Malaysia: Exclusive – Consumption blues

PETALING JAYA: Declining household income, insufficient savings and a resurgence of the Covid-19 threat will likely dampen private consumption, a key component of the Malaysian economy, in the near term.

The job prospect level would also dictate private consumption trends moving forward, amid unemployment which is expected to hover between 4% and 4.5% this year.

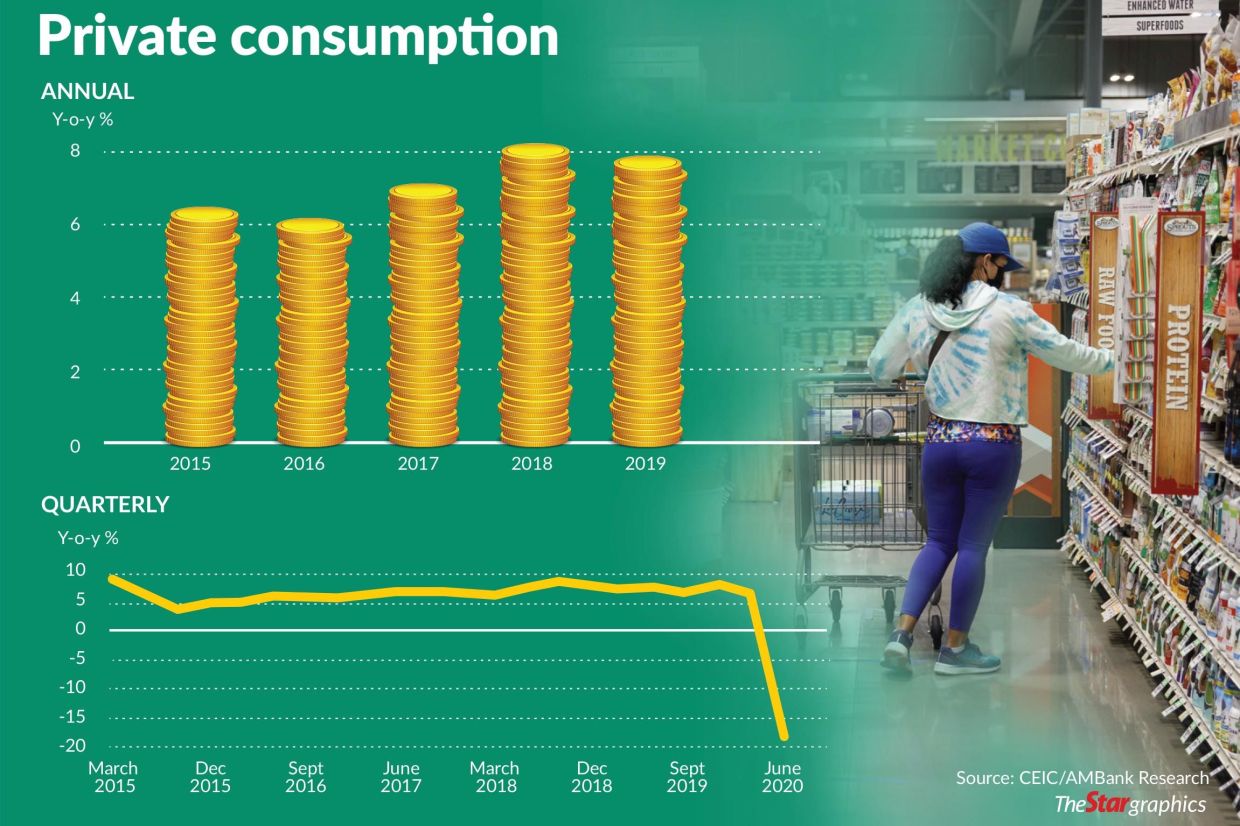

Economists are projecting private consumption to contract by 0.9% to 2% this year, substantially below the 7% trend growth of previous years.

Private consumption currently accounts for about 60% of the gross domestic product (GDP). In the second quarter, private consumption contracted 18.5% year-on-year (y-o-y).

GDP contraction in the second quarter of 17.1% y-o-y was the worst since the Asian Financial Crisis in 1997.

Malaysian Rating Corp Bhd (MARC) chief economist Nor Zahidi Alias told StarBiz that the declining growth in household income would be another challenging factor for the private consumption trend in the medium term.

Even before the Covid-19 pandemic struck globally, he said household income growth had been trending down since 2012, based on statistics recently released by the Department of Statistics Malaysia (DOSM).

For instance, the median income growth for Malaysian households moderated to 3.9% per annum on a compounded average growth rate (CAGR) basis in the 2016-2019 period (2012-2014: 11.7% per annum).

