Japan credit rating agency maintains Philippines’ investment grade

MANILA, Philippines — The Philippine government managed to keep its investment grade credit rating from Japan-based debt watcher Rating and Investment Information Inc. (R&I), which cited the country’s “solid” economic recovery despite COVID-19 flare-ups.

R&I, whose ratings matter to Japanese companies, the country’s top investors, maintained the Philippines’ triple B plus rating, which is two notches above the minimum investment grade.

A credit rating is a measure of an entity’s capacity to settle its debts. The higher the rating, the better the perception of investors on a borrower, and therefore the lower the interest charge on debts.

R&I likewise kept its “stable” outlook on the Philippines, which indicates no near-term adjustments are expected in the country’s level of creditworthiness.

In a statement, Finance chief Carlos Dominguez welcomed this development, especially since the Duterte administration had tried its best to protect the country’s investment grade amid a pandemic-induced growth of government debts.

“R&I’s affirmation, in our view, reflects confidence in the country’s sound policy framework, which augurs well for the next administration to pursue further structural reforms that are necessary to sustaining high and inclusive growth,” Dominguez said in a statement.

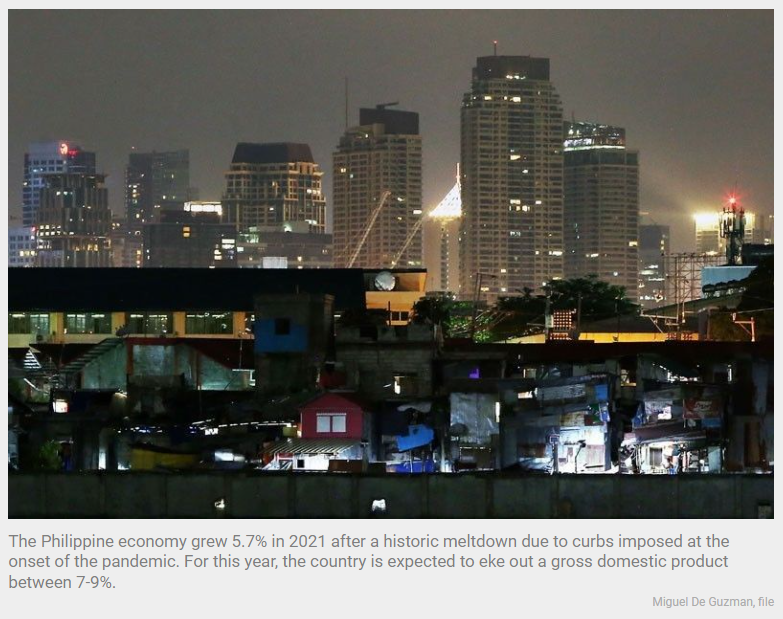

The Philippine economy grew 5.7% in 2021, rebounding from a historic meltdown when strict curbs were imposed at the onset of the pandemic. As restrictions ease, the government expects the economy to grow between 7-9% this year and 6-7% by 2023 and 2024.

Separately, Bangko Sentral ng Pilipinas (BSP) Governor Benjamin Diokno said the government’s startegy worked. “On top of the national government’s measures, the BSP’s proactive COVID-19 response — including historic-low policy rates that supported credit activities, time-bound financing support to the national government, and a long list of regulatory relief measures for banks so that they may continue serving their customers — has helped achieve a holistic approach to Philippine economic recovery,” Diokno added.

Explaining its decision, R&I cited three key factors: the country’s “stable” growth since the second quarter of 2021; stabilizing government debt ratio; and limited dependence on external borrowings.

But R&I said they will monitor the results of the country’s presidential elections, as this will determine the policy direction of the country in the next six years.

“R&I will keep an eye on the new administration’s policies, particularly on continuing key infrastructure projects and structural reforms, which are deemed essential in attracting investments from both domestic and external sources,” it said.

Source: https://www.philstar.com/business/2022/04/19/2175226/japan-credit-rating-agency-maintains-philippines-investment-grade

Thailand

Thailand