Export opportunities abound for Vietnam

Erkut Duranoglu, chief representative of Vestel Electronics Vietnam, said he never expected the global pandemic would teach his company a practical lesson in risk management.

But teach it did.

His company had been considering an alternative supply chain in Asia to utilise cost-reduction opportunities arising from the constantly developing supply chain amid the pandemic.

Turkey-based Vestel Electronics, Europe’s biggest consumer electronics plant, which supplies to more than 500 brands world-wide, wanted to explore Vietnam and its neighbouring markets to “mitigate the geographical risk of China-centric procurement.”

“We had been considering and analysing various countries such as Vietnam, India, Indonesia, Malaysia, and Thailand.

“We chose Vietnam for good reasons. It was becoming the most suitable country as an alternative production hub for the world, next to China,” Duranoglu told Việt Nam News in a telephone interview.

“All in all, that is how we decided on establishing our representative office in HCM City in February 2021 in addition to our existing offices in (mainland) China and Taiwan.”

Experts said the US-China trade war and the pandemic have pushed companies to diversify supply chains outside of China, which has given rise to the ‘China plus one’ strategy in which multinational firms are moving to other countries.

Sam Hui, general manager of Global Sources, an international B2B sourcing platform company based in Hong Kong, told Việt Nam News: “Vietnam has become the most popular destination under the strategy, due to its low costs, proximity to China and multiple trade agreements.

“Under the policy, as demand for Vietnamese products increases, we expect an overall improvement in the manufacturing capability, product design, quality control, and export volumes.”

Nguyen Van Than, chairman of the Vietnam Small and Medium-sized Enterprises Association, said: “Vietnam with a population of 100 million has a strategic location, an affordable yet well trained workforce and a friendly environment for foreign investment.

The country has achieved impressive results in its COVID-19 vaccination campaign, having among the highest immunisation rates in the world, he said.

The free trade agreements it has signed with India, the EU and other Southeast Asian countries have enabled Vietnam to surpass other countries in terms of attracting FDI, he added.

A 2030 master plan for transport infrastructure includes construction of 5,000km of expressways, a deep-water port, high-speed rail routes, and completion of the Long Thanh international airport in Dong Nai Province near HCM City.

These have added to the attraction it holds for foreign investment, according to Than.

Recently Danish toy production company Lego signed an MoU with the Vietnam–Singapore Industrial Park Joint Stock Company to build a new factory worth US$1 billion in the southern province of Binh Duong.

LG Electronics has decided to expand its production facilities in the north.

According to the European Business Review, Vietnam will be one of the leaders in 2022 for companies to source, manufacture and export from.

Most sought-after sourcing destination

Hui, general manager of Global Sources, said, “Vietnam has the potential to be one of the most sought-after sourcing destinations for buyers world-wide.”

A 2021 survey by the company said, “Vietnam has consistently ranked the number one destination from where buyers plan to source from Asia, outside China, over the next 12 months, followed by India, Cambodia and Bangladesh.”

Buyers said their top three pain points in sourcing from Vietnam are product quality, choice of suppliers and delivery time.

Electronic products, apparel, fashion accessories, tableware and kitchenware, home appliances, and hardware products are key products buyers look for.

At a recent conference for connecting supply and demand organised by Global Sources in co-operation with Binh Duong Province authorities, major international buyers like Target Australia Sourcing Group (Australia), AEON TopValu (Hong Kong), W.H. Smith (the UK), Metro Sourcing (Hong Kong), and Walgreens (the US) said Vietnam is their preferred sourcing destination.

“This shows there is strong demand for sourcing from Vietnam among buyers around the world,” Hui said.

“With such strong demand, Vietnamese suppliers should act fast to grab the opportunity and promote their companies and products to buyers world-wide.”

The company surveyed more than 1,200 respondents in all regions, including in the US, India, mainland China, Australia, the UK, Hong Kong, and South Africa.

‘Sourcing from home’

Nguyen Van Than, chairman of the Vietnam Small and Medium-sized Enterprise Association, said: “Businesses should be aware that buyers have shifted from their traditional sourcing channels like trade shows to a new online model, ‘sourcing from home.’

