Thailand – Moody’s: New BoT rules rate as credit-positive

The Bank of Thailand’s new rules to tighten mortgage lending are credit-positive to reduce property speculation, says Moody’s Investors Service.

“The new mortgage-lending rules are credit-positive because they will help to reduce speculative buying and require banks to focus on borrowers with better credit quality,” said Moody’s.

“We expect the measures to improve the asset quality of banks’ newly originated mortgage loans. Amid Thailand’s prolonged low interest rate environment, property prices have been rising steadily.”

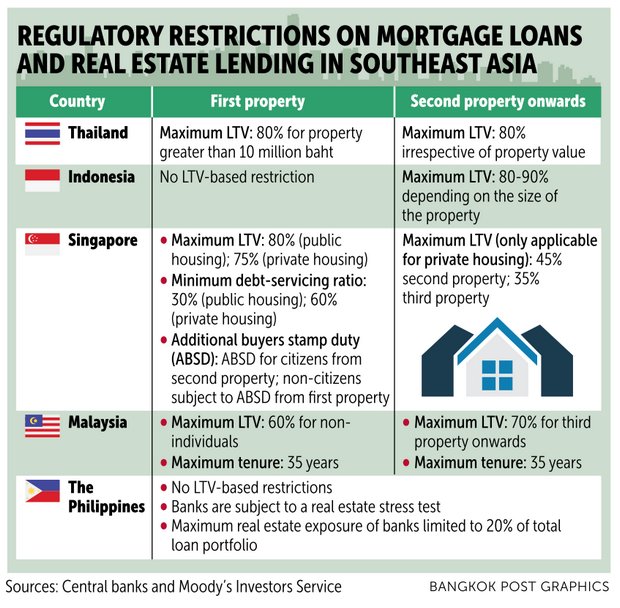

On Oct 4, the central bank announced measures to tighten credit underwriting standards for mortgages. Under the new rules, the maximum loan-to-value (LTV) ratio will be restricted at 80% for new mortgages for homes worth more than 10 million baht.

The same LTV restrictions will apply for the purchase of a second home irrespective of the property value. Banks will also be prohibited from providing advances that exceed the value of a property.

The Bank for International Settlements reported residential property prices in Bangkok have increased 49% over the past decade. The increase in condominium prices has been sharper, at 78% during the period.

The Bank for International Settlements reported residential property prices in Bangkok have increased 49% over the past decade. The increase in condominium prices has been sharper, at 78% during the period.

Banks’ credit underwriting standards for mortgages have deteriorated because a greater proportion of newly originated mortgages have higher LTV and lower debt- servicing capacity, said Moody’s.

The share of high-LTV mortgages, those with ratios above 90%, increased to 49% of newly originated loans at the end of the first half from 34% at the end of 2013.

The median loan-to-income ratio rose to around 3.8 times at the end of this year’s first quarter, up from 2.7 times in 2013.

For Thai banks, housing loans are the only consumer loans where the non-performing loan (NPL) ratio has been increasing, as NPLs in other retail segments still remain stable or have improved, said Moody’s.

The housing NPL ratio rose steadily to 3.4% as of June 2018 from 2.4% three years ago. Household leverage also remained high in Thailand at 77% of GDP at the end of June, although growth has slowed, said the service.

“Mortgages are a big business for Thai banks, accounting for 17% of system-wide loans and about 50% of total retail loans at the end of the first quarter,” said Moody’s.

“As such, the deterioration in mortgage underwriting quality can have a significant effect on banks if property prices decline substantially. The macro-prudential guidelines from the Bank of Thailand follow similar guidelines issued by other countries in the region the past few years.”

Source: https://www.bangkokpost.com/business/news/1554466/moodys-new-bot-rules-rate-as-credit-positive

Thailand

Thailand