Malaysia: Cut in statutory reserve requirement likely

PETALING JAYA: A cut in the statutory reserve requirement (SRR) may be in the offing if liquidity in the banking system is further impacted by foreign capital outflows amid the external headwinds and domestic uncertainties.

Some economists agree that SRR could come into play this year if financial conditions tighten further as a result of slower economic growth in view of the macroeconomic conditions.

AmBank Group chief economist Anthony Dass told StarBiz a potential SRR cut could happen if liquidity is being further tightened following net external outflow.

“At the moment, foreign investors are net sellers. In the equities market, net foreign capital outflows year-to-date stand at RM2.4bil while total ringgit debt is at RM4.7bil.

“Besides, we expect pressure on foreign holdings in the bond market – to be in a net outflow position in April – to remain following the headline news of the withdrawal of Norwegian Wealth Fund and FTSE Russell’s move to place Malaysia on the fixed-income watch list,” he said.

On April 15, FTSE Russell said Malaysia had been placed on its fixed-income watch list for six months until September 2019, following the completion of its first fixed-income country classification review.

Malaysia, currently assigned a “2” and included in the World Government Bond Index (WGBI) since 2004, is being considered for a potential downgrade to “1”.

In the event of a downgrade, it would render the country ineligible for inclusion in the WGBI. Bond pundits expect the move would see a significant capital flight out of the local bond market.

FTSE Russell’s move to review the nation’s government bonds’ participation in the WGBI came a week after Norway’s US$1 trillion sovereign wealth fund decided to cut emerging-market government and corporate bonds, which include those from Malaysia.

DBS Research has recently downgraded Malaysian government bonds to “neutral” although the local debt papers rank as the third-best performer among Asian emerging markets year-to-date.

It attributed the rating downgrade to Malaysian government bonds’ rising valuation and mounting risks.

Meanwhile, Socio-Economic Research Centre executive director Lee Heng Guie said the central bank has policy tools at its disposal to conduct monetary operations to support the orderly function of the domestic financial markets. These include direct liquidity lending, the reverse repo facility and SRR to provide liquidity to the banking system.

“If net external outflows continue to reduce the amount of liquidity in the banking system and result in increased cost of funding, there is a likelihood that the bank would reduce the current SRR ratio of 3.50% by between 0.5%-1% to release an estimated RM7.3 to RM14.4bil to the banking system, based on total SRR deposit of RM50.6bil (as at February).

“This helps to ease liquidity condition in the banking system, ease the cost of funding and lending and increase credit growth,” he noted.

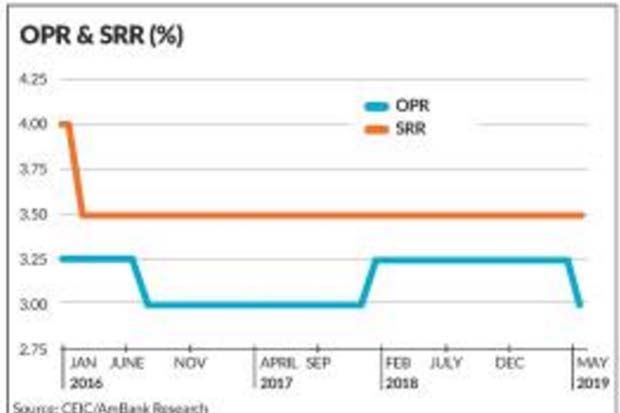

The central bank last lowered SRR ratio from 4.00% to 3.50% on Feb 1, 2016.

The SRR is the amount of funds that commercial banks are required to keep with the central bank, interest-free, and is an instrument to manage liquidity. The overnight policy rate (OPR), on the other hand, is the rate at which banks lend to each other.

The SRR is an instrument to manage liquidity and it is not a signal on the stance of monetary policy, Lee said.

Malaysian Rating Corp Bhd chief economist Nor Zahidi Alias is not ruling out the possibility of a reduction in SRR, by 50 basis points (bps) this year, especially if the economic growth continues to decelerate to around 4%.

“If the global development becomes so unfavourable and global trade continues to slide, Malaysia could take an additional step to avert a sharp deceleration in growth by ensuring sufficient liquidity in the system although liquidity is still not an issue at this juncture,” he said.

This could be done through a reduction in SRR, he said. Lower SRR would release the liquidity that banks could utilise to increase lending, hence stimulating the economy, Zahidi noted. He said a reduction in SRR also influenced money multiplier.

RAM Ratings co-head of financial institution ratings Wong Yin Ching said if loan growth slowed to unexpected level, she did not rule out a cut in SRR to release more liquidity into the system.

“We are not sanguine that the lower interest rates will spur loan growth materially, given still-sluggish consumer and business sentiments. As such, RAM is maintaining its loan growth target of 5% for 2019 at this juncture,” she said.

Maybank IB Research, which is maintaining its 2019 loan growth forecast of 5.1% for now, said: “Loan application trends point to moderating growth in the coming months for on a three-month moving average basis, loan applications contracted 8.5% in March – this being the fifth consecutive month of contraction.”

Based on estimates, Dass said a 50-basis-point cut in the SRR should help release about RM7bil of liquidity into the system.

Assuming the SRR is set at 1%, this would release an estimated RM35bil of liquidity, he noted.

On the challenges of the banking sector this year, OCBC Bank (M) Bhd CEO Datuk Ong Eng Bin said: “Aside from the slow loan growth and fee income, banks will need to manage their provisions well in light of the MFRS 9.

“The industry will also need to fully embrace the opportunities offered by digital and technology platforms to manage their cost better and become more efficient. “

MFRS 9, which comes into effect last year, will see banks having to make additional provisioning for their existing loan portfolios, leading to higher credit costs and ultimately, impacting earnings.

The new accounting standard is based on an expected loss model unlike the existing standard, which is based on the incurred loss model.

Ong said the 25-basis-point cut in OPR would not see OCBC Bank revising its loan growth numbers.

He said there would unlikely be another rate cut in the near term, unless the economic storm clouds persist over the next six to 12 months and the country’s GDP numbers are affected.

Ong said on the non-interest income side, fee income remained subdued as the wealth management business continued to be impacted by the current market sentiment, while trade and forex activities were at the same levels as last year.

Wong expects the OPR cut to crimp banks’ net interest margins further. This is because most financial institutions are dominated by floating rate loans while the bulk of their deposits took time to reprice, she said, adding that banks with larger proportion of fixed-rate loans would be less impacted.

Meanwhile, RAM Ratings head of research Kristina Fong views the recent OPR cut as a pre-emptive move by the central bank in anticipation of more pronounced weakening in global conditions due to ongoing uncertainties, like the trade war which seems far from fizzling out. “OPR call for year-end now stands at 3%,” she said.

Source: https://www.thestar.com.my/business/business-news/2019/05/13/cut-in-statutory-reserve-requirement-likely/#4xgSXOiKp7jWGHid.99

Thailand

Thailand