Insight – Predictions for the employment market in S-E Asia industrial sector

TO make accurate predictions about the job market and hiring trends in South-East Asia, we need to assess the current global economy together with Covid-19’s impact on Asean economies.

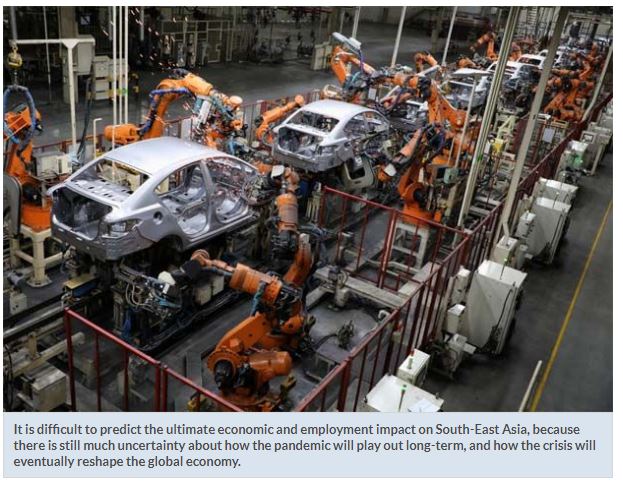

It is difficult to predict the ultimate economic and employment impact on South-East Asia, because there is still much uncertainty about how the pandemic will play out long-term, and how the crisis will eventually reshape the global economy.

Employment is a much-discussed topic, as a number of senior management professionals have been laid off or furloughed, and this trend is continuing.

As an executive search professional, I have witnessed an increasing number of CVs arriving in my inbox each morning, many from senior management professionals. Clients and candidates regularly ask me, “What will the post-Covid-19 employment market be like, and what will the post-pandemic hiring trends be?”

In order to provide useful answers, I have examined the business and growth prospects of selected sectors, and the anticipated trends moving forward.

Hopefully my study will throw some light on this subject, and my findings may be interesting and useful for companies, hiring managers and candidates.

Manufacturing

Manufacturing in S-E Asia has been badly depressed as a result of Covid-19, due to weak demand in key consumer-driven segments amid ongoing trade tensions and slower economic growth.

This sector has been particularly vulnerable, as it relies on global supply chains and is therefore susceptible to disruption. Port and transport links have been impacted in many S-E Asian countries by containment measures.

There was a breakdown in supply chains and logistics due to over-reliance on China. Many companies began to reassess their supply chains, becoming more self-sufficient by diversifying their supply bases to spread out the risk.

Motivated by escalating trade tensions, the threat of tariffs, and China’s decline in cost competitiveness, some companies had already begun relocating their supply chains in 2019, before Covid-19 hit. This trend continues in 2020.

The shift in manufacturing from China to S-E Asia creates new opportunities for experienced manufacturing leaders across several sectors. Lower labour costs have motivated a massive shift towards Vietnam in the textiles, auto, ICT, and consumer goods sectors, including electronics giants such as Foxconn and Samsung.

Electronics

The electronics manufacturing industry in S-E Asia is well-developed and diverse. A wide range of products are manufactured in the region, including semiconductor devices, passive components, micro assemblies, printed circuits, substrates and connectors.

Much of the world’s consumer electronics (televisions, radios, computers, tablets, mobile phones) come from this region, including more than 80% of the world’s hard drives. Electrical and electronics manufacture directly employs more than 2.5 million workers in S-E Asia, and is a mainstay of the region’s economic growth.

Rising labour costs in China, supply chain issues and geopolitical tensions have further stimulated the growth of the S-E Asian electronics sector. Low labour costs continue to attract foreign direct investments (FDIs) from multinational companies.

In Singapore, for example, the electronics manufacturing sector is expected to create 2,100 new jobs for professionals, managers, executives, and technicians (PMETs) by 2020. Moreover, the sector accounted for 4.4% of Singapore’s GDP last year, generating a total of S$90bil in manufacturing output.

Other countries in the region also show great potential in electronics.

Thailand is recognised as a global leader in integrated circuits, semiconductors, and hard drives, with over 2,300 companies employing 400,000 workers. Thailand is also the world’s fourth largest producer of refrigerators and the second largest producer of air-conditioning units.

