Thailand – REIC: Residential purchases to reduce speed

Residential developers should be more cautious with new supply launches in Greater Bangkok in 2019 as the absorption rate declines, leading the number of unsold units to exceed the five-year average, says the Real Estate Information Center (REIC).

Vichai Viratkapan, acting director-general of the REIC, said a significant decrease in the absorption rate will take place in the second half of 2019 after the Bank of Thailand’s new lending curbs take effect on April 1.

“Purchasing power will slow down as homebuyers are required to make a higher down payment from the decrease in the loan-to-value ratio,” he said. “Their payment burden will also increase as interest rates rise.”

The REIC forecasts the monthly absorption rate of residential supply in Greater Bangkok to fall to 4.8% and 4.2% in the first and second halves of 2019, respectively, from 4.9% in the second half of 2018, which was up from 4.5% in the first half.

Over the past five years, the average monthly absorption rate was 4.6%.

The monthly absorption rate of condos will drop from 6% in the second half of 2018 to 5.9% and 5.1% in the first and second halves of 2019, respectively. The five-year average was 5.7% for condos.

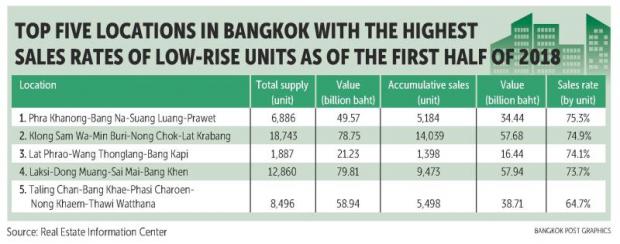

For low-rise houses (single detached house, townhouse, semi-detached house and shophouse), absorption will decline to 3.3% in the second half of 2019 from 3.8% in the first half of 2019 and the second half of 2018 and 3.6% in the first half of 2018. The five-year average was 3.5%.

The decreases in absorption rate will boost unsold supply to total 139,500 units in the second half of 2019, up from 133,326 units in the second half of 2018.

Of the amount, 61,955 units or 44.4% will be condos, up from 59,172 units. Some 66% or 40,827 units will be in Bangkok, followed by Nonthaburi (8,136), Samut Prakan (6,636), Pathum Thani (4,987), Nakhon Pathom (1,259) and Samut Sakhon (110).

Low-rise units remaining in the second half of 2019 will total 77,544, rising from 74,155 units. Bangkok and Pathum Thani will see the largest number of unsold low- rise supply with 19,962 and 19,616 units, respectively.

Low-rise units remaining in the second half of 2019 will total 77,544, rising from 74,155 units. Bangkok and Pathum Thani will see the largest number of unsold low- rise supply with 19,962 and 19,616 units, respectively.

They will be followed by Nonthaburi (17,131), Samut Prakan (13,122), Samut Sakhon (5,367) and Nakhon Pathom (2,348).

“Developers should avoid launching new supply in locations where a large number of units remain unsold and should check the sales rate of supply in each location before making an investment,” Mr Vichai said.

He predicts that the top five locations and housing types seeing the highest monthly absorption rates in the first half of 2019 will be condos and shophouses in Bangkok at 7.2% and 5.5%, respectively.

They will be followed by semi-detached houses in Samut Prakan (5.2%), townhouses in Bangkok (5.1%) and semi-detached houses in Bangkok (5%).

The same perspective will continue in the second half of 2019, Mr Vichai said.

According to the REIC’s market survey, the amount of residential supply at projects that had at least six units remaining unsold in Greater Bangkok totalled 452,614 as of the first half of 2018, up slightly from 451,089 in the first half of 2017.

Low-rise supply dropped by 4.6% to 198,715 units from 208,237 units but condo supply rose 4.5% to 253,899 units from 242,852 units, meaning new condo supply launched in the first half was in a greater amount than the number of units sold, except for low-rise units.

The better part of the supply was priced at 2-3 million baht for 128,652 units, accounting for 28.4%, followed by units priced 3-5 million baht with 114,706 units or 25.4%.

Most condo and townhouse supply was priced at 2-3 million baht a unit. Most single detached houses and semi-detached houses were priced at 3-5 million baht.

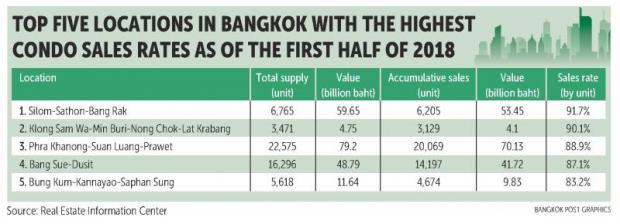

Of total condo supply, 174,373 units or 68% were in Bangkok. The top three locations were Huai Khwang-Chatuchak-Din Daeng with 30,977 units, Phra Khanong-Bang Na- Suan Luang-Prawet (22,575) and Sukhumvit (19,524).

Of total condo supply, 174,373 units or 68% were in Bangkok. The top three locations were Huai Khwang-Chatuchak-Din Daeng with 30,977 units, Phra Khanong-Bang Na- Suan Luang-Prawet (22,575) and Sukhumvit (19,524).

The highest sales rate was in Silom-Sathon-Bang Rak at 91.7% as land plots remained scarce. Meanwhile, Sukhumvit saw the largest sales value of total supply with 170.9 billion baht from 19,524 units, with the majority in the high-priced segment.

Muang and Pak Kret districts in Nonthaburi province saw the largest condo supply launched: a total of 28,602 units that accounted for 86% of total supply in Nonthaburi and 36% of total supply in five neighbouring provinces.

The two Nonthaburi districts also had the largest unsold condo supply in Greater Bangkok at 9,002 units accounting for 16% of total unsold supply.

They were followed by Muang-Phra Pradaeng-Phra Samut Chedi in Samut Prakan with 6,645 units and Huai Kwang-Chatuchak-Din Daeng with 6,493 units.

Source: https://www.bangkokpost.com/business/news/1604530/reic-residential-purchases-to-reduce-speed

Thailand

Thailand