“The model has proven convenient, safe and effective during the pandemic.”

|

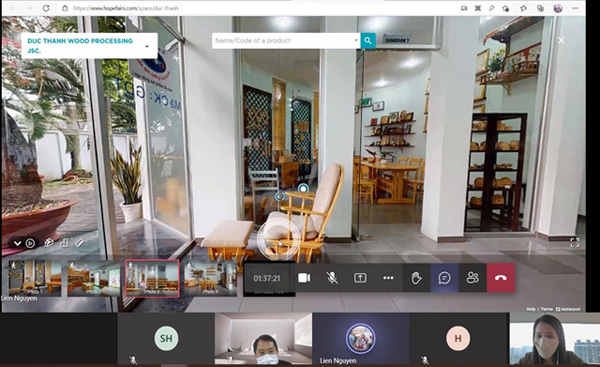

| A screenshot of a buyer from Australia speaking with a HCM City supplier of kitchenware at an online sourcing tour facilitated by a B2B online platform. Photo courtesy of Global Sources |

Buyers want to source directly from manufacturers and are looking for Vietnamese suppliers who are digitally ready to match their sourcing needs, he said.

“As the sourcing process becomes digitised, it is inevitable that Vietnamese suppliers will adopt digital transformation.”

In 2020 the association began a programme to promote 40 export-oriented suppliers of products ranging from garments and furniture to handicrafts on a B2B platform and connect them with global buyers, he said.

The survey showed 90 per cent of the respondents who want to source directly from Vietnam do not have an office in the country.

Due to the pandemic, 60 per cent plan to use the online marketplace and 35 per cent will appoint sourcing agents in Vietnam.

While international tradeshows are still very popular among buyers, the online marketplace remains the preferred option, the survey found.

Quach Kien Lan, CEO and founder of GreenYarn Bao Lan Company, which makes environment-friendly fabrics for export, said the pandemic has put businesses in a difficult situation, which requires them to constantly search for solutions to survive.

The fashion and textile industry is under pressure due to the pandemic, he said.

“The good news is global buyers are now looking closely at Vietnam to see how well the country is rebounding from the pandemic.”

They see the need to move their production to Vietnam.

However, the uncertainty and lack of information about local suppliers often leaves buyers disappointed when searching for the right producers in Vietnam since they do not know where to look.

Meanwhile, most suppliers in the textile industry still use traditional methods such as face-to-face meetings and trade shows to find buyers, but the pandemic has made this unfeasible, Lan said.

“To find new clients and diversify markets during the pandemic we have shifted from traditional platforms such as trade shows to online tools.

“Shifting to online channels may require businesses to adjust, but it is the management and mindset that makes the process successful.”

Supply chain crisis

The pandemic has caused a supply chain crisis not only in Vietnam but globally.

Experts said the country’s output would not normalise until the middle of this year.

Duranoglu said his office did not start operations until last November because of the latest COVID outbreak that began in April last year.

Though global supply chain disruptions have caused uncertainty for businesses, Vietnam has been adapting rapidly by amending laws to improve its business climate, he said.

“Vietnam’s notable strength is its stable economy, which has been growing despite the impact of the current outbreak. Although I am quite new to the country, I have personal experience that Vietnamese people are likely to honour promises.

“I believe Vietnam has a concrete foundation to bounce back much stronger in 2022.”

Experts said to meet the requirements of global buyers, manufacturers should study prices, consumer tastes and trends in those markets, and have labels and packaging in English as well as the local language.

In choosy markets like the US, the EU, Japan, and South Korea, exporters should be prepared to face technical barriers that could change without warning, they said.

Duranoglu said: “We export to 157 countries with our main market being Europe. But now we are looking for alternative regions to grow. Vietnam is one of them. It is not only a strategic location for us to develop an alternative supply chain but also an attractive market to be in with our products.

“The pandemic has taught all of us a lesson about the importance of not putting all your eggs in one basket.”

Source: Vietnam News

Thailand

Thailand