Indonesia: Regencies asked to waive $6m in street lighting taxes for poor households

The government is pushing regencies to slash street lighting taxes (PPJ) for 31 million of Indonesia’s poorest homes in helping them weather the economic shocks from the COVID-19 pandemic.

The plan is estimated to free up Rp 95.26 billion (US$6.1 million) in liquidity each month but also lowers each regencies’ locally generated incomes (PAD), out of which around 20 percent comes from street lighting taxes, experts told The Jakarta Post.

“On one hand, regions face huge fiscal strains as they reallocate and refocus spending on the pandemic, yet on the other hand, they are losing income,” Robert Endi Jaweng of think tank Regional Autonomy Watch (KPPOD) said on Monday.

Indonesia, like many other countries, is allocating millions of dollars to tackling the pandemic, which has killed 582 people as of Sunday, the highest death toll in Southeast Asia, while the country is also cutting tax rates across the board in shoring up economic growth.

The PPJ is one out of 10 types of taxes collected by regency administrations to finance, among others, healthcare facilities and social safety net programs. Such taxes are calculated as a maximum 10 percent of each household’s electricity bill. The rate is 2.4 percent in Jakarta.

Robert said PPJs contributed an average 20 percent “but up to half in some regions” of a regency’s locally generated income. Without PPJs, many regencies’ other source of income is from the issuance of building permits (IMBs). Other usual sources such as hotel, restaurant and entertainment venue taxes have dried up over the past two months due to the pandemic.

An official from the Energy and Mineral Resources Ministry, which is among several ministries pushing the tax break, said last week that the government was awaiting approval from the Fiscal Policy Agency (BKF), which oversees regional incomes, before expediting the plan.

“In a few days, once the decision is made, the Office of the Coordinating Human Development and Culture Minister will bring in the Home Affairs Ministry and we will explain this plan to each regional administration,” said the Energy and Mineral Resources Ministry’s electricity business development director, Hendra Iswahyudi.

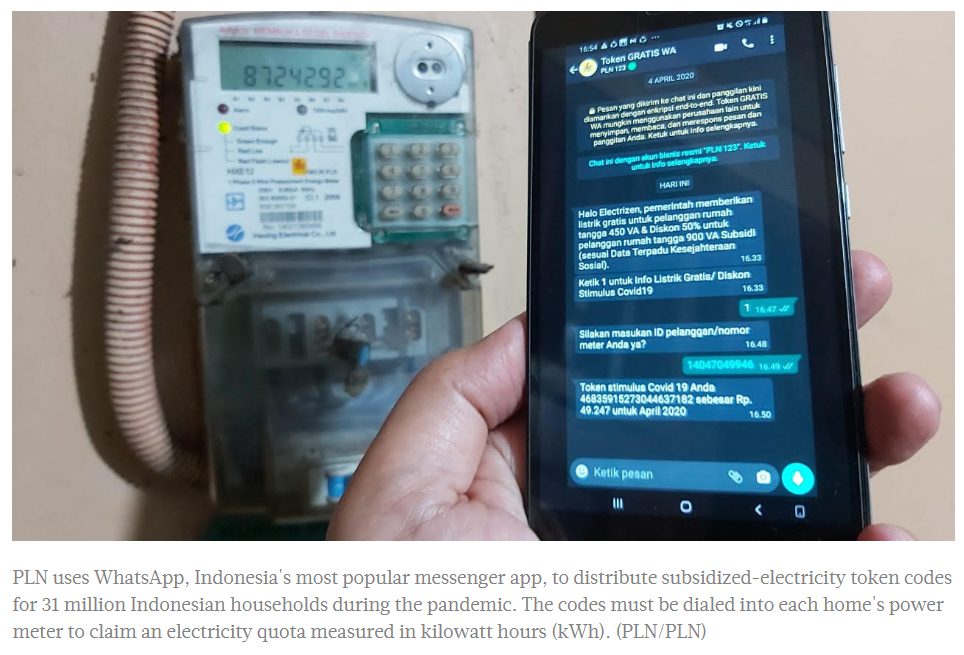

He added that the plan was to waive PPJs for 24 million homes in the 450 volt ampere (VA) power category, the lowest out of six under existing regulations, and for 7 million homes in the second-lowest 900 VA Subsidized category.

The tax break would add on to the government’s Rp 3.5 trillion electricity relief program in reducing the living costs of Indonesia’s poorest households, for whom electricity is the third highest non-food spending.

The chairman of the Regency Administrations Association (APKASI), Abdullah Azwar Anas, who is also Banyuwangi regent, told the Post that government officials have discussed the plan with association leaders via video conference.

“The point is, in relation to street lighting tax, I think it is a good idea as the reduction of electricity bills have really benefited the poor,” he said.

Meanwhile, the Home Ministry, which oversees regional administrations, is working to put in place the necessary regulations for such a tax break.

Such regulations include Ministerial Instruction No. 1/2020 that tells regents to “prioritize” spending on health care, social safety nets and economic incentives and that extends the submission deadline for regional budgets (APBD) to April 23.

The Home Ministry is also revising ministerial regulation No. 33/2019 on compiling 2020 regional budgets. The revision, which is expected to come out this month, includes a clause that allows regents to factor in tax breaks in their 2020 regional budgets. Breaks include waiving, reducing or postponing payments.

“It means that under that revision, we urge all regional administrations to provide tax breaks for that tax,” said the ministry’s regional revenue director Hendriwan.

He added that many regencies had already implemented PPJ breaks for hotels and restaurants at the request of the Indonesian Hotel and Restaurant Association (PHRI), whose members are among the hardest hit by the pandemic.

Source: https://www.thejakartapost.com/news/2020/04/21/regencies-asked-to-waive-6m-in-street-lighting-taxes-for-poor-households.html

English

English