Environmental tax hike to add US$673 million to Vietnam’s public revenue

On September 20, the National Assembly’s Standing Committee passed a resolution which raises the environmental protection tax on fuels and takes effect from January 1, 2019.

Accordingly, each liter of gasoline will be subject to an environment protection tax of VND4,000 (US$0.17), up from the current VND3,000 (US$0.13), and kerosene to VND1,000 (US$0.043), up from the current VND300 (US$0.013). The tax on heavy fuel oil and lubricants moves to VND2,000 (US$0.086) per liter, up from the current VND900 (US$0.039).

The resolution was delayed in July due to inflation concerns, stated VDSC, while inflation and overall budgetary deficit are two important dimensions explaining the government’s decision.

According to VDSC, the resolution, which will take effect from January 2019, is a similar move to last December’s increase in electricity prices. Obviously, the increase is more technical than anything in order to transfer the effect on inflation to next year.

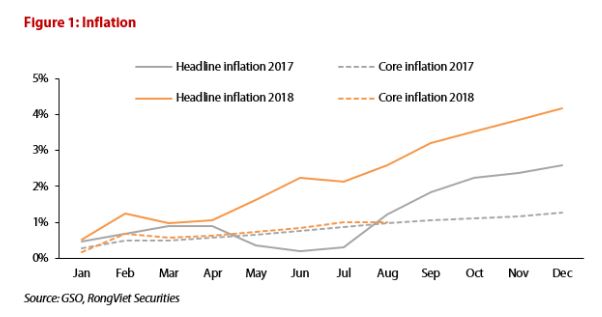

Vietnam has seen a real uptrend of inflation due to the rapid demand of essential goods and government-controlled goods in recent years. In 2018, inflation is inching up and closing on the target of 4%. Higher food prices caused by the effect of diseases and storms as well as unpredictable oil prices played an important role so far this year. VDSC estimated that Vietnam’s headline inflation will rise by 4.1-4.2% year-on-year in 2018.

With regard to the public budget, there is no doubt that there is limited room to maneuver as the public debt is close to the maximum level and the budgetary deficit is on the way. The pressure on rebalancing the public budget is rising in the context of global economic changes.

While Vietnam has one of the highest budget deficit to GDP in Asia, the commitments to reduce export-import taxes dragged public revenue down. Increases in electricity prices and the EPT put on gasoline retail prices, which reduce public subsidies and hike up public revenue, are positive.

It is obvious that the public budget rebalancing, through higher revenues and lower expenditures, has to happen. This is the time for the government to strengthen the public budget before entering into the busy period of debt repayment in the next three years.

The timing to eliminate the negative effect on consumption and inflation is a key point. VDSC expressed concern over the negative effects of this tax on household consumption which accounts for over two-third of total GDP. Higher taxes and reduced subsidy for government-controlled goods such as healthcare services, electricity, among others, will put a certain burden on individual expenditures.

Thailand

Thailand