Filipinos tighten belts as inflation jumps to new 9-year high in August

MANILA, Philippines (Update 2, 12:24 p.m.) — Consumers already bearing the brunt of rising prices of widely used goods and services continued to feel the sting of inflation, which hit its highest level in nearly a decade in August and may prompt the central bank to hike policy rates anew.

Inflation rose for the eighth consecutive month to 6.4 percent in August, the highest level since the 6.6 percent posted in March 2009. The official release of the data was delayed by more than an hour due to “technical difficulties,” the Philippine Statistics Authority said.

The August print exceeded July’s 5.7 percent and topped the Bangko Sentral ng Pilipinas’ forecast for the month and market estimates. Year-to-date, inflation averaged 4.8 percent, or above the central bank’s 2-4 percent target range in the medium term.

Food and beverage prices up 8.5 percent

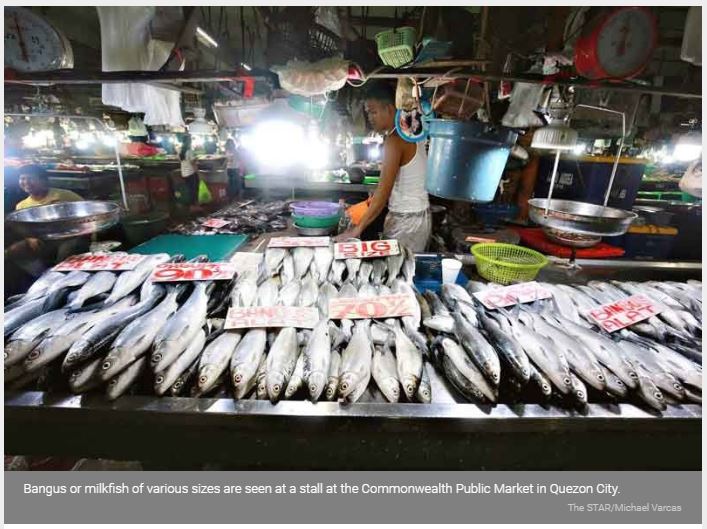

Broken down, prices of food and non-alcoholic beverages surged 8.5 percent while transport costs spiked 7.8 percent last month.

The National Capital Region felt an inflation rate of 7 percent in August, up from July’s 6.5 percent while inflation in areas outside the capital jumped to 6.2 percent from the previous month’s 5.5 percent.

In a statement, BSP Governor Nestor Espenilla, Jr. said the faster-than-expected inflation was mainly due to “food supply shocks” — or supply problems — particularly in rice, that cannot be mitigated by adjusting the central bank’s benchmark rates.

Espenilla added that elevated oil prices, a weakening peso and “strong” domestic demand fueled inflation last month.

“An unfortunate confluence of cost-push factors continue to drive consumer price inflation in August beyond the acceptable target range,” Espenilla said. “These warrant more decisive non-monetary measures to fully address.”

The BSP has raised its policy rates by a cumulative 100 basis points from May to August to discourage bank lending and cool down consumer demand that could have pushed up inflation.

Investors predicted lower inflation

As of noon Wednesday, the bellwether Philippine Stock Exchange index was down by more than 1 percent, with analysts pointing to the surprising inflation result.

“Investors were predicting lower [inflation] as the BSP set the high end of the range at 6.2 percent. This will probably also add pressure to another rate hike which could be as much as 50 bps,” Luis Limlingan of Regina Capital said.

Meanwhile, economists at Japanese bank Nomura said the August figure could further stoke inflation expectations and increase the odds of another policy rate hike.

“All this strengthens the case for more rate hikes than we currently forecast,” they said.

Policymakers have been concerned over inflation this year after it slowed economic growth to a three-year low of 6 percent in the second quarter. Inflation has also been hitting the poor as prices of rice, a Filipino main staple, continue to climb due to reported shortage of cheap rice.

Global oil prices have also risen this year, translating to higher local pump prices. Fuel companies raised gasoline and kerosene prices by P0.95 per liter and diesel by P1.20 per liter on Tuesday morning.

“Under the circumstances, we will weigh the need for further monetary policy action,” Espenilla said. “It is most critical at this point to restore inflation back to the target range soonest and securely anchor inflationary expectations.”

The BSP’s Monetary Board will review policy settings on September 27.

Source: https://www.philstar.com/business/2018/09/05/1848899/filipinos-tighten-belts-inflation-jumps-new-9-year-high-august#AB2GT36OWczYgCMS.99

Thailand

Thailand