Malaysia: Cloudy outlook

KUALA LUMPUR: With Malaysia posting its worst economic growth rate since the Global Financial Crisis a decade ago, the outlook for the first quarter of 2020 (1Q20) has turned more cautious amid the worsening coronavirus (Covid-19) outbreak that may further dampen the economy.

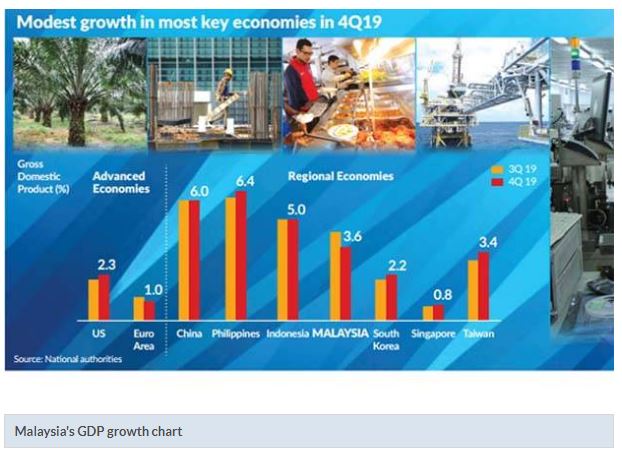

The Malaysian economy was badly hit in the fourth quarter of 2019 (4Q19) as it grew by 3.6%, the lowest level since the third quarter of 2009.

Bank Negara governor Datuk Nor Shamsiah Mohd Yunus said that the central bank has ample policy ammunition to deal with the growth slowdown as she expects further sluggishness to be felt in 1Q20 due to Covid-19.

“The severity of economic impact depends on how the virus spreads and evolves as well as countries’ responses to the outbreak, ” she told reporters during a briefing yesterday.

In a note yesterday, OCBC Bank economist Wellian Wiranto said that the Malaysian economy needs “help” to avert further slowdown.

“If the economic momentum was already slowing even before the coronavirus outbreak, what chance do we have of a pick-up if the current scare drags on and on in the coming weeks?

“While the government is preparing a stimulus package to help, we caution against harbouring hopes of any forceful injection, given fiscal constraints.

Hence, for all the help that the Malaysian economy needs this year, Bank Negara remains the main source relative to the fiscal side, ” stated Wellian.

The country’s gross domestic product (GDP), which grew by just 4.3% last year, failed to meet the government’s official target of 4.7%. It is worth noting that the target was previously revised downwards from 4.9%.

In addition, the growth also fell below market expectations of 4.5%, based on an earlier Bloomberg poll comprising eight economists.

The fall in growth was mainly due to slower global growth and trade activities, contraction in public investments and disruptions in commodity-related sectors.

Following the release of the gross domestic product (GDP) figures for 4Q19 and full-year 2019 yesterday, the FBM Kuala Lumpur Composite Index (KLCI) fell by 0.55% or 8.54 points to 1,542.94 points.

Banks led the FBM KLCI lower on Wednesday’s trade after Bank Negara hinted of the possibility of another cut in the interest rate.

“Our inflation is still low and so, we do have the policy space (to ease monetary policy), ” Nor Shamsiah told the reporters.

In an attempt to calm market fears, Nor Shamsiah insisted that the economy would have grown by 4.7% in 2019 – similar to 2018 – if not for commodity supply disruptions.

She said that the economy continued to be supported by “resilient private sector spending” and “the expansion in the services and manufacturing sectors”.

An earlier Bloomberg poll of 21 economists showed a median growth forecast of 4.1% for the October to December 2019 period, with individual forecasts ranging between 3.4% and 4.3%.

The weaker growth was a result of the supply disruptions in the commodity sector in 4Q19.

For perspective, oil palm production contracted by 16.9% year-on-year (y-o-y) in 4Q19, natural gas production was down by 2.1%, while crude oil output remained in contraction of 5%.

Source: https://www.thestar.com.my/business/business-news/2020/02/13/malaysia-posts-worst-growth-rate-in-decad

Thailand

Thailand