London property market lures Thai billionaires

London residential property remained attractive to Thai billionaires who eye an investment, with sales of 400 million baht expected over the next six weeks, according to property consultant Knight Frank Thailand.

Frank Khan, the consultancy’s executive director, head of residential, said Thai billionaires were interested in London property purchases due to the weak pound and an annual rental yield of 3-4%.

“We have seven Thais interested in a new residential project in London that we are introducing,” he said. “We expect five units to be sold with a combined sales value of 400 million baht.”

The project is The Whiteley London which will be renovated from the former Whiteleys Department Store on Queensway, in the Bayswater district.

It is the first London property that Knight Frank has offered to Thai buyers since the pandemic.

Developed by London-based real estate firm Finchatton, the project will comprise 139 residential units with a total sales value of £1.1 billion, 20 new stores and restaurants, a cinema and the 109-room Six Senses Hotel.

Charles Leigh, Finchatton’s sales director, said 40 units had been sold since it was launched for sale in November last year.

The majority of buyers were British, while five units were sold to buyers from Southeast Asian countries, including Singapore and Thailand.

Unit prices range from £1.5 million to £35 million for sizes ranging between 70 and 600 square metres.

The unit prices sold to Southeast Asian buyers were between £1.5 and £8 million, said Mr Leigh during a roadshow in Singapore and Thailand.

Thai billionaires were one of the key targets for London property purchases as the number of wealthier Thais was on the rise.

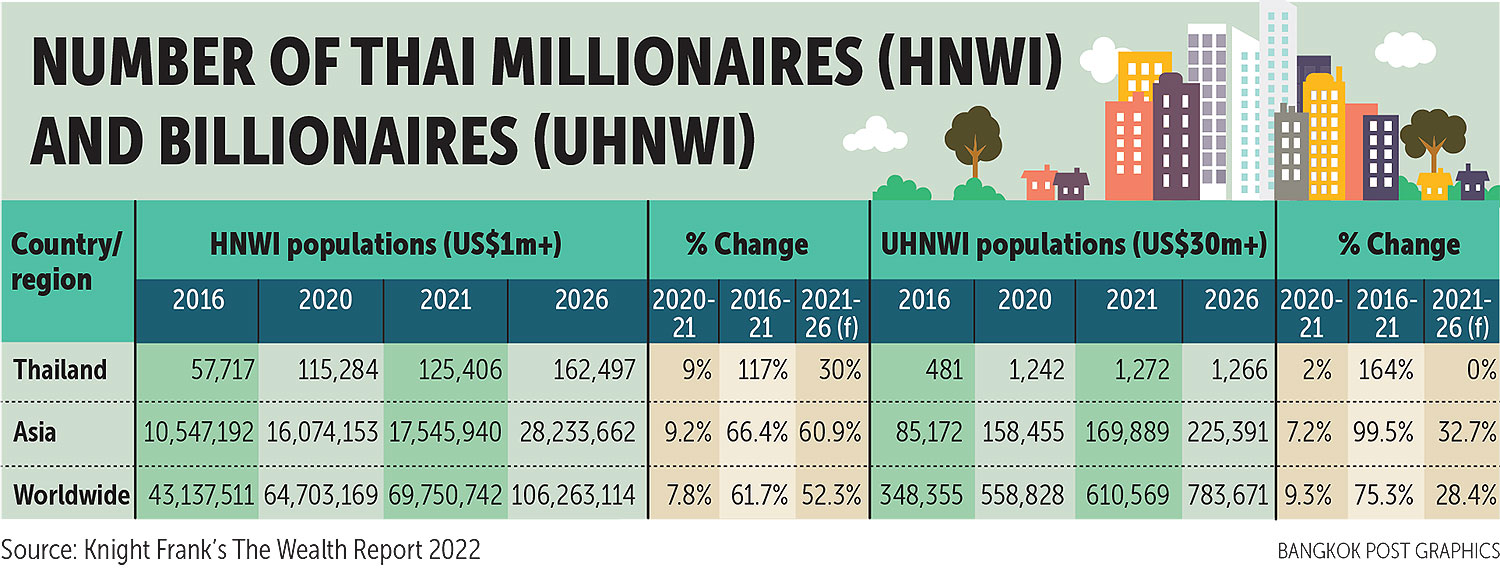

According to Knight Frank’s The Wealth Report 2022, the number of high-net-worth individuals (HNWIs) or those with net assets worth US$1 million or more from Thailand rose by 9% to 125,406 in 2021 from 115,284 in 2020.

The growth of Thai HNWIs was ranked second in Asia which had an average growth of 9.2%.

Asia’s largest growth was China which had an increase of 13%.

In Southeast Asia, Singapore and Malaysia were second with a rise of 6% each, while both Indonesia and the Philippines dropped 5% and Vietnam saw a decrease of 7%.

At the same time, the number of Thailand’s ultra-high-net-worth individuals (UHNWIs) or those with net assets worth $30 million or more rose by 2% from 1,242 in 2020 to 1,272 last year.

Among six Southeast Asian countries in the report, the largest annual growth in UHNWIs was Singapore (9%), followed by Thailand and the Philippines (2%) and Indonesia (1%) while Malaysia had no growth and Vietnam dropped 1%.

Source: https://www.bangkokpost.com/business/2340432/london-property-market-lures-thai-billionaires

Thailand

Thailand