Malaysia: An Introduction to e-Commerce in Malaysia

By Harry Handley

In recent years, the Malaysian government has worked tirelessly to achieve their goal of becoming a high-income nation by 2020. Through the government’s Economic Transformation Programme (ETP), a number of key service industries have been heavily promoted and subsidized in order to make this goal become a reality – one of which is e-commerce.

Despite almost 70 percent internet penetration in 2015, only five percent of Malaysian businesses had an online presence. Many leading experts believe that the Malaysian e-commerce market is at an inflection point and may be about to experience a serious boom period. Along with rising incomes, growing smartphone and internet penetration is expected to increase the proportion of online retail spend in Malaysia from 0.5 percent of total retail spending (2014) to five percent by 2020. This makes it an interesting time to assess the state of the market, in terms of government initiatives, consumer trends, incumbent players, and opportunities for foreign firms.

Government Initiatives

One of the key Entry Point Projects (EPPs) of the ETP is the ‘Virtual Mall’ project, which according to the government’s Performance Management and Delivery Unit (PEMANDU) “aims to grow the internet-based retail market, taking advantage of higher disposable income of the Malaysian population, better broadband services, and the proliferation of mobile devices in the country”. This initiative is supported by the National e-Commerce Strategic Roadmap, which has six prime goals:

- Increase seller adoption of e-commerce;

- Accelerate adoption of e-procurement by businesses;

- Remove non-tariff barriers (domestic e-fulfillment, cross-border e-commerce, e-payment, consumer protection);

- Realign existing economic incentives;

- Make strategic investments in key e-commerce firms; and

- Promote Malaysian businesses to increase cross-border e-commerce.

The e-commerce market in Malaysia is expected to grow by 10.8 percent in 2016. With the help of Alibaba’s Jack Ma, recently appointed Malaysia’s Digital Economy Advisor, the government hopes to double this growth to 20.8 percent by 2020. A number of innovative policies have been pushed by the government to make this happen, including the world’s first ‘digital free trade zone’, set to open in March 2017.

Malaysian Consumer Preferences

According to a 2016 Bain Brief and Google’s Consumer Barometer, 14 million people – almost half of Malaysia’s population – are considered ‘digital consumers’, meaning that they research products or services online. However, a challenge faced by e-commerce firms is that only 29 percent of consumers convert this research into an online purchase. A lack of trust is cited as the main reason for this hesitance, which is also highlighted by the desire to pay cash on delivery when purchasing goods online. The Bain research also found that Malaysian consumers’ primary reason for purchasing online is to take advantage of products not available in the local market; interestingly, price was not listed as a significant influencer.

Another challenging aspect of the Malaysian e-commerce market is the preference towards ‘social commerce’ – the use of social media sites, such as Instagram or Facebook, to facilitate online transactions. Bain research suggests that up to 30 percent of all e-commerce transactions in Southeast Asia are ‘social sales’. The personal nature of a social sale, in which a consumer connects directly with a seller on social media, helps to eliminate the lack of trust that is still present for a large number of Malaysian shoppers. The key challenge for firms, particularly coming from overseas, is how to develop a personal e-commerce strategy.

