Malaysia: CPO futures continue uptrend on better sentiment

PETALING JAYA: The uptrend in the crude palm oil (CPO) futures contract on Bursa Malaysia Derivatives continued for the seventh consecutive day yesterday, backed by positive market sentiment.

A dealer said the recent export figures helped boost investor sentiment amid better economic data from China, one of the world’s largest palm oil consumer.

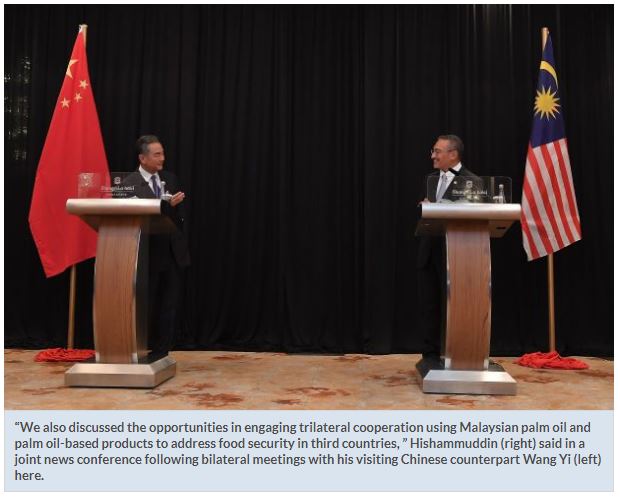

Earlier today, Foreign Minister Datuk Seri Hishammuddin Tun Hussein announced that China expressed its commitment to purchase 1.7 million tonnes of palm oil from Malaysia until 2023.

“We also discussed the opportunities in engaging trilateral cooperation using Malaysian palm oil and palm oil-based products to address food security in third countries, ” he said in a joint news conference following bilateral meetings with his visiting Chinese counterpart Wang Yi here.

In 2017, Malaysia exported 2.87 million tonnes of palm oil and palm oil derivatives worth RM9.42bil to China.

Exports of palm oil and palm oil-based agriculture products to China also rebounded by 17.8% in 2019 after declining for seven consecutive years.

According to the Malaysian Palm Oil Council, Malaysia’s palm oil exports to China increased by 438,747 tonnes, or by 31.1%, to 1,848,433 tonnes for the January-August 2020 period.

At the close, the CPO futures contract for October 2020 and November 2020 gained RM7 each to RM3,067 per tonne and RM3,054 per tonne, respectively, December 2020 bagged RM9 to RM3,003 per tonne, while January 2021 added RM8 to RM2,952 per tonne.

Total volume reduced to 58,695 lots from 58,695 lots on Monday, while open interest narrowed slightly to 261,276 contracts from 253,605 contracts.

Meanwhile, the physical CPO price was RM10 easier at RM3,080 per tonne for October South. — Bernama

Source: https://www.thestar.com.my/business/business-news/2020/10/14/cpo-futures-continue-uptrend-on-better-sentiment

Thailand

Thailand