Grab, Mastercard Expected to Dominate SE Asia e-Money Market

TEMPO.CO, Jakarta – Grab and Mastercard will launch special cards for unbankable customers in Southeast Asia, eyeing to dominate the regional market.

The companies will issue two types of cards, a physical one and virtual one. The cards are an extension of GrabPay, the e-money product of the ride-hailing app, which Grab users can also use to transact in stores that accept Mastercards.

From the partnership, the two companies seek to lead the Southeast Asian payment system market through 110 million Grab users and Mastercard’s 3 million merchant partners.

“Our cooperation with Grab significantly increases our reach in Southeast Asia, while strengthening our mission to expand our digital payment systems for consumers and merchants,” Mastercard released a statement yesterday.

Since its establishment six years ago—starting out as a ride-hailing service provider, Grab has transformed into a multi-service digital provider. The app now offers food and parcel deliveries, microloans, and multiple types of payments as well.

In Southeast Asia, Grab’s services are head-to-head with a single competitor, Go-Jek. In Asia however, both are facing challenges from digital giants like Alibaba Group Holding Ltd, JD, and Tencent Holdings Ltd.

To people in Southeast Asian nations, the Grab-Mastercard coupling offers them the simplicity of digital payment—particularly people who have been untapped by banking services.

According to the World Bank, 71 percent of Southeast Asian are still receiving their salaries in cash—spending them traditionally as well. Only 30 percent of the region’s population have debit cards, and only nine percent are credit card holders.

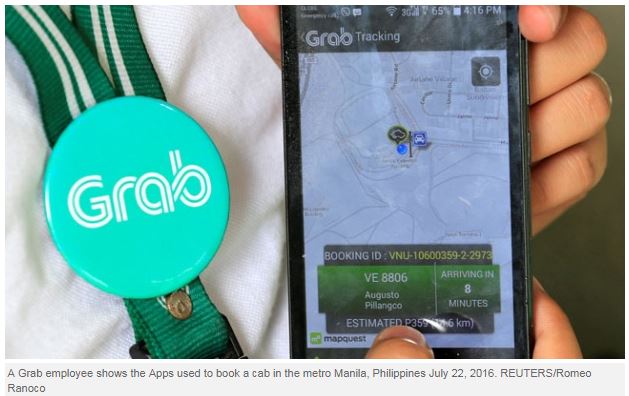

REUTERS

Source: https://en.tempo.co/read/news/2018/10/26/056922891/Grab-Mastercard-Expected-to-Dominate-SE-Asia-e-Money-Market

Thailand

Thailand