The Philippines is also a top producer of hard drives and semiconductors, currently producing 2.5 million hard drives per month and representing 10% of the world’s semiconductor manufacturing services.

Malaysia’s electronics and electrical sector has more than 1,695 companies, with a total investment of US$35.5bil, which could increase further through R&D investment.

The impact of Covid-19 on growth in this sector is expected to be short-lived, with a healthy rebound in the fourth quarter of this year and sound growth in 2021. Many large electronics companies in S-E Asia have started hiring robotic automation professionals to manage the transition to automation in this sector.

The Boston Consulting Group (BCG) noted that four groups in this sector will account for 75% of robotic automation installations by 2025: electrical equipment, appliances and components; computers and electronic products; transport equipment; and machinery.

Chemicals

The chemical industry was unscathed by the pandemic; chemicals were deemed essential materials, with petrochemical and oleochemical plants and suppliers permitted to continue doing business. The production of oleochemicals continues to rise, with Malaysia and Indonesia as the region’s main producers. Ethylene plants in Thailand, Indonesia and Malaysia continue to operate at full capacity, and the production of surfactants and oleochemicals used in various industrial applications has returned to full capacity.

The growth of the S-E Asian petrochemical market is giving rise to more strategic collaboration opportunities amongst SE Asian petrochemical producers, as they continue to expand market share and presence. SE Asian petrochemical producers have two main advantages: local access to natural oil, gas, and feedstocks; and government support such as investment incentives and the development of infrastructure and logistics systems.

In Singapore, the government has significantly enhanced infrastructure development, created competitive petrochemical feedstocks, and is focusing on moving up the value chain with advanced materials and specialty chemicals.

Engineering and Construction

The SE Asia region is experiencing substantial economic and population growth, a trend which is set to continue.

The Asian Development Bank has reported (2017) that the total infrastructure needs in the region will exceed $22.6 trillion through 2030, or US$1.5 trillion per year. This need for large-scale projects involving energy, road, rail, water, and other infrastructure will continue to drive demand for construction.

Although on-site work has been temporarily stopped or reduced due to lockdowns in SE Asia, functions such as architecture, engineering and project management have continued relatively undisturbed.

There is a growing digital trend for management professionals in the construction solutions business, with Building Information Modelling and integrated project management platforms already identified as digital growth areas for the construction industry. In engineering and construction, there are new management opportunities in technologies such as drone tech, communication tools, augmented reality (AR), virtual reality (VR), and building information modelling (BIM).

Medical Gloves

Finally, I would like to mention medical glove manufacture, an example of a niche sector which has boomed as a direct result of COVID-19. Malaysia is the world’s biggest producer of medical gloves, and Malaysian manufacturers are reporting a surge in disposable glove orders from Europe and the US.

According to Technavio, the disposable glove market in Europe is expected to grow by USD 780.35 million. This marks a significant market growth compared to the 2019 estimates, due to surging demand in the first half of 2020, caused by the pandemic. Steady growth is expected to continue throughout the forecast period, and the market is expected to grow at a CAGR of almost 7%.

Disposable medical gloves include examination and surgical gloves, and with the growing number of surgeries and cosmetic procedures worldwide, the market is expected to generate an incremental sale of 36.54 billion units during the forecast period. Revenue growth in the Asia Pacific region is expected at a CAGR of over 18%. The boom in medical tourism in countries such as Malaysia, Thailand, and Singapore has led to rising demand for surgical supplies. Demand for medical gloves is also being driving by the aging of the population, and the resulting increase in chronic illness and the expansion of healthcare facilities.

Although COVID-19 has derailed all economic predictions for 2020 and 2021, the manufacturing sector in SE Asia is fundamentally strong. It has successfully withstood serious economic and logistical challenges, and is already showing signs of recovery. There are great opportunities for visionary managers and executives who have experience with digital transformation and innovative technology, and who are able to use their insight into the emerging opportunities and risks to develop new business strategies and create solutions.

Ian Robertson is a Client Partner in South-East Asia, based in Singapore. He is a search industry veteran with almost two decades of Executive Search expertise in the Middle East and Asia.

Source: https://www.thestar.com.my/business/business-news/2020/08/03/insight—predictions-for-the-employment-market-in-s-e-asia-industrial-sector

Thailand

Thailand