Malaysia: Bank stocks skid on possible cut in rate

PETALING JAYA: Banks led the FBM KLCI lower in Wednesday’s trade after Bank Negara hinted at the possibility of another cut in the interest rate.

Central bank governor Datuk Nor Shamsiah Mohd Yunus had said the central bank has ample room to adjust the overnight policy rate due to economic challenges.

The GDP growth slowed to 3.6% in the fourth quarter of 2019.

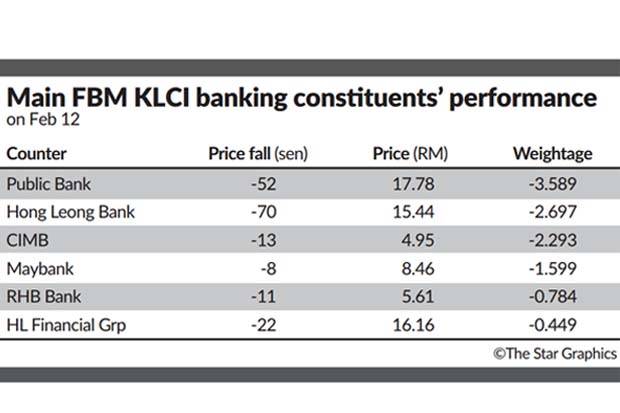

On Bursa Malaysia, HONG LEONG BANK BHD was the biggest decliner, falling 70 sen to RM15.44, while PUBLIC BANK BHD

was the biggest decliner, falling 70 sen to RM15.44, while PUBLIC BANK BHD declined 52 sen to RM17.78.

declined 52 sen to RM17.78.

Hong Leong Financial Group Bhd lost 22 sen to RM16.16, CIMB GROUP HOLDINGS BHD

lost 22 sen to RM16.16, CIMB GROUP HOLDINGS BHD dropped 13 sen to RM4.95 while RHB Bank Bhd declined 11 sen to RM5.61.

dropped 13 sen to RM4.95 while RHB Bank Bhd declined 11 sen to RM5.61.

Banks, being the largest industry constituent, dragged the FBM KLCI lower as the benchmark index fell by 8.54 points or 0.55% to 1,542.94.

There are also concerns that the Covid-19 (coronavirus) outbreak, that is still persisting, may further disrupt the global economy.

Nor Shamsiah said yesterday that the country’s growth in the first quarter will be affected by the outbreak that is currently still developing.

“The overall impact of the virus on the Malaysian economy will depend on the duration and spread of the outbreak as well as policy responses by authorities, ” she was reported as saying.

She also noted that the measure of impact at this stage cannot be fully ascertained due to other economic variables.

Moody’s, in a note, said that if the Covid-19 outbreak intensifies and the disruptions stemming from it were not contained in the next few months, it will hurt asset quality and profitability at banks in the Asia Pacific region. “The severity and length of the outbreak remain highly uncertain. If the virus related disruptions are short-lived, there will be a limited credit impact on APAC economies and banks, ” it said.

“However, the outbreak can also last for a prolonged period and become more severe. In that scenario, APAC banks will be affected in: travel and tourism, private consumption, supply chains, commodities, property prices and financial markets, ” Moody’s added.

On Bursa Malaysia, other major decliners included CHIN TECK PLANTATIONS BHD , which fell 35 sen to RM6.50 and AEON CREDIT SERVICE (M) BHD

, which fell 35 sen to RM6.50 and AEON CREDIT SERVICE (M) BHD , which lost 30 sen to RM12.90.

, which lost 30 sen to RM12.90.

Gainers were led by FRASER & NEAVE HOLDINGS BHD after it added 40 sen to RM33.78, Kumpulan Powernet Bhd

after it added 40 sen to RM33.78, Kumpulan Powernet Bhd rose 35 sen to RM2.52 and Scientex Bhd

rose 35 sen to RM2.52 and Scientex Bhd gained 29 sen to RM9.34.

gained 29 sen to RM9.34.

Some 2.81 billion shares worth RM2.78bil changed hands while gainers almost equalled losing shares at 419 to 405 counters while 417 counters were unchanged

Most active stocks as measured by the number of shares traded were led by My EG Services Bhd , which lost one sen to RM1.32, Securemetric Bhd declined three sen to 15.5 sen and AIRASIA

, which lost one sen to RM1.32, Securemetric Bhd declined three sen to 15.5 sen and AIRASIA Group Bhd which gave up three sen to RM1.20.

Group Bhd which gave up three sen to RM1.20.

Brent Crude Oil rose at press time by 2.06% or US$1.11 to US$55.12.

Source: https://www.thestar.com.my/business/business-news/2020/02/13/bank-stocks-skid-on-possible-cut-in-rate

Thailand

Thailand