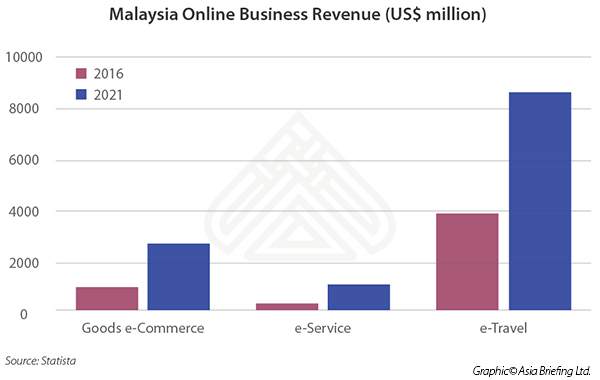

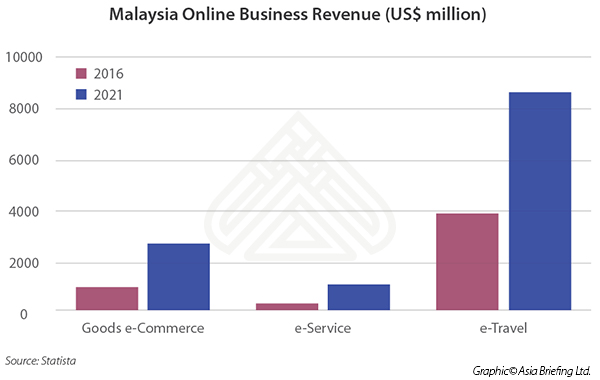

Statista reports that e-travel is the largest segment of the online business-to-consumer (B2C) market in Malaysia. This segment includes mobility services (e.g. ride hailing apps, such as GrabTaxi) and online travel bookings, and is set to generate over US$3.5 billion in revenue in 2016. The online purchase of goods will yield a further US$894 million, with ‘Electronics and Media’ being the most popular category among Malaysian consumers. Finally, e-services, including food delivery services and online dating, among others, will add another US$260 million. The graph below shows the current and expected size of the segments in 2021.

Major e-Commerce Players in Malaysia

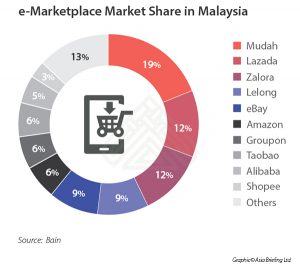

In terms of online marketplaces for goods, the market is highly fragmented; 10 platforms serve around 90 percent of the market (see graph below). The largest market shares are dominated by local and regional players, with global players such as Amazon and Groupon struggling to gain market share. This can be linked to the Malaysian consumers’ desire for a personal service.

According to the Malaysia Digital Economy Corporation (MDEC), the country’s e-commerce ecosystem is still in a relatively early stage of development. A number of factors identified by MDEC as holding back the e-commerce market in Malaysia include a lack of a supporting ecosystem, poor fulfillment experience, and low adoption rates. Despite this, a number of key players are emerging in supporting services (e.g. e-payment and e-fulfillment). IPay88, an online payment gateway, claims to have secured 60 percent market share of e-payments. They face competition from MOLPay, GHL e-payment, and PayPal. The two leaders in e-fulfillment are POS Laju, a subsidiary of POS Malaysia postal services, and GDex. Smaller couriers, such as Aramex and Easy Parcel, are also competing for market share.

The lucrative e-travel market has high barriers to entry, mainly due to the presence of large regional and global incumbents. Ride hailing apps such as GrabTaxi, BlaBlaCar, and Uber have recently been legalized by the government and, as such, have strengthened their grip and saturated their market. Similarly, global travel booking sites, including Expedia, dominate the online booking market, making it difficult for new smaller players to enter the e-travel battleground.

Identifying Opportunities for Foreign Firms

Although Malaysia has a relatively small population, its position at the heart of ASEAN (a market of 625 million people) and its developed infrastructure make it an attractive target for foreign firms. The appeal of the e-commerce industry is boosted by high speed internet that reaches almost three quarters of the population, as well as fast-improving support services and a willing government. Malaysia is also one of the most open economies in the world, scoring highly on both trade and investment freedom on the Economic Freedom Index.

Malaysian consumers’ desire to purchase foreign goods online presents a potentially lucrative opportunity to foreign retailers and wholesalers. Existing e-marketplaces offer a solid platform from which to penetrate the market. When entering the Malaysian market, it is extremely important to do extensive research before choosing a local partner; diversification of partners may help to alleviate risk in the evolving e-commerce ecosystem.

Further government incentives and increased adoption are expected to draw investments from global players who do not want to miss out on Malaysia’s impending e-commerce boom. The extra investment will facilitate the development of the industry and its supporting services, further increasing its attractiveness to new entrants. With 2017 touted to be ‘the year of the Internet Economy’, it will be interesting to see whether the Malaysian e-commerce industry can live up to the hype.

Source: http://www.aseanbriefing.com/news/2016/12/16/an-introduction-to-e-commerce-in-malaysia.html

English

English