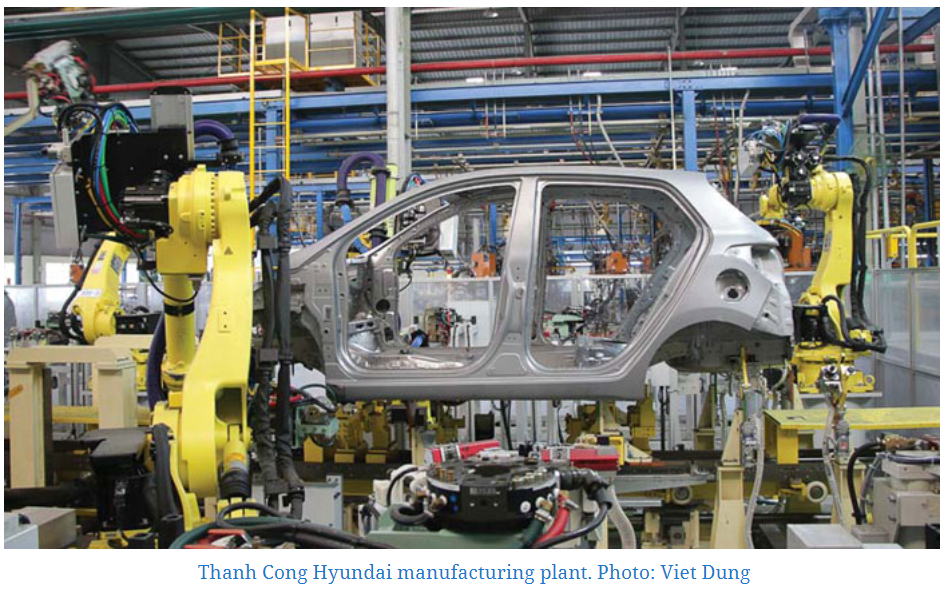

Vietnam to maintain tax incentives for domestic cars beyond 2022

Car manufacturers are planning to shift production chains elsewhere to Vietnam in case such tax incentives are extended.

The current tax incentives for domestically-produced cars, set to expired on December 31, 2022, are expected to be extended beyond that timeline to continue supporting the local automobile and supporting industries.

The Ministry of Finance (MoF) proposed this move as it plans to revise decree No.57/2020/ND-CP on amending import-export tariff schedules.

Under the proposal, the MoF noted a number of automobile manufacturers are considering plans to expand production activities in Vietnam or shift part of their production chains elsewhere to the country in case such tax incentives are extended.

Given the complicated procedures and large-scale investment required, car manufacturers are mapping out production plans for 2023 and onward, so policymakers should make decisions well in advance of the timeline.

According to the MoF, at a time when import tariffs for cars have been lifted under Vietnam’s commitments to free trade agreements, a supporting program for domestic cars would be necessary.

“This is the important basis for enterprises to work on their plans in subsequent years,” added the ministry.

Along with a request for extension of the tax incentives beyond 2022, the MoF is expected to keep requirements on minimum production capacity unchanged.

Under existing policies, production capacity is one of the main criteria for local automobile companies to take part in the tax incentive program, which allows them to enjoy a 0% import tariff for car parts and accessories for domestic production.

“This is necessary for local firms to continue investing in production and enhancing their capabilities,” stated the MoF.

However, such requirements may be modified to better reflect the current difficult economic climate due to the pandemic.

The Vietnam Automobile Manufacturers’ Association (VAMA) previously called for the removal of the requirement on minimum production capacity, due to a sharp decline in market demand.

TC Motor suggested those with a minimum investment capital of VND3 trillion ($130.5 million) are still qualified for the program without having to meet the production capacity requirement.

Source: http://hanoitimes.vn/vietnam-to-maintain-tax-incentives-for-domestic-cars-beyond-2022-318263.html

Thailand

Thailand