Thailand: Of debt, cars and condos

A mountain of debt continues to shackle purchasing power in Thai households as they grapple with a harsh reality amid sputtering economic conditions.

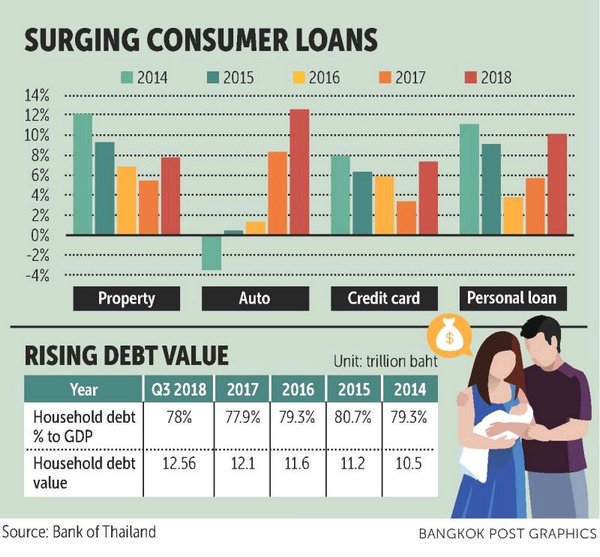

Household debt to GDP rose marginally to 78% as of last year’s third quarter from 77.9% at year-end 2017, but the debt value has risen considerably to 12.56 trillion baht from 12.1 trillion, according to Bank of Thailand data.

The fear of accumulated debt destabilising the economy rings a bell among many Thais, as the 1997 Asian financial crisis still haunts policymakers and the public, a reminder of how corruption and financial mismanagement paved the way to disaster.

The increase in household debt could be attributed to rapid growth in auto loans, in line with the country’s solid car sales in 2018, said Titanun Mallikamas, secretary of the central bank’s Monetary Policy Committee (MPC).

Other consumer loans, such as housing, credit card and personal loans, have also edged up, contributing to a fair share of high debt liabilities and a grim private consumption outlook.

“The MPC appears concerned with household debt, reflected by the committee’s policy interest rate hike to preserve financial stability,” said Amonthep Chawla, head of research at CIMB Thai Bank. “Higher financial burdens have not transpired, as commercial banks have not increased interest rates considerably.”

AUTO SALES

In 2018, Thailand’s automotive sales saw a sharp rise with 19.5% growth to 1.042 million units, registering a five-year high.

In December, car sales stood at 113,581 units, the highest since January 2014, with a growth of 8.9% year-on-year and 20% month-to-month.

Last year’s sales reflected two straight years of strong performance, the best since the record high propelled by the Yingluck Shinawatra government’s first-time car buyer scheme.

The scheme offered tax rebates of up to 100,000 baht to first-time buyers who bought passenger cars with a maximum engine capacity of 1,500cc, or pickup trucks with unlimited engine capacity but priced at no more than 1 million baht.

They were eligible to receive the refund after owning the cars for one year on the condition that they maintained ownership for at least five years.

In 2012, car sales stood at 1.436 million units, while sales figures totalled 1.33 million a year later.

While the market is not reliving the buying spree seen in 2012, higher non-performing loans (NPLs) in overall auto loans have been driven by significant growth in car sales.

In 2018, auto NPLs rose to 1.66%, up from 1.60% in the previous year, according to Bank of Thailand data.

Toshiaki Maekawa, president of Tri Petch Isuzu Sales, said last year’s aggressive car sales growth could dent purchasing sentiment, but higher auto NPLs are not expected.

Toshiaki Maekawa, president of Tri Petch Isuzu Sales, said last year’s aggressive car sales growth could dent purchasing sentiment, but higher auto NPLs are not expected.

“Buyers’ worries will slow down local purchasing power in this year’s market,” Mr Maekawa said. “This year’s sales volume is expected to be the same as last year’s figure at 1.04 million.”

With this projection, a rise in NPLs for auto loans is not expected this year.

“As a car distributor, Isuzu also forecasts the policy interest rate to be unchanged in 2019. In the bigger picture, the auto market is expected to be steady,” Mr Maekawa said. “Isuzu expects that auto NPLs will not be as high as during the bad debt situation transpiring after the tax-rebate programme on first-time car buyers ended.”

Despite overall household debt from all loans remaining high, hire purchase loans for cars continue to see healthy performance, said Surapong Paisitpatanapong, a spokesman for the automotive industry club under the Federation of Thai Industries.

In 2018, car sales growth was due to the introduction of new cars at affordable prices, Mr Surapong said.

