FTI: Vietnam’s red tape to persevere

The Federation of Thai Industries (FTI) expects Thailand’s car shipments to Vietnam to continue affecting all carmakers, even after both governments resolved to tackle obstacles posed by Vietnam’s non-tariff barriers.

Surapong Paisitpatanapong, the FTI’s automotive industry club spokesman, said the two governments have acknowledged the problem, but the resolution has yet to be implemented by Vietnam.

“The FTI expects the non-tariff barriers to remain an issue of concern among carmakers in Thailand, as they see shipments to Vietnam have high operating costs and long delays in delivery to customers,” he said.

Since early 2018, carmakers in Thailand have put off shipments to Vietnam after the latter tightened regulations by inspecting all imported cars at the port of entry, resulting in a longer clearing process of 30-45 days for delivery to local buyers, up from 3-4 days.

The regulation was issued after Vietnam announced an exemption from import duty for cars under the Asean Free Trade Area last October.

Earlier this month, Thailand and Vietnam agreed in principle to push forward a mutual recognition agreement (MRA) on automotive standards. Vietnamese officials vowed to forward the proposal to transport authorities.

Thailand has many agencies to test imported completely built-up (CBU) cars under the MRA.

The standards should help shorten the delivery process, as there is no need for repeated testing at Vietnamese ports.

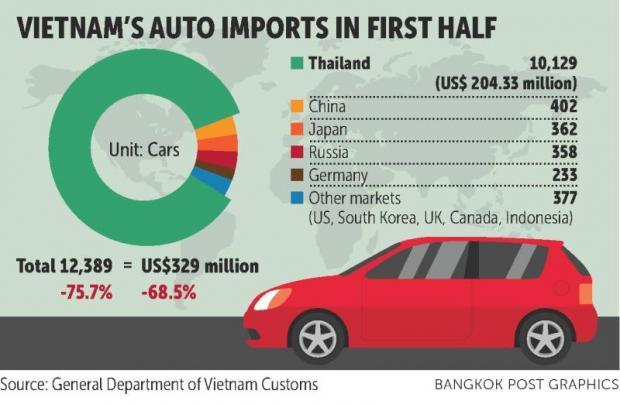

Mr Surapong said the non-tariff barriers made Vietnam’s car imports drop sharply by 75.7% to 12,389 vehicles during January to June, while imports from Thailand made up 81.8% of the total.

“Personally, I think Vietnam may prolong the MRA standards to protect their local automotive industry, which is nascent,” Mr Surapong said. “Vietnam has to generate 400,000-500,000 finished cars to become part of the auto supply chain.”

According to Asean Automotive Federation, Vietnam’s car output in the first half rose slightly by 1.6% to 101,459 cars.

In related news, the club reported that Thailand’s automotive output in July rose 15.1% to 183,119 units, driven by production for both domestic sale and export.

Compared with June, July saw a contraction of 3.1%, Mr Surapong said.

Overall car output rose by 11.7% to 1.24 million units from January to July.

The local sales in July rose by 25.7% to 81,946 but compared with June, sales made a contraction of 6.7%.

The car sales saw 20.2% rise to 571,064 units over the first seven months.

Car exports in July increased slightly by 0.15% to 90,151 units, thanks to improving economic sentiments globally.

Shipment value in July increased by 4% to 49.9 billion baht.

From January to July, car exports increased by 4.1% to 652,111 cars and value rose by 2.8% to 341 billion baht.

Source: https://www.bangkokpost.com/business/news/1525526/fti-vietnams-red-tape-to-persevere

Thailand

Thailand