needed for mass vaccination rollout, Yeah said the 5.5%-6.5% range may be a more realistic expectation for GDP growth this year.

AmBank Group chief economist Anthony Dass (pic below) agrees that the GDP growth target set for Budget 2021 would pose a challenge.

With the ongoing uncertainties over the Covid-19 cases and restrictive measures, he said more downside risk prevails at the moment, especially with the drag likely to be felt in the first quarter. The potential growth of the GDP would depend on the efficacy of the Covid-19 vaccine.

He noted that the restrictive measures are expected to weigh on domestic spending.

“Pressure on the job market with more being laid off would hurt domestic spending. This, in turn, will impact manufacturing production volume and sales. A more subdued output and new order will thus weigh on the IPI.

“Concern in the coming months is the rising Covid-19 that may lead to tighter restrictions locally and abroad. It would also affect production for both trade and domestic-oriented industries, ” Dass noted.

However, he said, the recovery in China’s production would help moderate the decline in the domestic industrial production in the near future. Besides, he said, Budget 2021 should provide some positive impetus.

Juwai IQI chief economist Shan Saeed (pic below) views the declining IPI numbers as short term.

With the economy slowly picking up amid the implementation of the MCO, he expects the government to come up with structural and economic policy levers to bolster the economy.

“We expect manufacturing to lead the way for IPI to grow faster and better than many other economies in Asean. The notable sectors to watch out for will be semiconductor, transportation and logistics as well as rubber, plastics and petroleum.

“IPI will pick up the momentum, moving stronger in the second half with domestic and global economic recovery in a structured way. China and Asean markets are the key to the growth landscape, ” Shan said.

OCBC Bank economist Wellian Wiranto (pic below) agrees that the level of industrial production may see a decline overall in the first quarter due to the relative pullback in economic activities due to the MCO.

He said this might be felt especially in the electricity industrial production sub-component from the suspension of normal business activities for those sectors that are not deemed essential.

However, he said, the degree of pullback may be mitigated by the fact that the manufacturing sector – which is a key component of the overall IP index – remains open due to its essential classification.

“We have cut our growth forecast from 6% to 5.7% for the whole year, and see a chance that GDP growth may dip into -0.1% year-on-year in the first quarter, ” Wellian noted.

Bank Islam Malaysia Bhd chief economist Mohd Afzanizam Abdul Rashid (pic below) noted that the manufacturing sector, especially the electrical and electronics, would be the growth driver for IPI to rebound.

He said the outlook for the IPI for 2021 is expected to be subdued, especially the mining-related sector, as the country is also participating in the production cuts under the Opec+ agreement.

“The downside risks are highly visible and we expect business and consumer sentiments to remain weak. The government will need to play an active role to curb the virus spread and at the same time, keeping the economy and businesses afloat, ” Afzanizam said.

Source: https://www.thestar.com.my/business/business-news/2021/01/18/ipi-seen-to-rebound-in-second-quarter

Thailand

Thailand