Local shares drop as Delta variant brings fresh threat to Philippines

MANILA, Philippines — The detection of highly contagious Covid-19 Delta variant in the Philippines sent local shares into a tailspin on Monday, amid growing unease among investors over the virus’ threat to economic recovery.

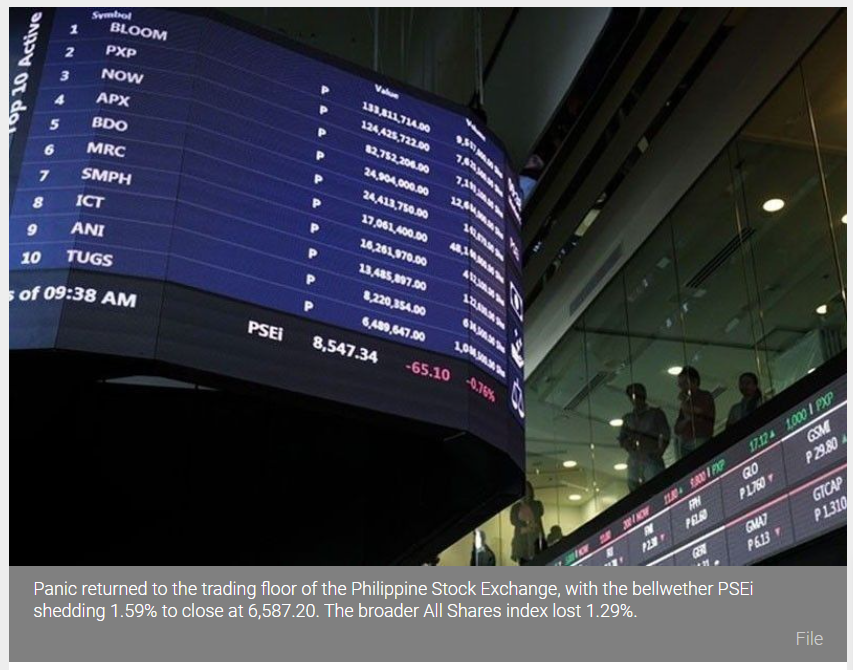

Panic returned to the trading floor of the Philippine Stock Exchange, with the bellwether PSEi shedding 1.59% to close at 6,587.20. The main index sagged by as much as 2.7% durinh the trading day but pared earlier losses.

The broader All Shares index lost 1.29%. All sub-indices finished in the red, with property firms leading the pack of losers after declining 3%.

“I think aside from mimicking the US market, today’s index performance can be largely attributed to the public’s fear after the detection of Delta Variant in Taguig, one of the Philippines’ central business districts,” Arielle Santos, equity analyst at Regina Capital, said in a market commentary.

The Taguig City government on Monday reported that it detected the highly infectious Delta variant in one of the 73 variants recently recorded in the city. Prior to this, the health department last week reported it found 11 local cases of the Delta variant in Northern Mindanao, Metro Manila, Western Visayas and Central Luzon.

The frightening spread of the highly transmissible Delta variant has thrown a spanner in the works as leaders in several countries — particularly those with slow inoculation programs — re-impose lockdowns and other containment measures.

Manila tracked a broader sell-off in the region. Hong Kong shed more than 2%, with traders also weighing a US advisory on doing businesses there in light of China’s clampdown.

Tokyo, Singapore and Seoul all lost more than 1%, while there were also big losses in Shanghai, Sydney, Taipei, Jakarta and Wellington.

At home, foreign investors sold P362.1 million more shares than they bought in the stock market. A total of 2.1 billion local shares, valued at P6.5 billion, were traded on Monday.

For Regina Capital’s Santos, the stock rout might not be over yet. “For the rest of the week, we’re still looking at the bourse to get traded at least above 6,400. But, if this support gets broken the next strong one is at 6,200,” she said.

“In my view, the decline in new COVID19 cases, effective control measure to be imposed on the spread of the variants, and ramping up of vaccine administration are the factors that would likely stop the index from falling further,” she added. — with a report from AFP

Thailand

Thailand