Malaysia – Consultants: Vacancy tax won’t solve overhang

PETALING JAYA: The government’s plan to impose a vacancy tax on developers to resolve Malaysia’s unsold units have been shot down by property consultants, the view being the tax will not solve the overhang but will instead raise prices.

All three consultants say Housing and Local Government Minister Zuraida Kamaruddin should look at other ways to resolve the issue of unsold units that go into billions of ringgit.

VPC Alliance Malaysia managing director James Wong said: “It is not a good idea. Developers are already burdened with a lot of taxes including the payment of contribution and levies for the infrastructure in housing projects. More importantly is to address the root causes of the overhang.”

Last week, Zuraida said her ministry is formulating a tax to be implemented as early as next year. She said recommendations and the tax formula was tabled to the National Economic Council on Aug 19.

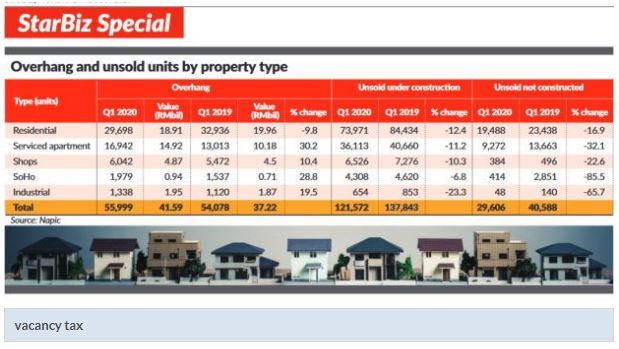

The National Property Information Centre reported that unsold units amounted to RM42bil; residentials RM19bil, serviced apartments RM15bil, shops RM5bil, small office, home offices (SoHos) RM1bil and RM2bil worth of industrial properties.

VPC Alliance’s Wong; PPC International managing director Datuk Siders Sittampalam; and the Association of Valuers, Property Valuers, Property Managers, Estate Managers, Estate Agents and Property Consultants in the Private Sector of Malaysia (PEPS) president Michael Kong Kok Kee concur that the way forward is to make it mandatory for developers to do a full and independent market and financial feasibility study before building their projects.

Wong pointed out that many housing developers built without proper market and financial feasibility studies, resulting in wrong products, pricing and location of their projects.

“Secondly, there are 10 local authorities in the Klang Valley. Each approves housing developments without knowing what the others had approved. This has resulted in too many condo and serviced apartments being built too close to each other with insufficient effective demand, ” Wong said.

He said there should be a coordinating unit among the 10 local authorities to ensure similar housing types are not build too close to one another that would reduce competition.

A full study would enable developers to discover buyers’ purchasing power, demographics, competition, demand and supply and formulate the right pricing, Wong said.

Because property development involves huge financial outlays and risks – for developers, banks and lending institutions – Wong said lenders should make the market and financial feasibility study a criteria before approving bridging loans.

“The solution to solve the huge overhang is not to impose a vacancy tax but to make it mandatory for developers to conduct a market study and financial feasibility study for future housing developments.”

He suggested further reductions in house prices to clear the overhang units. “The Home Ownership Campaign is timely. With the above measures, the vacancy tax will not be necessary, ” Wong said.

Michael Kok, presiding over PEPS, asked: “What exactly is the objective of this tax? Is it to compel developers to sell unsold units at low prices or to rent out vacant units at low rents? Alternatively, is it to deter developers from overbuilding without considering the market demand and supply situation?

“If it is (to compel developer to lower prices), it is quite draconian. If it is to deter overbuilding, obviously this is a bad idea. It is akin to closing the stable door after the horse has bolted. The current overhang situation is culminated from various factors and circumstances, both internally and externally.

“The key point here is independent market and feasibility study. The study should be commissioned by the bank or financier instead of the developer to avoid undue influence in the outcome of the study.”

The “logical course of action” is to allow developers to reduce prices first, should this tax even be implemented, Kok said.

He said unlike countries where developers hoard units in order to sell them at higher prices in the future, developers here do not do that.

The cost of holding vacant and unsold units is hefty and involves taxes, service charge and maintenance.

“Let’s say a developer has 100 unsold serviced apartments averaging 1,500 square foot (sf) per unit within a project. Assuming a service charge of 30 sen per square foot, the cost of holding the vacant units per year is RM540,000 per annum, ” he said.

PPC International Siders said Melbourne, Canada and Hong Kong have their respective vacant residency home or empty homes tax but the situation and the market there are different.

“The proposal basically interferes with the free laissez faire market. Each developer has their own market strategy and if at all they (overreach), they bear the price of that. So they now bear the burden of excess stock.

“In order to reduce inventory, prices have to come down. If the tax goes ahead next year, and they had planned to launch, developers will view this as a business cost and this will be passed on to buyers.”

While he supported a mandatory independent market and financial feasibility study, that study is not a panacea for all the challenges facing the property market today.

It is “only a tool to help developers and lenders” to weigh the risks facing them. That study cannot guarantee what the economic health of the country will be tomorrow. Neither will such a study guarantee what developers will do in the future (whether they will adhere to the views outlined in the study), ” said Siders.

Source: https://www.thestar.com.my/business/business-news/2020/08/24/consultants-vacancy-tax-wont-solve-overhang

Thailand

Thailand