Vietnam’s e-commerce market set to become second largest in ASEAN by 2025

Vietnam’s e-commerce market is estimated to reach US$15 billion by 2025, second only to Indonesia in the Southeast Asia region, according to Deloitte’s latest report.

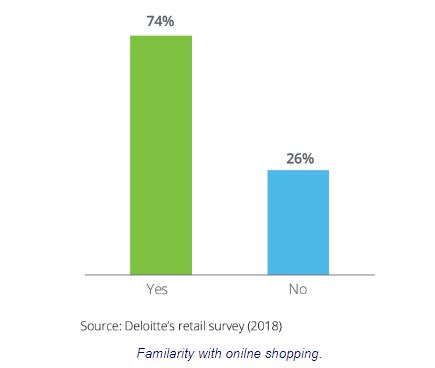

Consumers in Vietnam are accustomed to the use of digital channels, with nearly three-quarters of survey respondents (74%) conducted by Deloitte having indicated familiarity with online shopping.

At the same time, the country also has a relatively young population, with 40% of its population below the age of 24. With their greater propensity for digital technology, many of these younger consumers are driving the rapid expansion of Vietnam’s e-commerce market, as they spend more time shopping on their digital devices than in physical stores.

In general, survey respondents perceived online shopping to be convenient – as it enables them to save time, and shop from anywhere as long as they have their phones and Internet access – and felt that online shopping gives them access to a greater variety of products.

Drivers of online shopping.

|

For the majority of survey respondents (56%), promotional offers are the top driver of online shipping, implying that price is the top consideration. This is followed by delivery time (46%), as well as the availability of a wider range of merchandise (42%).

However, several concerns remain around delivery time and product quality. For instance, long delivery time and difficulties in ascertaining product quality online are some of the issues that have been raised by survey respondents.

In terms of B2C channels, Lazada and Tiki emerged as the most popular platforms amongst survey respondents. Nonetheless, the rise of C2C platforms is noteworthy as 45% of survey respondents reported having purchased items on social media channels, such as Facebook and Instagram.

Preference for different payment methods for online shopping.

|

Indeed, these social networks are not only useful for consumers to search for reviews and compare products, for many smaller businesses, these platforms can be easy and cost-effective ways to increase consumer awareness and drive sales

Even as they do their shopping online, the majority of survey respondents still continue to prefer pay with cash on delivery at 65%. This was followed by bank transfers (29%), as well as credit cards (27%) and debit cards (17%), implying that several concerns still remain around issues such as payment security.

Thailand

Thailand