Indonesia Set for Half-Point Interest Rate Hike to Aid Rupiah

(Bloomberg) — Indonesia’s central bank is expected to deliver another half-point increase in the policy rate to stem the rupiah’s slide and check price pressures.

Bank Indonesia will raise its 7-day reverse repurchase rate by 50 basis points to 4.75%, according to 19 of 31 economists surveyed by Bloomberg as of Wednesday. Eleven forecast the rate will rise by a quarter-point while one sees a 75 basis-point increase.

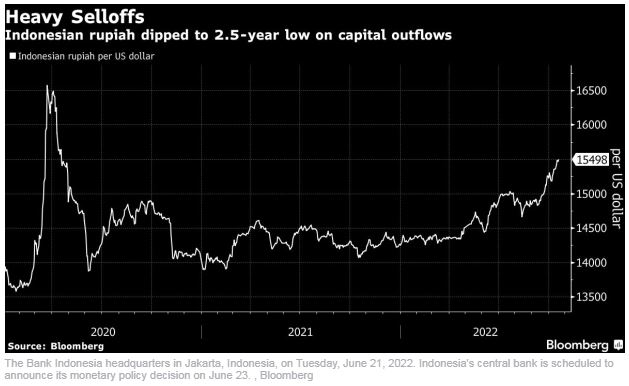

A latecomer to the global tightening club, Bank Indonesia raised borrowing costs by a quarter-point in August when most saw a hold, and delivered a surprise 50 basis-point increase last month. With the rupiah breaching the 15,500 to the dollar level, Governor Perry Warjiyo’s comments Wednesday that the bank will remain “pre-emptive, front-loaded, and forward-looking” keep the door open for another jumbo hike.

Warjiyo also sought to temper expectations, saying Indonesia need not be as aggressive as peers nor match the Federal Reserve’s pace as inflation is manageable. The rupiah has fared relatively better than most neighbors, having lost only 8% of its value this year compared with the Philippine peso, Thai baht and Malaysian ringgit that have each depreciated more than 10%.

Here’s what to watch out for in Thursday’s decision:

Currency Rout

Bank Indonesia will continue conducting market interventions — in foreign exchange spots, domestic non-deliverable forward, and bond markets — to stabilize the currency and avoid spillover effects on domestic prices, Warjiyo said Wednesday.

Interventions this year had shrunk foreign exchange reserves to a two-year low in September. While trade balance remained in hefty surplus, exports growth is expected to moderate amid a bleak global economic outlook. That could add pressure on the currency.

The central bank needs to show that it’s taking the initiative to tame inflation and attract foreign inflows to support the rupiah by delivering a jumbo hike, Satria Sambijantoro, a Jakarta-based economist at PT Bahana Sekuritas, wrote in a note.

Capital Flight

Bank Indonesia’s strategy to lure inflows by selling short-term bonds in the secondary market to push up yields, also known as Operation Twist, seems insufficient to contain outflows. More than $9 billion of foreign funds have exited the domestic market so far this year.

Demand for government debt also weakened as both bond and Sukuk auctions failed to meet even the reduced targets since mid-September.

“Although the operation appears to be able to buck the spike in the 10-year benchmark yield, its impact has been limited in supporting the rupiah,” said Fikri Permana, an economist at PT Samuel Sekuritas in Jakarta.

Peak Inflation

Headline inflation is expected to peak at 6.3% by the year-end while the core measure — which is Warjiyo’s preferred gauge — is seen to max out at 4.3% during the same period, according to the governor.

Both estimates are lower compared to his assessment on Sept. 22 and he expects the numbers to return to the central bank’s 2%-4% target by the third quarter of 2023.

Monetary authorities, however, “have to take preventive measures because the second-round impact has not been fully reflected in prices, according to Faisal Rachman, economist at PT Bank Mandiri, who expects a half-point rate increase this month.

Thailand

Thailand