Malaysia: Banks gear up to face headwinds

PETALING JAYA: With the banking sector’s dismal second-quarter performance, industry captains are not wasting any time as they gear up to navigate headwinds and improve bottom lines for this year and next.

Malaysian banks’ earnings have been weighed down by large modification losses, pre-emptive provisions and significant margin compression.

The modification charges came about as banks are unable to charge interest on the installments of hire-purchase loans and Islamic financing under the six-month moratorium. At the same time, margins have been severely compressed by the numerous overnight policy rate (OPR) cuts.

The tough economic climate spurred by the Covid-19 pandemic and headwinds also deterred major banks like Malayan Banking Bhd (Maybank), CIMB Group

(Maybank), CIMB Group , Public Bank Bhd

, Public Bank Bhd and RHB Bank Bhd from paying out dividends in the second quarter.

and RHB Bank Bhd from paying out dividends in the second quarter.

Public Bank managing director and CEO Tan Sri Tay Ah Lek (pic below)told StarBiz the group is in a good position to navigate the challenges, supported by its resilient loan portfolio, prudent lending practices and strong credit-risk profile.

“Under any adverse economic conditions, the earnings sustainability of banks will be very much dependent on the level of asset quality and the extent of credit charges. For the group, its strong asset quality and prudent credit management will provide support to its earnings stability, ” he told StarBiz in an e-mail reply.

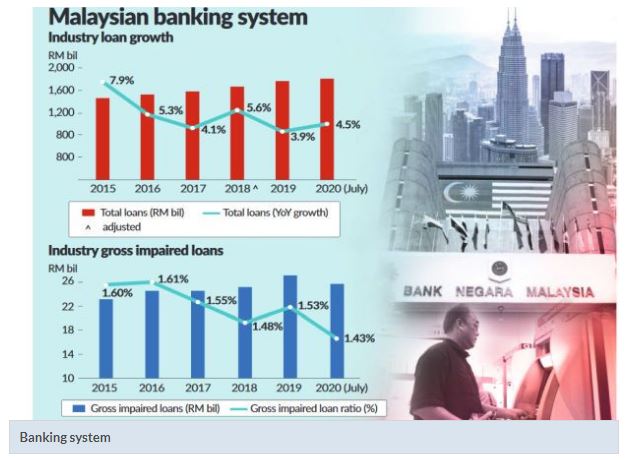

In terms of asset quality, the group’s impaired loan ratio as at June 30,2020 stood at 0.4% as compared with the industry’s gross impaired loan ratio of 1.5%. Gross impaired loan ratio for the banking sector in July this year stood at 1.43%.

He said although the asset quality stress is expected to increase, the group has put in pre-emptive measures to ensure its asset quality remained manageable.

For example, Tay said, Public Bank has been proactively engaging customers who continue to face cash flow constraint when the moratorium ends this month.

Several repayment assistance packages have been put in place which suit different customers’ financial conditions.

“All these initiatives will certainly mitigate the asset quality stress arising from the difficult economic conditions, ” Tay noted.

He said the group has remained conservative and prudent in setting aside higher provisions due to the significant uncertainties persisting in the operating environment as reflected in its high reserves for loan losses, which stood at 301.7%, inclusive of regulatory reserves.

With these, Tay said the group’s credit cost is expected to be manageable and this would help to support its earnings.

Public Bank reported a net profit of RM1bil in the second quarter, down by 24.8% from RM1.33bil a year ago due to a one-off net modification loss of RM498.4mil related to Covid-19 relief measures.

On revenue growth, the group would remain focused on organic growth strategy in retail consumer and commercial banking.

The group would continue to leverage on the various government and Bank Negara’s initiatives such as the Penjana financing schemes and Home Ownership Campaign to grow its loan portfolio.

In 2019, the group’s loan portfolio expanded by 4.1% and it expects loan growth to be at 3% to 4% for 2020.

Some of the major banking groups also reported second-quarter results that were below expectations. For the second quarter ended June 30, the country’s largest lender by asset Maybank’s net profit plunged 51.55% to RM941.73mil from RM1.94bil due to higher allowances for impaired loans.

The second-largest lender CIMB Group was also not spared. For the second quarter, the group’s net profit plunged nearly 82% year-on-year to RM277mil.

RHB Bank’s group net profit for the quarter under review dropped 34.9% year-on-year to RM400.8mil.

RHB Banking Group managing director Datuk Khairussaleh Ramli (pic below) said the group has undertaken a few initiatives to manage funding costs and overheads, which are now bearing results.

“We may also monetise our fixed-income securities gradually while striking the right balance between growing the current non-fund-based income and future fund-based income. Income from our stockbroking business has also increased significantly in line with the increase in trading volume on Bursa Malaysia.

“The group has also gradually built up its loan loss provision to cater to any need to absorb the impact on the potential deterioration in asset quality post-moratorium. Coupled with our robust capital and liquidity ratios, we believe our balance sheet is in a position of strength to weather this challenging period, ” he said.

RHB has also prioritised certain key initiatives under its 5-year strategy, FIT22, to meet the changing customer behaviour and respond to the demands brought about by Covid-19.

The bank is accelerating a number of its capability development initiatives, in particular its digital transformation and IT, to provide for longer-term growth.

On its growth drivers, Khairussaleh said income wise, its non-fund-based income has been holding up and providing a mitigating effect to the drop in net fund-based income and RHB expects this to be the case for the full year.

For loan growth, he expects the main drivers to be mortgage, SME and its Singapore operations. The group targets loan growth to be between 2% and 3% in 2020 compared with a 4.3% growth in 2019.

Meanwhile, in responding to queries from StarBiz, CIMB Group said that in view of the challenging short-term economic outlook, the group is recalibrating its mid-term Forward23 plan to ensure it is well positioned to take advantage of an economic recovery.

“We will share the updated strategic plan in due course. In the meantime, the group will continue

to be prudent and maintain the utmost discipline in managing both risk and asset quality, ” it noted.

To mitigate the impact of the challenging economic environment, CIMB also aims to aggressively rationalise cost.

Cost on an absolute basis has declined by 3.3% for the first half of the year and it targets an absolute cost reduction of around RM500mil or 5% for full-year 2020.

“The group continues to be well-capitalised to withstand shocks via prudent approach with a strong common equity Tier-1 ratio and liquidity coverage ratio remaining comfortably above 100%, ” CIMB said.

It is projecting a low single-digit loan growth in 2020 compared with 2019 where total loan growth stood at 6.7%.

Source: https://www.thestar.com.my/business/business-news/2020/09/14/banks-gear-up-to-face-headwinds

Thailand

Thailand