In 2019, the car market is expected to perform well, he said, but the club’s projection is similar those of car distributors, with sales volume increasing incrementally by 0.8% to 1.05 million cars.

“Local economic sentiment seems to be healthy, capable of maintaining the projected sales volume,” Mr Surapong said. “New car models will be launched with smaller engine sizes and cheaper prices. In addition, Thailand’s GDP is projected to expand and local purchasing power is strong enough to cover debt repayments.”

PRUDENT APPROVALS

As one of the main pillars of the economy, financial institutions have tightened loan approvals since reports of swelling household debt emerged.

Sakchai Peechapat, president and chief operating officer of Tisco Bank, said the bank has seen riskier signs in the auto loan business and swelling household debt, validating the Bank of Thailand’s concerns.

Special mention (SM) auto loans in the banking industry, including at Tisco Bank, have increased and stayed at a high level for a while.

“Rising SMs are partly due to the higher debt burden of borrowers and their lower debt payment ability,” Mr Sakchai said. “With this scenario, Tisco is being prudent on auto loan expansion.”

Auto finance is the bank’s core business, representing 54.4% of the total loan portfolio at 130.86 billion baht, while NPLs of car loans make up 2.76%.

Mr Sakchai said auto loans have been growing more than other consumer loan products.

Rising car loan demand is in line with the country’s new-car sales after the end of the first-time car buyer scheme in 2017.

At the same time, the cycle of new car purchases on average has shortened from eight-and-a-half years before the scheme to five years.

The bank has controlled debt service ratio (DSR) of the loan product at a maximum 50% on average. In case of higher down payments, the bank can offer a higher DSR ratio in line with the borrower’s risk profile.

Despite rising SM loans, Tisco Bank can keep auto NPLs at a low level by managing short-term loan products. On average, an auto loan is repaid over five years.

Amid higher credit risk, the bank has slowed auto loan expansion, setting low-range auto loan growth at 3-5% for this year versus double-digit growth in the past.

Tisco Bank booked a marginal growth rate for auto loans of 0.9% last year.

A selective strategy focused on business partners’ vehicle brands, namely Ford and Mazda, is also helping control the bank’s loan product quality.

Mr Sakchai said greater competition and the underpricing of risk in the auto loan market have eased since automakers and financial institutions began controlling risks prudentially.

“Each loan provider has assessed asset quality thoroughly amid current economic conditions,” said Charl Kengchon, managing director of Kasikorn Research Center.

With the need to maintain financial stability, the central bank can implement a macroprudential measure on DSRs for retail borrowers, similar to how it has targeted a stricter loan-to-value ratio for mortgage loans, Mr Charl said.

SHRINKING SPECULATION

The low-interest-rate environment has encouraged speculators to adopt search-for-yield behaviour, with property among their targeted segments.

Phattarachai Taweewong, senior manager of the research department at property consultant Colliers International Thailand, said the ratio of condo buyers who dump a unit they booked earlier has lowered over the past few years.

“Buyers who discontinue paying down payments for an off-plan condo unit are mostly speculators,” Mr Phattarachai said. “But this kind of buyer is lower in number, as the condo market for the past two years has not been as attractive as in previous periods.”

The market saw a lot of short-term condo speculators five years ago when the condo sector heated up. With the cooling off in demand and prices, these speculators could not resell their units, with some discontinuing paying down payments.

“When they are unable to resell units they booked, they usually dump them during the first few months of down payment so that they will not take a huge loss,” Mr Phattarachai said.

The condo speculation landscape has changed since. The number of speculators shrank as the condo sector became less attractive, with an oversupply spotted in some locations.

Speculators who remain in the market will not dump booked units, but will instead resell at a discounted price — in some cases at half the price, Mr Phattarachai said.

“This happens when a project where speculators booked a unit comes closer to completion,” he said. “If these speculators are unable to resell, they need to transfer the units.”

Some of them are able to get a transfer and rent out the unit, but many are not so fortunate.

Mr Phattarachai said the number of condo units booked, then dumped, by short-term speculators has decreased because there are numerous online channels for reselling, along with many individual agents who provide such services.

The impact of high household debt on the property sector can be seen in the first-time car buyer scheme during 2011-12.

“People who are paying a down payment for an off-plan condo mostly make up either real demand or long-term investment buyers buying to rent out,” Mr Phattarachai said. “For single houses and townhouses, buyers have real demand.”

Source: https://www.bangkokpost.com/business/news/1630718/of-debt-cars-and-condos

Thailand

Thailand