Similarly, the median income of the urban and rural population continued to decline, ie, urban population 3.8% per annum (2016-2019) from 9.8% per annum (2012-2014); the rural population 3.3% per annum (2016-2019) from 13.8% per annum (2012-2014).

The B40 group (household income level of less than RM4,850 per month) experienced the slowest growth in the median household income in the 2016-2019 period (+1.8% versus 6.6% in the 2014-2016 period).

The median income for the M40 group also slipped to 4.1% per annum (2014-2016: 6.9%). Such a trend would have an important repercussion on the medium-term growth landscape of private consumption, as the various groups normally have a high propensity to consume, Zahidi noted.

MARC expects private consumption to decline by about 1% this year and then rebound to between 5.3% and 5.7% next year.

“Malaysia’s future growth trajectory hinges largely on private consumption, which accounts for 60% of GDP. From another perspective, private consumption has contributed an average of 71% of Malaysia’s headline GDP growth in the past decade, ” Zahidi said.

The deterioration in consumer sentiment is partly due to insufficient savings as reflected in the recent DOSM survey.

According to the survey, 71% of those who have worked for between 11 and 20 years do not have enough savings to last them more than two months.

He said the reluctance of consumers to indulge in conspicuous consumption patterns similar to pre-pandemic levels would mean that consumer spending growth may not spike as strongly.

Notwithstanding this, Zahidi said mobility indicators, eg, Google’s Community Mobility Indices, have recently shown improvements, ie, minus 18% for retail and recreation from the minus 83% recorded in the third week of March.

Such improvements, he said if they were to continue, would imply some recovery in consumer spending in the second half of the year.

Sunway University professor of economics Yeah Kim Leng said following the second-quarter plunge, private consumption is recovering modestly but is ikely to end the year slightly negative or flat.

“A key factor underlining a more modest-than-expected recovery in consumer spending is the continuing threat of a Covid-19 resurgence and the necessary restrictions in place such as physical distancing that have enabled social and economic activities to normalise, but not fully.

“Other factors constraining consumer spending are the large job and income losses that had incurred in the second quarter, a greater tendency to save rather than spend due to increased risk aversion, and subdued income and wage growth expectations as employers focus on rebuilding businesses and impaired balance sheets.

“These headwinds are being mitigated by fiscal stimulus measures to spur spending, historic low interest rates, and recovery in commodity and stock market prices, ” Yeah, a former external member of the central bank’s monetary policy committee (MPC), noted.

OCBC Bank economist Wellian Wiranto said private consumption was hit very badly in the second quarter by the pandemic and the movement control order (MCO) restrictions, shrinking by a massive 18.5% y-o-y and shaving off headline GDP by 10.7 percentage points.

While we don’t expect a sharp recovery to where things were before the mess began, he thinks the worst is over for the consumption slump, and hence, the overall GDP might well see a chance of GDP growth eking out back to neutral 0% growth by the fourth quarter instead of shrinking y-o-y throughout.

“Huge challenges remain. For one, the expiration of the loan moratorium at the end of September will mean at least some period of adjustment for households in re-assessing their spending patterns once again, ” he said.

Wellian sees private consumption staying as a driver of the economic recovery – however nascent and dependent on global growth – rather than a net drag by year-end.

AmBank Group chief economist Anthony Dass, who is also a member of the Economic Action Council secretariat, cautions on the risk of employment in the manufacturing sector.

Downside risk remains, he said, as reflected by the employment index of the PMI which is in the contraction region and falling slightly in July to 48.2 from 48.9 in June.

“The risk of the second wave of the virus pandemic plus ongoing external uncertainties and domestic challenges and some recovery measures that come to an end in September could weigh on the job market.

“Although unemployment is now at 4.9%, the downside risk remains, especially from the informal sector, contract employees and part-time workers. Possibilities for unemployment to scale up above 5% remains, ” he noted. Dass is projecting private consumption to contract by 2% by year-end.

Meanwhile, Bank Islam chief economist Mohd Afzanizam Abdul Rashid, who is forecasting a 0.9% decline in private consumption and unemployment at 4.5% this year, said he foresees food and beverages, domestic tourism, manufacturing and agriculture picking up in employment opportunities.

Aviation and tourism that rely on foreign tourists would continue to be impacted by the pandemic this year, he noted.

“We can safely say that consumer spending is expected to recover in the second half of the year. However, the trajectory may not reach 7% as in normal times. We are projecting private consumption to grow 3.9% in the second half after experiencing a sharp 6% contraction during the first six months, ” he said.

Source: https://www.thestar.com.my/business/business-news/2020/08/24/exclusive—consumption-blues

Thailand

Thailand