Indonesia, Philippine Policy Rate Paths Seen Diverging

(Bloomberg) — Two Southeast Asian central banks are likely to take different policy actions on Thursday as inflation paths diverge, with the Philippines seen raising borrowing costs again to cool prices and Indonesia expected to hit the brakes on tightening.

All 25 economists surveyed by Bloomberg see Bangko Sentral ng Pilipinas raising its benchmark rate, with 13 predicting a half-point increase and the rest a 25 basis-point move. Meanwhile, 26 of 28 surveyed on Bank Indonesia’s decision expect it to stand pat, with the rest betting for a quarter-point hike.

In Indonesia, consumer prices gained at the slowest pace in five months in January, while Philippine inflation unexpectedly surged last month.

Here’s what to watch for in Thursday’s decisions:

Indonesia

Governor Perry Warjiyo has said that a total of 225 basis points rate hike since August should suffice in reining in price expectations. That strong signal has so far been supported by softer inflation data and a relatively stable currency.

Rupiah has gained more than 2%, delivering the best carry returns in Asia year-to-date, while growth in Southeast Asia’s biggest economy has returned to the pre-pandemic level of around 5%. “A resumption of foreign flows into the debt markets bode well for macro stability, backstopping the decision to pull the brakes on the hike cycle,” senior economist Radhika Rao at DBS Bank Ltd. wrote in a note.

However, the currency strength may fade along with the declining trade surplus, PT Bank Central Asia analysts Lazuardin Thariq Hamzah and Barra Kukuh Mamia said. Last month, Indonesia’s trade surplus narrowed further to $3.87 billion as prices of key commodities dragged down exports.

Investors will watch closely how Bank Indonesia assessed the latest signals from its US counterpart on a higher interest rate peak, as it may weaken capital inflows and expose rupiah to more depreciation pressures going forward.

Philippines

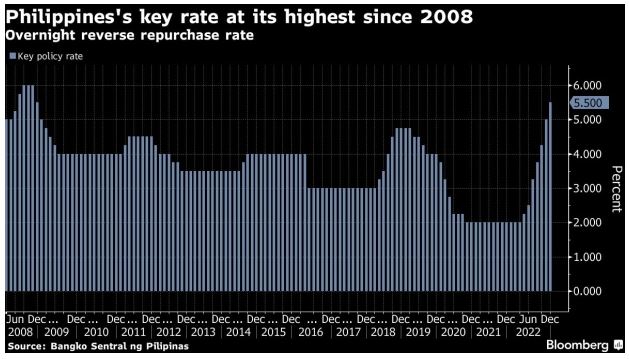

While economists are fairly split between a quarter- and half-point actions by the BSP, choosing either would be enough to return borrowing costs to the highest level since November 2008.

With consumer price gains remaining at a 14-year high, inflation expectations will be a key barometer for the rate trajectory, as authorities have vowed to quell spillover cost pressure.

Policymakers need to show commitment to fighting inflation, said ING Groep NV’s Nicholas Mapa, who forecast a 50 basis-point move. Further down the line, “BSP will turn its attention to supply-side oriented remedies while waiting for the wallop” from its most-aggressive tightening in two decades, he said.

Already, a Bloomberg survey shows bets for higher peak rate and longer tightening cycle, which prior to the January consumer-price data was pegged by Governor Felipe Medalla to end as early as this quarter.

BSP will unveil its revised inflation forecasts, as well as a comprehensive quarterly monetary policy report on Thursday. Views on economic growth may also prove crucial for the key-rate path as a raft of challenges could slow expansion from last-year’s near-half-a-decade high.

Source: https://www.bnnbloomberg.ca/indonesia-philippine-policy-rate-paths-seen-diverging-1.1884460

Thailand

Thailand