Thailand: Phuket tourism slows even as hotels, condos booming

Phuket, Thailand looks set to weather a perfect storm as soaring hotel supply is forecast to be challenged by declining tourism demand.

New research from consulting group C9 Hotelworks in its “Phuket Hotel Market Update Mid-Year Edition” has revealed a development pipeline of 15,348 rooms set to enter the market over the next five years, which represents an 18 per cent push in total supply.

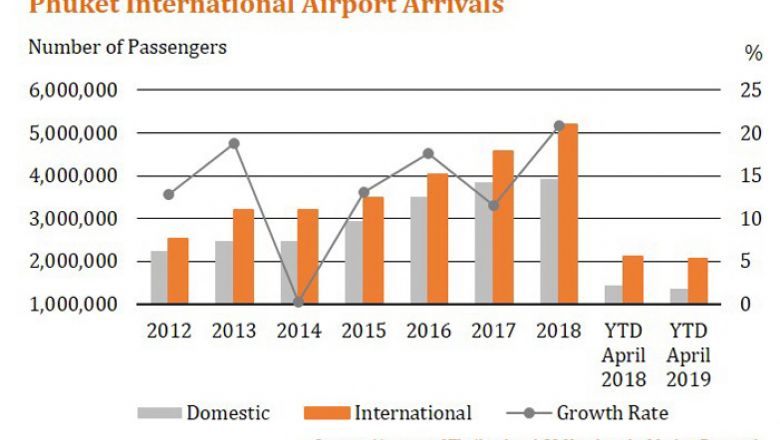

During the first four months of this year – high season – year-on-year international passenger arrivals at Phuket Airport slipped by three per cent, while the domestic segment was down six per cent.

The first half of last year had been a record-setting tourism period, with the succeeding six months experiencing a sharp decline due to the retraction of the Mainland China market.

Mainland China remains at the forefront of any discussion about Phuket and the segment remains volatile, with a 19 per cent decrease registered this year from January through May.

Russian arrivals have yet to fully recover.

Hotel performance has mirrored the current trend. Data reflect a 12-per-cent retraction of RevPAR, driven largely by lower market-wide occupancy.

While May and September are the two lowest months for Phuket hotels, July and August are projected to experience boosts in occupancy. But the reality remains that non-high season attracts significantly lower room rates and this factor will undoubtedly suppress overall rate growth during the year.

The C9 Hotelworks report also highlights the growing influence of hotel-branded residences on the Phuket accommodation market.

More than 50 per cent of the incoming pipeline – 8,337 units – is being developed. The majority of this is condominiums, with many being affiliated with international hotel groups via management or franchise agreements.

Despite the drop in Chinese tourists, a number of Mainland real estate conglomerates have entered the island property sector.

Summarising Phuket’s forecasted tourism market conditions, C9 Hotelworks’ view is that, with the development of the new Greater Phuket airport by Airports of Thailand in Southern Phang Nga, the long-term forecast remains positive.

It’s probable that the current hotel sector will experience a cycle similar to what Bali saw between 2014 and last year and that new supply will eventually be absorbed on a medium-term basis. But in the shorter term, demand remains a key risk factor impacting operators and owners. THE NATION (THAILAND)/ASIA NEWS NETWORK

Thailand

Thailand