FTAs, FDIs and tourism essential for Cambodia’s economic bounce back

Although vaccines have begun to be administered in the Kingdom, a resurgence in cases and talk of new virus variants continues to fuel economic uncertainty. Tourist numbers dropped by over 70 percent between January and September of 2020 year-on-year. The disruption of the global supply chain resulted in a chokehold on the Kingdom’s exports and the fall in foreign direct investment (FDI) slowed the important flow of job-creating capital into the Kingdom

However, progress across three key economic drivers, pointing to better times ahead, has already been recognised

According to a recent report by the World Bank (WB), despite research indicating that a slow recovery in tourism may continue to weigh down growth in the first half of 2021, the sector may strengthen in the second half as vaccines become more widely available and consumer confidence improves.

The report added the government having extended monthly tax exemptions to hotels, guesthouses, travel agents and restaurants in selected provinces, amongst other measures, is improving the situation.

Additionally, Cambodia’s openness to trade remains another factor that will likely spur development, said the report.

The WB report comes on the heels of a DHL Global Connectedness Index study that showed Cambodia ranking 46th on DHL’s list of most globally connected countries. This is a high ranking for a lower-middle income state.

Country Manager of DHL Express Cambodia, Prayag Chitrakar said: “Maintaining trade accessibility is critical in encouraging foreign investment in the country. The free trade agreements (FTAs) on the horizon will likely unearth new growth opportunities for the country’s key sectors.”

Online news site, The Business Times, added government intervention will be a major factor in Cambodia’s return to economic health.

“The government supported the economy by introducing a broad package of fiscal stimulus measures to aid recovery as the pandemic recedes. This unprecedented direct support, which has accounted for 5 percent of its gross domestic product (GDP) so far, included a $1.16 billion equity injection as well as loan guarantees, development spending, tax relief for hard-hit businesses and more.”

“Phnom Penh doubled down on that approach in December 2020, with new measures to boost local production capacity for export to help return the economy to normal. These measures include extending financial aid to suspended workers in the textile, garment and apparel sectors. Those sectors together account for over 80 percent of Cambodia’s total exports and 16 percent of its GDP.”

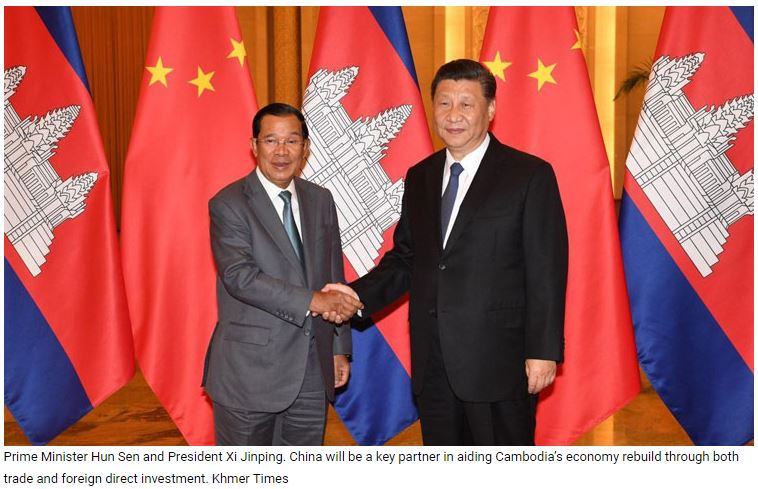

Cambodia has also been quick to move towards a number of regional FTA signings, with an agreement signed with China and the terms of one with South Korea agreed on.

The former is especially important, with China already being the Kingdom’s largest trading partner and accounting for 23.6 percent of the nation’s total trade in 2019

On the regional front, the newly established Regional Comprehensive Economic Partnership (RCEP) is expected to boost economic confidence across Asia substantially. The WB predicts the agreement could increase Cambodia’s exports to China by 23 percent.

FDI is also looking up for 2021. China remains the largest source of FDI inflow to Cambodia, with the bulk of its investments going to key sectors such as garments, large infrastructure projects, electric and electronic components, agriculture, mining and energy, coal and tourism.

Other major sources of FDI include South Korea, the UK, Malaysia, Japan and Hong Kong (China). Similarly, the largest share of committed investment from these countries goes to the garments, construction and infrastructure sectors, followed by tourism and agriculture.

According to Deborah Elms, Founder and Executive Director of the Asian Trade Centre, “Cambodia will need to ensure that domestic rules and regulations are simplified as much as possible. Companies that are looking for new sourcing locations to diversify risks and new ways to build Asian supply chains have a lot of options. They prefer to locate in markets that are easy to do business with [as goes] clarity on rules,” she said.

Source: https://www.khmertimeskh.com/50822760/ftas-fdis-and-tourism-essential-for-cambodias-economic-bounce-back/

Thailand

Thailand